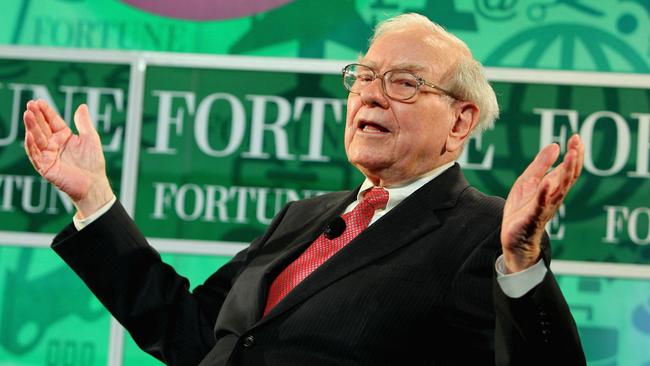

It’s not often that the Sage of Omaha’s business affairs get questioned, but with Warren Buffett set to step down from Berkshire Hathaway at the end of the year, perhaps some cracks are beginning to show.

That certainly seems to be the case at one of Berkshire’s Australian outposts, Freo Group, which bills itself as this country’s biggest crane hire and logistics company.

Freo is ultimately a subsidiary of Berkshire’s mammoth Marmon industrial and construction group, which booked a tidy $US1.6bn pre-tax profit across its global operations in 2024 – albeit down close to 9 per cent from the year before.

And Freo itself is in a state of some turmoil these days, Margin Call is told, amid a slew of senior executive departures since the beginning of the year and talk of asset sales and contract losses.

The crane group is now being run by Marmon Crane Services boss Tim Macleod, a Canadian, after the departure of Freo CEO Sven Gade in February. Gade only took the job 18 months ago, after the departure of previous boss Steve Rogers in early 2023.

Freo also lost chief financial officer Joseph Jeevaraj in February, and this month shed another few members of its executive leadership team – including its health and safety boss, its general manager of strategy, and the national recruitment manager.

On top of that, industry sources say Freo has recently been pipped to major contracts worth more than $50m by smaller local rivals.

For years, Freo’s operations have been underpinned by a long-term contract with BHP – worth around 40 per cent of its annual revenue, according to reporting when the mining giant signed a 10-year extension of the deal in late 2023.

Even that relationship may be looking wobbly, however, with BHP adding other contractors to its roster of options in recent times.

There’s no suggesting that Freo is in any immediate financial trouble, to be clear. Marmon Construction Services Australia posted a $26.6m profit in 2023, the last year for which the company filed financial results with the corporate regulator. And whatever its wobbles, Berkshire clearly has enough spare cash floating around to rescue its Australian arm from any financial difficulties.

But all of this has sparked internal talk of another wave of restructuring, and strong rumours that Berkshire could be preparing the unit for sale.

Berkshire bought Freo Group back in 2012 from Perth’s Canci family, who established the business with just a single crane in 1974. Tony Canci is still in the same game, through WA contractor Macs Australia – which also, as it happens, runs a crane hire business. It’s not often a family built company gets to buy back the assets sold out to a bigger player – but stranger things have happened.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout