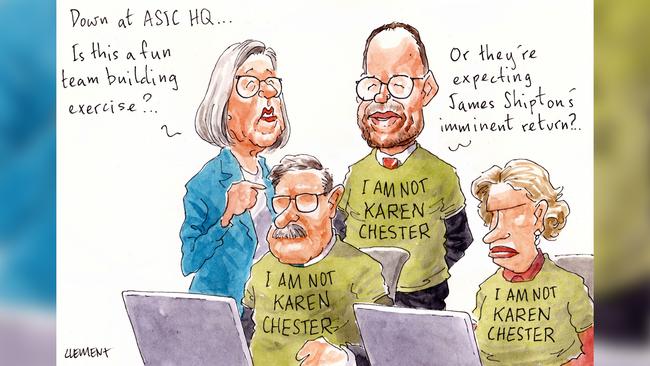

ASIC vows its still on the job

With ASIC chairman James Shipton on leave and deputy Daniel Crennan recently departed in the wake of an expenses scandal, the top ranks of the corporate regulator are looking a little bare.

Still, the group maintains it’s business as usual, even as it seemingly paddles furiously under the surface.

Up until just a few days ago, acting chair Karen Chester, the former productivity commissioner, was on the bill for the Financial Services Council’s inaugural investment summit, her first public appearance since she effectively threw Shipton under the bus at Senate Estimates last month.

In a late shake-up to the line-up, however, those tuning in to the session were met instead with senior executive leader Rhys Bollen, a marked change from Chester even he was prompted to point out to the online audience.

“I am not Karen Chester,” he aptly stated in his opening comments, going on to say she had offered her apologies while noting that the Vivienne Thom-led independent investigation into the expenses audit was ongoing.

“I just wanted to say it is business as usual for ASIC,” he went on.

Not very comforting given the circumstances, however, as it soon emerged that the key regulatory reform he “had hoped would be out this week” was still being held up.

We’ll save you the financial services jargon, but suffice it to say the regulator’s guidance for the design and distribution obligations (DDO) regime legislated to take effect from October 5 next year is still in the works.

It was a point that didn’t go unnoticed, with Herbert Smith Freehills partner Fiona Smedley describing the impending regulation as an “iceberg” alongside fellow panel members APRA deputy Helen Rowell and FSC senior policy manager Bianca Richardson.

Thom’s review of Shipton’s $118,000 tax bill, and Crennan’s accrual of $70,000 in accommodation expenses in Sydney, continues in the background, with no set date to be handed down to the treasury secretary.

At the October Estimates hearing, Chester indicated that a report was likely before year’s end, but strongly knocked back any assertions from ACT Labor senator Katy Gallagher that the organisation was “drifting” without its two most senior appointees.

“We’re anything but drifting. You have myself acting, and I’m ably assisted by three very good commissioners. We have an energised and capable team of 2056 staff across every city in Australia, plus Traralgon, and we continue on … We are busy. We are doing our jobs,” he said.

Their jobs and everyone else’s, by the looks of it.

ANZ pay hits

As ANZ shares on Monday bucked the Joe Biden-fuelled stockmarket boom, the bank’s head Shayne Elliott and his senior execs will no doubt be crossing their fingers for a miraculous 30 per cent turnaround before the end of the month.

Under the group’s equity incentive plan, detailed in its annual report released on Monday, Elliott was granted 12,006 deferred shares last year that are exercisable at $24.79 in two weeks’ time.

With current trade at a more moderate $19.22 a pop, the vesting is unlikely, meaning Elliott says goodbye to almost $300,000, alongside holdings of other executives the likes of digital executive Maile Carnegie, chief risk officer Kevin Corbally and tech group executive Gerard Florian, among others.

Rest assured though, Elliott was still handsomely remunerated for the financial year to September 30. The bank’s remuneration report shows Elliott netted a tidy $5.22m, comprising a base salary of $2.48m, cash bonus of $625,000, $828,507 in shares and $1.16m in performance rights.

Across the top execs, institutional group executive Mark Whelan took the biggest hit to his pay packet for the year as his cash bonus was cut by two thirds, while Antonia Watson’s elevation to the head of the NZ bank (following the fall of David Hisco in his own personal expenses scandal) prompted a $1.2m pay rise to more than $2.76m.

Now-departed chairman David Gonski left with 31,500 shares worth roughly $605,000 at today’s prices, leaving Graeme Liebelt now as the largest holder on the board with just over 20,000 ordinary shares.

But when it comes to the best customer, we think ANZ director and former local Deutsche chairman John Macfarlane takes the cake, with outstanding loans of $13.3m at the bank.

It remains to be seen what kind of salary sacrifice plan he might be on, but with annual interest payments of more than $370,000 eclipsing his $318,500 director’s pay cheque, we’d say it’s a net positive for the bank.

Waislitz earns stripes

Billionaire tech investor Alex Waislitz has officially joined the ranks of the illustrious Cubs — well, grand cub to be exact.

Now before you get ahead of yourselves, he hasn’t got himself a cougar, nor any affiliation to the Chicago major league baseball team, rather his latest investor the Jim Davis -led Woodson Capital is seeded by famed hedge fund manager Julian Robertson’sTiger Management.

While the family tree of cubs is as long and winding as most of their web of investments, Thorney joins Woodson’s most recent Australian holdings such as Afterpay and Splitit.

But while its Robertson’s big tech bets that have garnered the most attention, its his New Zealand property interests that have this column’s attention.

Robertson has built a portfolio of three luxury resort and golf clubs across the ditch since the mid-1990s, including the $2800-a-night Kauri Cliffs on the North Island, Cape Kidnappers at Hawkes Bay or Matakauri on the shores of Lake Wakatipu in Queenstown.

One more is in the works, a 40-guest lodge at Kauaroa Bay on Waiheke Island he bought from local dairy farmer turned property developer Christopher Reeve for $NZ18.9m in 2018, currently pending Auckland Council approval.

It remains to be seen whether grand cubs get preferential treatment at the lodges, but surely a little help with Waislitz’s handicap wouldn’t go astray.

Big deal in Portsea

The property market has been running hot down at the billionaires paradise that is the Portsea end of the Mornington Peninsula because, let’s face it, who would be caught dead in the Melbourne CBD at the moment.

But Margin Call is reliably informed that the biggest sale down that way for some time could be about to take place in what would be one of the biggest deals of the year. Roger Kimberley, brother of Just Jeans founder Craig, has quietly put his clifftop mansion at Sorrento on the market, and it may fetch up to $25m.

It would be a substantial profit for Kimberley, who was persuaded by his brother to invest in his first Just Jeans shop in Chapel Street, Prahan in 1970.

Kimberley paid $1.36m for the clifftop mansion with views back to Melbourne in 1995. The Kildrummie Court mansion also has its own pier, handy when one wants to take in a dip in the bay. The house is flanked by one owned by the family of the late Ron Walker, with the Deague family on the other side. Property doyen Max Beck is just along the cliff and his great mate Lindsay Fox isn’t too far away, either.

Mornington Peninsula property expert Rob Curtain, of Sotherby’s, is said to be handling the sale.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout