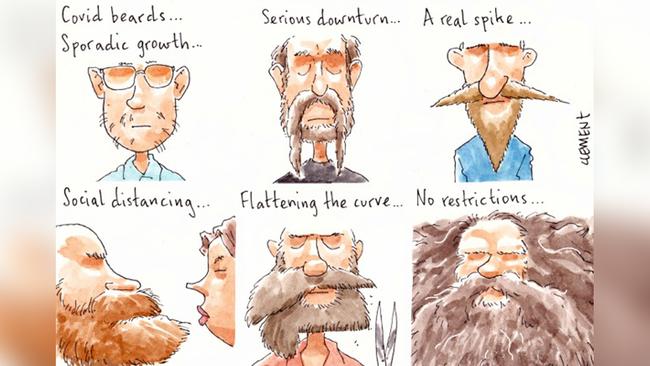

This May will long be remembered as the month of the iso-beard as our bearded male business leaders stay the course.

They are now emerging from total hibernation, often startling colleagues on video conference.

The grooming gods are not necessarily evident with these COVID-19 quarantine beards, given the understandable hesitation to seek out a barber. No doubt some of their wives are privately rolling their eyes off camera at husbands who think they are rocking it.

The fanciest new beard is possibly on Gillon McLachlan, the AFL boss who has been social distancing from his razor. He had a holiday beard, but this one, deep into the delayed season, is likely to stay for some time yet. It’s been done with the approval of his wife, Laura.

Caught recently on FaceTime, it was his “unruly” hair that then elicited his self-comparison to Ridge Forrester from The Bold and Beautiful.

Seek chief executive Andrew Bassat addressed the Trans Tasman Business Circle mid-week and you could hardly see him behind the beard.

Bassat volunteered that he hadn’t shaved since he started working from home and won’t until the crisis is over.

“I have quite embraced the sloth of it all,’’ joked an otherwise busy Bassat, who’ll be foregoing his annual French winery tour with the likes of Raphael Geminder and Andrew Fox.

He was last spotted with a beard three years ago.

Some top executives are possibly struggling to unlock their iPhones through Face ID. Others appear freshly shaven, like Medibank boss Craig Drummond at the Macquarie 2020 Australia Conference midweek.

It’s bearded business as usual for Mike Cannon-Brookes, but not his Atlassian partner Scott Farquhar, who appears to have stuck to his regular stubble.

Justin Hemmes, the boss of Merivale, has always been partial to a nicely trimmed beard, but he’s let it grow in recent weeks while he works on re-employing some of his 3000 staff with his home delivery service.

Casting a wider look, cricketer Steve Smith sported his “awful” beard during a Rajasthan Royals podcast last month, but it was gone before this week’s batting masterclass for his two million Instagram followers.

Buy Gillette shares in anticipation of the big shave? Though its $299 new heated razor sounds a bit rich for daily pre-dawn shave before heading off to the city office.

Billionaire’s bitcoin

The Connecticut billionaire hedge funder Paul Tudor Jones has revealed that one of his funds holds bitcoin futures, bought to hedge against “great monetary inflation”.

Comparing the controversial cryptocurrency to gold in the 70s, he says the best profit-maximising strategy is to own the fastest horse. Bitcoin futures trading was up slightly on the news, at around $US9855 for one bitcoin.

“I am not a hard-money or a crypto nut,” said the founder of Tudor Investment, who sees the digitisation of currency being accelerated by COVID-19. Jones, married to the Sydney-born former model Sonia Klein, achieved legendary status on Wall Street after predicting the 1987 stockmarket crash.

Rich pickings

There were billionaires aplenty on last Sunday’s screens.

The sanguine cautious investor Warren Buffett kicked off with his Berkshire Hathaway annual shareholders meeting, where the highlight was confirmation of his abandonment of airline investments.

Then there was a lacklustre return of the fifth season of the Billions drama which had hedge fund king Bobby Axelrod turn up to a Variety Fair cover shoot. He’s now worth $US10bn, but faces new rival Mike Prince, the wholesome Midwestern billionaire.

