Scale Facilitation’s growing mountain of defaults are all just ‘misunderstandings’

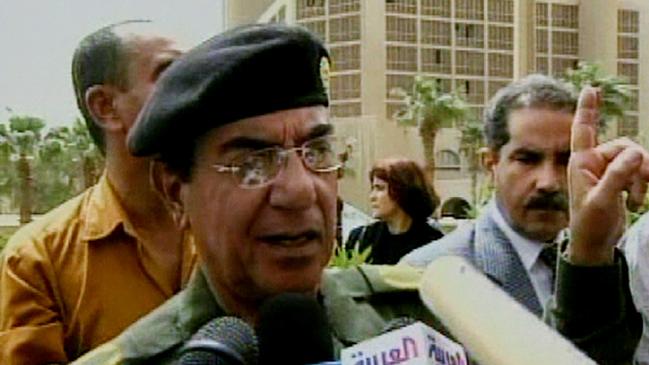

Not since “Baghdad Bob”, the Iraqi minister who kept denying the 2003 American invasion – even while US tanks could be heard in the near distance – have we seen an individual cling so comically to falsehood.

David A. Collard, founder of Scale Facilitation, is making earnest attempts to gain the mantle.

Scale is the parent company of Recharge Industries, an outfit of Collard’s creation that set out to build an electric battery gigafactory in Geelong. In a move that generated much excitement, Recharge earlier this year signed a deal to buy British car battery firm Britishvolt and, until about two months ago, Collard was being lauded in the global press for this feat of intercontinental entrepreneurship.

Since then, Margin Call has reported steadily on the decline of Scale, and of Recharge, and raised numerous questions about the conduct of Collard, who’s currently being evicted from his Manhattan apartment (for missing rental payments) by Chinese billionaire Liu Yiqian. A second lawsuit is continuing over Scale’s offices in the World Trade Centre building.

We’ve noted Collard’s repeated failures to pay his staff and his contractors; we broke the news that Australian Federal Police raided his Geelong headquarters; that Deakin University, having been promised a $10m donation, never received its funds; and we’ve lost count of how many high-ranking employees have resigned from Scale, or how many distinguished “advisers” have distanced themselves from the company.

At every turn, Collard, like Baghdad Bob, has made statements at odds with reality. In Town Hall meetings he assures staff that mere technicalities are blocking the cashflow that will be used to pay their salaries. The police raids? A misunderstanding soon to be ironed out.

When Britishvolt administrator EY said this week that Recharge had failed to make a final payment for the company, Scale rejected that, too, saying “The timing of the final instalment to the administrator is linked to a funding facility, which when closed will also cover the cost of the land acquisition and provide additional working capital for the project.”

Margin Call has learned this statement was made just as the aforementioned funding facility, sought from US Capital Group, was deemed no longer viable due to Scale’s inability to meet the conditions of approval. That just about seals all of the available pathways for Recharge to pursue the Britishvolt buyout. It’s been made clear to us that the deal is over.

And maybe that’s why Recharge CEO Rob Fitzpatrick has sensationally quit the company in recent weeks, a development that was kept ultra-quiet by those within Scale’s inner circle.

Following him out the door are Phil King, Scale’s head of real estate and development, Thomas Dwyer, Scale’s head of external affairs, Kimberly Chehardy, Scale’s head of compliance, and former Australian journalist Melanie Slade, Scale’s head of public relations, the company’s name already scrubbed from her LinkedIn profile.

These are all people who worked without pay for months. Others, too, are starting to see the writing on the wall.

Flight turbulence

Margin Call’s eyes in the sky were bracing for a drop in cabin pressure on Thursday when former Virgin Australia boss Paul Scurrah boarded a 3pm flight from Sydney to Brisbane and took a seat near who else but Bain Capital CEO Mike Murphy.

Readers will recall that Scurrah had been earmarked to lead Virgin during Bain’s buyout of the airline in 2020, with Scurrah supported by the PE firm during much of the negotiations. Later, Bain heartlessly flipped the script and backed iron lady Jayne Hrdlicka (formerly of Bain & Co) to replace Scurrah as CEO. As one would expect, relations between Scurrah and Murphy have been cool ever since.

And so there’s Scurrah and Murphy, seated not quite alongside each other on this Virgin flight but certainly within earshot, crammed into the first two rows, and then, as if paid to do it, no less than three hosties have bee-lined for Scurrah to tell him what a gem of CEO he once was! Even the pilot came out to shake his hand, for goodness’ sake. Of course, none of them had a clue that faceless Bain villain Murphy was glowering so close at hand.

Scurrah now runs freight outfit Pacific National, and we’ve already reported on his wife, Nicole, this week, noting that she recently started corporate play Create Advisory after walking out on her partnership at Sayers Group.

And, yes, Scurrah and Murphy were eventually forced to make some eye contact as they disembarked from the aircraft. We’re told pleasantries were exchanged.

Tough transition

What a joy to see the Business Council of Australia finally pick a successor to CEO Jennifer Westacott after their right cocking up of the recruitment over the past eight months. Imagine having a competent CEO-elect ready at hand in Kate Pounder, of the Technology Council of Australia, only to then fruitlessly squander that appointment by agreeing to a late entree from Stuart Ayres, a former NSW Liberal minister (trailed by scandal) whose name didn’t quite jive with the old boys in Canberra. When that failed, the BCA board went grovelling back to Pounder, begging her to take the job. Naturally she told them where to go.

Margin Call broke the news on Friday that Bran Black, erstwhile the chief of staff to former NSW premier Dominic Perrottet, had been appointed to the role instead, and, sure enough, the BCA limped to the announcement by the afternoon with an email to its members. “Bran has a unique understanding of how to deliver practical economic and social reforms by bringing together business, governments and academia in strong collaborative partnerships,” it said.

Presumably it’s a soft landing from the hardships he faced running the often shambolic Perrottet government for 18 months.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout