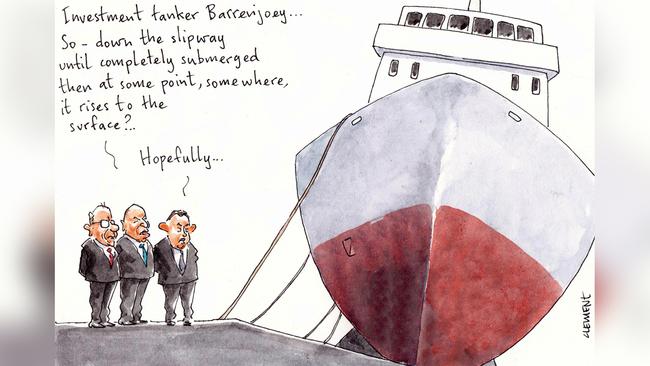

Barrenjoey reports $114m loss; alleged NAB fraudster stalls ahead of trial

The latest annual accounts of the Hamish Douglass-backed investment banking upstart Barrenjoey Capital Partners have provided a glimpse into just how much it costs to take on the bulge-bracket players.

Just a year since the firm made its official debut, accounts signed off by chief Brian Benari show the group notched a loss of $114.1m for the financial year to June 30, largely related to staff costs.

Luring 232 new staff from rival firms might have that effect, their shunning of “antiquated hierarchical structures” seemingly not enough to fill Barrenjoey’s ranks.

All up, staff costs equated to $82m, up from $5m in the prior year, while the services they provided have so far brought in income of just $8.7m through fees and commissions.

The net loss, directors said, represented the “costs of establishing the operations and infrastructure of the group. These costs were mainly attributable to staff and technology-related expenses”.

Delving further into the accounts shows a near third of the group’s income was wiped thanks to a $2.7m net trading loss, while their Liberty Place HQ set the group back $3.3m for the year.

All makes for not a bad start for the fledgling investment bank, which counts among its “firsts” the $1.2bn IPO of Pexa in May and Lendi’s M&A mandate in its $1bn merger with JamesSymond’s Aussie Home Loans, as well as the well-publicised Boral takeover by Seven and Kerry Stokes.

All these milestones, we might add, we are acutely aware of thanks to a carefully transposed road map of “firsts” released as the group celebrated its first birthday late last month.

Alongside the graphic, Magellan chief Brett Cairns noted the business was “developing ahead of expectations”, while Barclays’ Paul Compton spoke to growing the UK bank’s presence through the partnership.

At the end of the period, Barrenjoey had cash and cash equivalents of $197.6m, while a further $50m from Magellan remains undrawn.

Related party disclosures show one director in particular had more at stake through the year however, tipping in $2.52m in the form of a short-term line of credit, and which was promptly paid back during the year.

Momentum, the group said, was expected to increase in the 2022 financial year while all of its business units would begin generating revenue, which “will materially improve its financial performance”.

–

Cash flow problem

Taking on the seemingly unlimited resources of a Four Pillars bank and the public prosecutor is proving to be a difficult task for alleged National Australia Bank fraudster Helen Rosamond, her legal representation on Wednesday telling a NSW court she would need at least $1m in legal assistance to achieve a fair trial as she sought to have her day in court delayed further.

Rosamond stands accused of defrauding the now Ross McEwan-led bank out of millions through an elaborate expenses scheme conducted through her Human Group business along with co-conspirator Rosemary Rogers, former chief of staff to the bank’s then CEO Andrew Thorburn, who last year was sentenced to eight years behind bars.

Margin Call has previously told you of Rosamond’s apparent dwindling resources, not helped by the freezing orders on most of her assets, but now that she has at least secured some legal help in new lawyer Anton Hughes there’s further roadblocks preventing a fair trial, or so the court heard.

In a virtual hearing Wednesday, Hughes told Justice Robert Sutherland that without legal aid in the realm of $1m to cover a team of forensic accountants, there was a risk that any response to the prosecution’s 46,000-page McGrathNicol report would be unfair.

The key piece of evidence, which reportedly took 10,000 billable hours across a team of 25 to prepare, allegedly lays out the history of fraudulent transactions between the NAB and Human Group.

Hughes noted that it was questionable whether all transactions attributed to Rosamond were fraudulent, adding that, “NAB appears to have had a very loose grip on the purse strings for a period of time”.

“All sorts of people were making all sorts of requests of Human Group.”

It’s not the first time she has sought legal assistance, though to date discussions on the matter of forensic help have yielded just $1000 in state-funded support.

It appeared there was at least a semblance of victory to the defendant Wednesday, with Sutherland conceding that his answer on the matter would likely not be forthcoming given his busy schedule of matters and potential posting to Moree.

“My dance card is pretty full,” he told the court.

And Rosamond all too willing to wait.

–

Papa Papas

There will be more than the usual interest in the start of the Greek Super League 2 season this weekend, with local and international authorities likely to be watching closely for Xanthi FC owner Bill Papas.

The formerly Sydney-based Papas, better known for his involvement in Forum Finance, has been kicking back in Greece since investigators started sniffing around his alleged dodgy dealings, to date evading creditors including Westpac Bank and Societe Generale, among others.

But, as luck would have it, the football fanatic now faces arrest just as his team, including Aussie goalkeeper Paul Izzo, prepare to commence their 2022 campaign.

Only last week Justice Michael Lee ordered Papas’ arrest after Westpac alleged the equipment rental magnate cum football tycoon breached freezing orders aimed at stopping him accessing funds the bank says were defrauded from it.

With orders to be processed through the sheriff, then attorney general’s department before reaching Greek shores, we wouldn’t bank on an expedient arrest, in what could make for a final dash of freedom for Papas with the team he so loves.

Not one to shy from the cameras, the club owner poked his head out at the pre-season friendly in September, with local media outlet noting “Bill Papas brought good luck to Xanthi”.

🔥 It's Matchday 🔥

— Xanthi FC (@FcXanthi) October 27, 2021

🟠Xanthi FC Arena

â² 15:00

ðŸ†ÎšÏπελλο Ελλάδας #WeAreAOXpic.twitter.com/tSi4Y6T6LK

Perhaps that’s the same luck that saw his short-lived appointee Socceroo Tony Popovic quickly pick up a job coaching Melbourne Victory after he was punted from the Greek club in early February.

If only some of that would rub off on Papas himself.

Additional reporting: David Ross

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout