Bill Shorten Medicare scare short on backers

Not since Tony Abbott’s crusade against carbon pricing has a scare campaign matched Bill Shorten’s carpet bombing of misinformation on the Liberals’ alleged secret plan to privatise Medicare.

It has made Scott Morrison’s campaign against Labor’s proposed changes to negative gearing arrangements look seriously fluffy.

Shorten’s political mentor Bob Hawke has lent his good name, and ageing visage, to it.

But there are a few holdouts. There hasn’t been a peep from former Labor premier of Queensland Anna Bligh or Shorten’s one-time girlfriend Nicola Roxon, who was once federal Labor’s health minister and then its tobacco-extinguishing attorney-general.

Don’t expect that to change in the final week of the marathon election. The pair clearly have less strident views on the role of the private sector in the delivery of healthcare than Shorten’s mob. Roxon is on the John Conde-chaired board of Bupa Australia, the international private healthcare group best known as the more efficient British rival to the state-owned National Health Service.

Meanwhile, Bligh sits on the Elizabeth Alexander-chaired board of Medibank, the $8 billion private health insurer floated by the Abbott government at the end of 2014.

Medibank — which pays Bligh a $140,000-a-year director fee — is also on the wrong end of a lawsuit by Rod Sims’ competition regulator, the ACCC, for allegedly misleading customers.

Bet the former premier wants this election to be over even more than the rest of us.

Gale force subsides

“Brad Fail” seems a bit harsh. But the broking business is not a place for gentle souls, as trader-cum-golfer Angus Aitken could tell you.

Anyway, that’s what many in the rough and tumble equities trading world are calling Brad Gale, the current chief executive of Wilson HTM, the broking firm that demerged from fund managing business Wilson Investment Group almost a year ago.

The performance reviews were always going to be tough. As the sixth CEO of Wilson HTM in six years, some dubbed Gale the firm’s Steven Bradbury. And in further proof of the wild flux in the industry, there is already chatter about his future.

The case against him points to a huge loss of staff — some on Gale’s instruction, others checking themselves out voluntarily, as did Hugh Robertson, the billionaires’ banker who is now back at Colin Bell’s less bureaucratic shop. Robertson brought Michael Rosenbaum and almost 10 others with him.

Ultimately, any decision will fall on Wilson HTM chair Frank Aldridge, who is also the managing director of Craigs Investment Partners, the New Zealand-based fund manager that owns 40 per cent of the broker.

Dragoman talk

Some interesting news from 101 Collins Street, corporate Melbourne’s “Tower of Power”.

We hear from sources close to the prestigious building’s leasing agents that Tom Harley has taken out new floor space.

The secondary site is on a higher floor than the office he currently shares with John Fast, the fellow former BHP executive with whom Harley is a joint managing director of the successful corporate advisory firm Dragoman.

Few people in corporate Melbourne have better links than Harley into Malcolm Turnbull’s administration. Just ask him. So what’s going on? Is Harley — who was last spotted by this column escorting Foreign Minister Julie Bishop into the American Australian Association’s black-tie dinner — merely the advance party setting up new Dragoman digs, with Fast soon to follow? Or is Harley “Draxiting” Dragoman?

Watch this floor space.

Knives at the ready

An update on an item last week about the jockeying going on inside a raft of industry associations.

There will be an abundance of knives out after the July 2 election — as is always the case at that point in the political cycle.

Some aren’t even waiting that long. Cynthia Grisbrook, chair of the Mortgage and Finance Association of Australia, has already hit the “refresh” button. Her shop has parted ways with CEO Siobhan Hayden “due to strategic differences with the board”. No dithering around for an election result at Grisbrook’s shop.

Moving up the financial industry tree, there’s a lot of speculation in the commercialising disaster industry about the future of Rob Whelan, who since 2010 has been the chief executive officer of the Insurance Council of Australia.

Despite 6½ years in the role, many readers may never have heard of Whelan — which is sort of the problem.

To his credit, we’ve heard that Whelan seems to have forged something of a consensus across the council’s three main members, the listed insurance giants: Michael Cameron’s Suncorp, Peter Harmer’s IAG and John Neal’s QBE.

Unfortunately for Whelan, the agreement seems to be that it may be time to end his low-key approach to the fairly well remunerated job.

Another reason to prepare your CV ahead of this Saturday’s election.

Agents have a say

Recent coverage in this column might lead some readers to think the nation’s real estate agents are too busy dressing up in skimpy costumes, playing with toy machine guns and partying to involve themselves in the political process.

We better correct the record.

As mentioned earlier, Bill Shorten’s Labor is proposing to clamp down on the negative gearing arrangements that have nudged so many investors into property. The Liberals’ unwavering opposition to this has evidently impressed the nation’s agents.

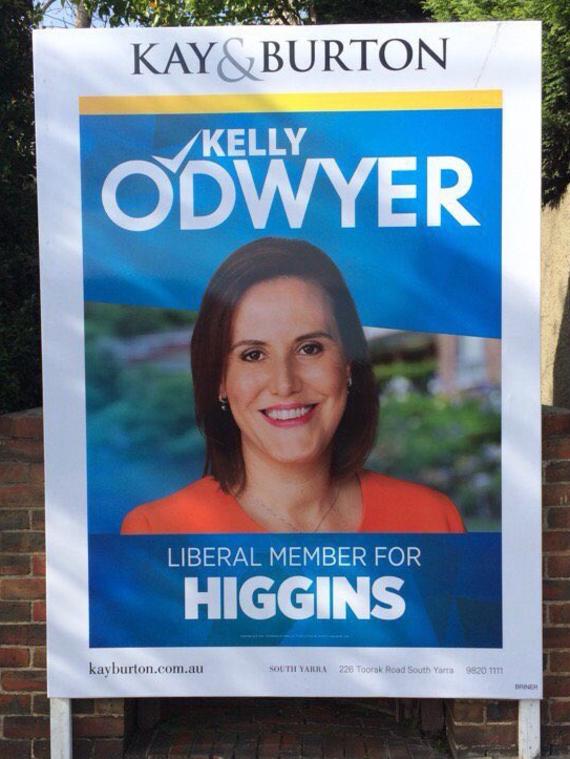

Just have a look at the logo for Melbourne agency Kay & Burton, which is stamped across billboards in Kelly O’Dwyer’sseat of Higgins.

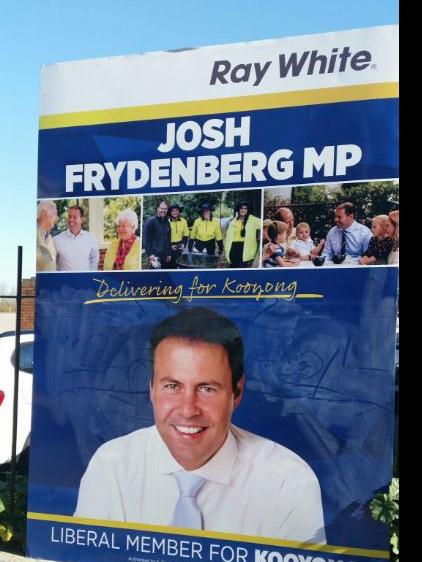

Or have a peek over in the fellow well-to-do Melbourne seat of Kooyong, where Ray White’s logo is lined along the top of some of Josh Frydenberg’s billboards.

Asked about their involvement in the campaign, a Ray White spokesman said it was “a stuff-up”.

Seems a bit of a harsh thing to say about the hard-working local member.

Right on Kew

Moving to a close Liberal ally of minister Frydenberg, the state member for Kew, Tim Smith, who was yesterday handing out how-to-vote cards at a freezing Kooyong pre-poll voting booth.

Smith, a former intern to British Conservative David Davis, gave a historic speech in the Victorian parliament last Thursday. Its impact on geopolitics and international markets is still being grappled with.

“For four hundred years, British politics and history has been permeated by parliament’s struggle initially against the Crown and now against Europe for supremacy,” the earnest Smith boomed, like the Winston Churchill of Spring Street.

The YouTube sensation urged his British audience — who we understand were live streaming the speech by the millions — to seize the “once-in-a-lifetime chance to free themselves from the clutches of the European Union”.

Less than 24 hours later, a majority of those Brits who turned up to vote answered Smith’s oratory.

History will surely record that this speech was the “black swan” event that ambushed pollsters, pundits and betting markets.

Let it never be said that nothing of importance happens in Australian state politics.