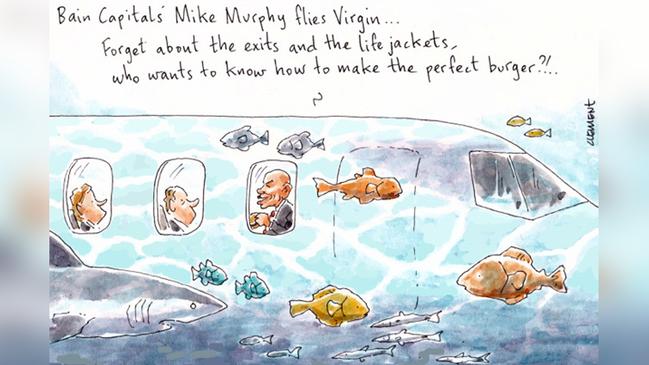

Bain Capital has high hopes for Virgin Australia

The Mike Murphy-led masters of the universe from Bain Capital are pushing hard to win the market over in their still-evolving multi-billion-dollar bid for the failed Virgin Australia.

While their peers keep a lower profile, Bain, with the help of corporate spin doctors from FTI Consulting, has been beating the drum on the depth of experience, certainty and stability they’d bring to a Bain-controlled Virgin, should they win out in the Vaughan Strawbridge-led Deloitte sales process.

In a rapidly unfolding sales process for the collapsed airline, second-round offers are due to the corporate undertakers at the end of this week, with Deloitte then whittling bidders down to only two.

Bain will be looking for a win following the demoralising withdrawal late last year of its planned float of its Zoo Retail portfolio of brands, which comprise Boost Juice, Salsas, Cibo Espresso and Betty’s Burgers.

Market conditions meant Zoo Retail, of which 46-year-old Murphy is a director, was pulled at the end of October last year, leaving Bain and the likes of Boost Juice founder Janine Allis as enduring shareholders with no short-term path to exit their investment.

Bain, which has been led in Oz by Murphy for the past five years, is telling the market it will bring a long-term mindset to running Virgin, with a commitment to operate a well-funded, successful airline.

Oh, and Murphy wants to make flying fun again.

That’s the pitch that is up against the local credentials of the likes of rival bidders such as Ben Gray’s BGH, which has teamed up with local super behemoth AustralianSuper.

But here’s some facts around structure for the market to chew over.

Bain controls its majority ownership of Zoo Retail Holdings Pty Ltd (about 65 million-odd ordinary shares out of a bit more than 73 million shares on issue) via an outfit called Bain Capital Roar Holdings.

And guess where that entity is run from? A post office box linked to Ugland House in George Town in the tax haven that is the Cayman Islands.

Unlike in Australia, that’s a place where virtually no tax is paid.

Wonder if the Virgin bid is structured the same?

A healthy rise

It seems those bothersome ailments are now getting the medical attention they deserve.

Andrew Demetriou’s Capitol Health has reported a “material increase” in patient attendances for diagnostic image testing.

The non-COVID-19 ill have been mostly content to stay at home, as far away from doctors’ waiting rooms as possible, ever since the mid-March pandemic shutdown.

But the ASX-listed diagnostic services provider told shareholders on Tuesday it had reopened seven of its centres earlier than envisaged, and expected the eight of its 64-centre network that remain closed to be back next month.

One of the reopened centres was at Frankston Central, which would probably be on the radar of federal Health Minister Greg Hunt, who not only needs to get the nation through the pandemic but also in the best health as possible.

And then perhaps Hunt will turn his attention to getting the grasping health funds to provide bonus benefits for members who’ve continued paying their dues despite forgoing medical treatments.

Meanwhile Demetriou, who took the Capitol Health chairmanship in 2014 after stepping down from the top job at the AFL, can now turn his attention to his board, where he’ll be seeking to replace the experienced Andrew Harrison, the company’s founder and former chief executive.

Harrison co-founded Capitol Health in Perth in 2005, as dental clinics, before listing on the ASX.

It typically performs over 1.2 million procedures annually across its four-state network.

“Andrew has made an outstanding contribution to the company over many years,” Demetriou advised.

“He remains a valued friend and shareholder of the company. We wish him well in his future endeavours.”

His shareholding sits at 5.5 million. They are currently trading at 22c, have hit a 15c low in March.

Harrison was chief executive from 2016 to 2019 as Justin Walter, the former EY director, became the company’s managing director.

There’s just four on the board now at Capitol, including Demetriou and Walter, so the search is on for a replacement with industry expertise. The busy Nicole Sheffield, Auspost’s executive general manager, is a director, along with Richard Loveridge.

Harrison has previously dabbled with olive growing as a side hustle, but we doubt that’s where he’s headed.

Mangan left hungry

Virgin administrators have plenty on their plate, but it’s not the delicious food served up by their unpaid celebrated chef Luke Mangan. Margin Call gleans the chef, who has been associated with Virgin for 17 years, is probably owed about $400,000 following the airline’s collapse.

Deloitte’s advised no paperwork had lobbed, so it seems his team is preparing documents that will get him invited to the next creditor’s meetings held by Deloitte’s Vaughan Strawbridge.

All up, Virgin Australia owes about $6.8bn to some 10,247 known creditors, and counting.

Mangan is believed to be disappointed to have had no contact from Virgin’s senior management team after everything his catering company achieved for their passengers’ nourishment in the sky.

It was Sir Richard Branson who first pursued Mangan in 2003 for a meal after his UK executives raved about the food after dining at Mangan’s Salt.

Folklore has it that when Branson called a month later, Mangan couldn’t get Branson and his nine guests into the busy Friday lunchtime so he sent them to his other restaurant, Moorish at Bondi.

And they’d been besties ever since.

Mangan’s expansive Glass Brasserie in the Sydney CBD remains closed, although Luke’s Kitchen, his restaurant and office HQ on Waterloo’s Dank Street, has reopened for private dining. Lukes At Home, his takeaway service, continues apace.

Over at Qantas, Neil Perry has headlined the shuttered catering over at the idle kangaroo’s kitchen for about two decades.

Ikin murder charge

There’s definitely a Dominick Dunne novel in the continuing intrigue surrounding the sudden death in 2008 of Australian pop music executive Peter Ikin in mysterious circumstances in a dingy Paris hotel.

Ikin, who founded Warner Music in Australia, was an influential force on the music scene, including helping establish the Aria Awards.

Alexandre Despallieres and Ikin had just a month before his death celebrated their London civil ceremony, attended by stage and screen star Simon Burke and music executive John Reid, the former manager of pop star Elton John. But now Despallieres faces trial in France on a murder charge.

Despallieres had advised Ikin’s friends and family back in Sydney and London that the death was the result of a heart attack, before organising a cremation in Paris.

It was Annette Sharp, the Sunday Telegraph columnist, who wrote straight after the funeral service at St Canice’s, Elizabeth Bay that there was mystery over the final weeks of his life. Questions arose later when a toxicology report was uncovered that he had “lethal doses” of paracetamol in his system.

Despallieres claimed most of the Warner Music boss’s $20m estate. However, a French judge has just ruled that Despallieres, who attests his innocence, should face trial for first-degree murder and forgery over the will.

Ikin’s estate included a $4m flat in Cheyne Place in London’s up-market Chelsea district and a $3m Kincoppal, Elizabeth Bay harbourfront apartment.