Bidding war erupts for minnow, listed kiddie carer Think Childcare

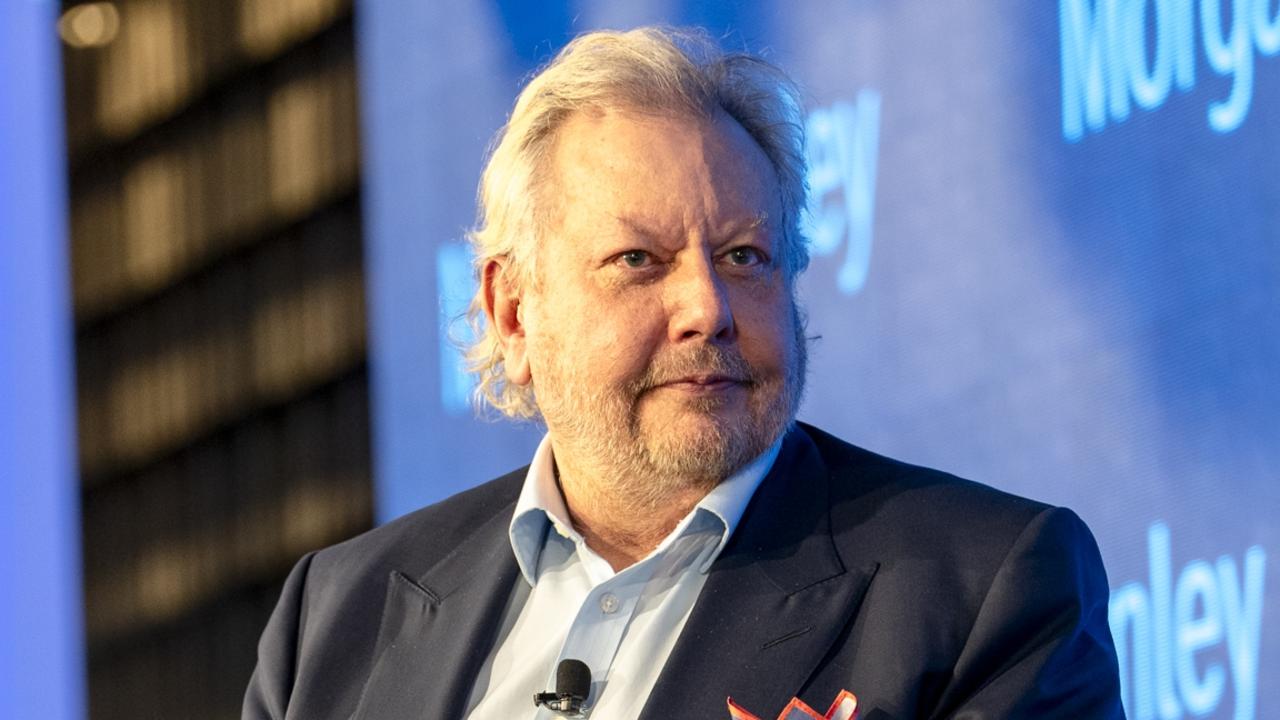

It’s shaping up as a bumper end to the year for Liberal Party powerbroker and investment banker Michael Kroger as a bidding war erupts for minnow, listed kiddie carer Think Childcare.

Think, led by Mathew Edwards and chaired by Mark Kerr, finds itself in the sights of two suitors, former Babcock & Brown execs Phil Green and Trevor Loewensohn’s Alceon and Canadian pension giant Ontario Teachers Fund via its global childcare group Busy Bees.

Alceon bid first for Think, which has 78 childcare centres across Australia, at $1.35 for each of the group’s stapled securities.

Then this week the deep-pocketed Ontario fund entered the game bidding $1.75 for each of Think’s securities, which sent Think shares soaring to $1.64 on Tuesday to value the group at just below $100m.

Such an unfolding competitive scenario will be heaven to Think’s advisers at the Andrew Pridham-led Moelis, but also to Kroger, who remains a top 20 shareholder in the company that at Busy Bees’ bid price will net him a bit over $3m.

Those close to the corporate play predict the price for Think could lift to at least $2 a share, which would land Kroger just over $3.5m.

Kroger is also a shareholder in fellow listed Victorian childcare provider Mayfield Childcare, which runs 21 centres in the state and whose shares rocketed almost 5 per cent on Tuesday off the back of the Think bid war and broader optimism in the sector.

Any final sale could be an important fill-up to Kroger’s coffers as he embarks on a reno of his relatively new home in the inner-Melbourne suburb of South Yarra.

Kroger bought the warehouse just off fashionable Chapel Street for $3.2m in August last year and settled on the property in April with the help of a mortgage from Macquarie.

Kroger has plans to overhaul the four-level residence top to bottom, including the installation of a lift.

Money off the tables

The perilous state of affairs unfolding at James Packer’s Crown Resorts was reinforced by Victorian Treasurer Tim Pallas on Tuesday as he unveiled his state’s financial blueprint for 2020-21.

As Crown, chaired by Helen Coonan and led by Ken Barton, awaits details of Patricia Bergin’s review of the group’s suitability to run a casino at Sydney’s Barangaroo, in Melbourne Pallas’s paperwork reveals the extent to which Crown’s operations in Melbourne have been devastated by closures forced by the COVID-19 pandemic.

Pallas’s 243-page financial statement for this financial year reveals that tax revenue from Crown in Melbourne is expected to plummet to $78m, compared with $229m in the following year, when activity is expected to rebound as a vaccine for the virus comes into effect.

“The forecast reduction of electronic gaming machines and casino gambling taxes in 2020-21 is primarily attributable to the temporary closure of Crown casino, hotels and clubs as a result of the public health restrictions associated with the coronavirus (COVID-19) pandemic,” the government doco reads.

That’s a massive 65 per cent difference in the two years.

The forecast drop this year follows an actual tax take of $161m in Victoria from the casino in the 2019-20 year just passed.

All this as Crown’s Barangaroo gaming rooms are set to remain closed beyond their planned December 14 opening date due to late admissions to Bergin’s inquiry conceding money-laundering at Crown’s operations, which will hit revenue as well.

Meanwhile, Macquarie analysts are running the numbers on what they say would be an earnings per share-positive Crown-Star merger as a shortcut workaround to the probity issues facing Crown.

At least the doors to Crown Melbourne are open again (albeit only to VIPs) and there is some money flowing in, rather than out the door to lawyers and the government.

Grilling goes on

The grilling of Crown Resorts directors at the NSW regulator’s inquiry may be over, but the probes keep coming at the rest of the well-connected board’s list of appointments

Professor John Horvath, previously a personal physician to the late Kerry Packer, was the latest to have his suitability questioned, this time at Ramsay Health, where he holds the title of chief medical officer.

A concerned shareholder on Tuesday raised the question of whether his association with Crown, in particular its connections to gambling, were suitable for the CMO.

Chair Michael Siddle was quick to come to Horvath’s defence, noting also his impending retirement in February, saying he had long been a pre-eminent practitioner and that the group was “indebted to him and his experience”.

It was that very skill that was probed by the regulator in October, when Horvath told the inquiry that his 30-plus years of experience in a teaching hospital had set him up to oversee the casino group — especially considering the hospital had been a “24/7 business with a high level of stress which is not dissimilar to hotels and casinos”.

No doubt Ramsay will be hoping that’s where the similarities stop.

Christian’s return

One of the stalwarts of the debt collection industry, Christine Christian, is returning to her roots by taking a directorship of the recently listed fintech known as Credit Clear, which is chaired by former NAB and Tyro Payments executive Gerd Schenkel.

Christian spent more than 15 years as CEO of credit check and receivables management company Dun & Bradstreet from 1997 to 2013. She was also chairman of Dun & Bradstreet Consumer Credit Services from 2004 to 2013.

But how the industry has changed — these days, instead of sending the debt collectors door knocking, companies like Credit Clear put the power back in the hands of the consumer.

The firm, which is backed by billionaires Paul Little and Alex Waislitz, automates the debt collection process and uses artificial intelligence to determine what time of the day and through which method of communication — most notably via Facebook Messenger, SMS or email — a debtor prefers to be reached over paying their overdue fees.

Its early days but Christian looks like she’s on a winner — Credit Clear shares closed at 75c on Tuesday, compared to their issue price late last month of 35c.

Also in the debt collecting space but in a different guise, Christian has a runner in the race for dominance of the booming “buy now, pay later” sector with her deputy chairmanship of FlexiGroup, whose shares have enjoyed a nice boost since early November with the sharemarket rally.