The episode’s major excitement came when Becky Lynch, the professional WWE champion wrestler known as The Man, turned up in the offices of AXE Capital.

The Billions rivalry continued between Axelrod and Chuck Rhoades and his right hand man Bryan Connerty, the idealistic lawyer played by Australian expatriate Toby Leonard Moore.

Billions’ return to CBS’s Showtime saw a sizeable drop in US viewers to 610,000, down on the season four premiere of 843,000.

Stan, streaming Billions here in Australia, won’t advise its download numbers. But oddly, while talking up its streaming service, Nine boss Hugh Marks did not give any update on total subscriber figures at Macquarie’s 2020 Australia Conference this week.

Meanwhile Succession, despite being commissioned for another season, never quite got into production, so that will push its highly anticipated season three to well after the COVID-19 snapback.

Patrick Delany’sFoxtel signed off this week on another HBO deal to ensure it will have Succession when the cast do reassemble. Succession was the HBO series that filled the gap left by Game Of Thrones.

There’s also Sky Atlantic’s Monaco banking drama Riviera, which Margin Call watches for the scenery rather than the acting, which is set to see its third series hopefully released soon, starring the reincarnated Anthony LaPaglia.

A class apartment

The heiress to some of the Packer fortune, Francesca Packer Barham, has offloaded her Encore, Elizabeth Bay apartment. The daughter of Gretel Packer and British financier Nick Barham secured $2.6m, $500,000 more than in 2016. It was sold to a local, Alfred Street, who once served on the Bundanon Trust.

Packer Barham is currently holed up in her whole-floor Darlinghurst apartment, Horizon which she bought from Julie Graham, wife of eye specialist Glen Fernando, for $15.8m. It was a surprise to some Packer family associates as they’d anticipated the selling agents Knight Frank might have steered Francesca instead to uncle James Packer’s Barangaroo apartment project.

Cook’s tour

National Australia Bank’s latest restructure has spurred changes to the responsibilities of its chief legal and commercial counsel Sharon Cook. She gains oversight of all the bank’s customer compensation programs, and for regulatory affairs, which was part of the risk unit before the change.

As part of changes made by chief executive Ross McEwan, he is bringing together marketing and corporate affairs functions and Ms Cook will cede responsibility for the latter. The overhaul sees marketing and corporate affairs report into the yet to be appointed group executive of digital arm UBank.

Stamping ground

Did NSW Treasurer Dominic Perrottet really have to float the idea of the end of stamp duty in NSW last weekend as part of his five-point recovery plan for NSW?

Amid the pandemic desperation, for once everyone wanted to believe him, so estate agents spent the week dealing with prospective vendors and buyers deciding to sit out and await its abolition.

No prospect of anything actually happening unless all state governments sit down to substantially raise GST, and then agree to their respective take, given how much stamp duty contributes to state government coffers.

Meanwhile, activist Sydney property developer and investor Theo Onisforou is riled by the recent attempt by the federal government to regulate the retail property rental market.

It’s time for a structural change, he has urged, after bricks and mortar retail owners were put through the hoops by Scott Morrison’s recent COVID-19 intervention, which he says “came on top of historic state and local government exploitation”.

“How can landlords and tenants ‘share proportionally’ when all of my outgoings continue and the tenant is allowed to exploit your decision and hibernate rent-free?”

He says NSW is continually increasing its official land values, indicating “that it clearly does not realise or care that there is a clear move to online retail and away from bricks and mortar”.

“Every year the total number of week’s rent received by me that goes straight to the NSW government increases,” he wrote in an open letter to state and federal leaders.

Last year it was about two months of his annual gross rent, he says.

“This COVID-19 year it is likely to be four to five months of my gross rent to you,” noting the state gets its cut from his gross rent and not his net rent.

He reckons it would be simpler to take a fair proportion of a landlord’s annual gross revenue via annual income tax returns.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout