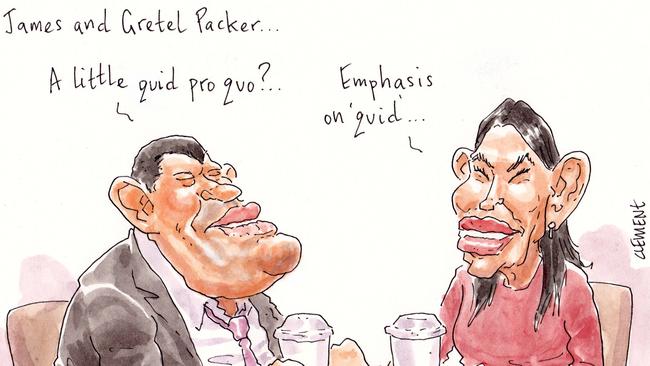

Another lazy $100m lands in Gretel Packer’s purse

Two years after David Gonski and Lloyd Williams administered the late Kerry Packer’s will, serious money is still migrating Gretel Packer ’s way.

Late on Friday, Crown Resorts told the ASX that 8.6 million of the gaming company’s shares (about $105 million worth) that were held by a vehicle called RPSCO Pty Ltd were no longer associated with James Packer.

That, in the words of the release, came about after the “termination of the right of first refusal CPH Crown Holdings Pty Limited had over RPSCO Pty Limited’s shares in Crown Resorts Limited”.

The company concerned, RPSCO Pty Ltd, has one director: James’s billionaire sister, Gretel Packer. It was created in December 2015 as the fraught negotiations over the billionaire estate were finally settled.

This latest update means more than $100m of Crown stock that was previously associated with James now belongs to his sister.

As was reported by The Australian back in February 2016, Gretel’s circa $1.25 billion settlement included $100m worth of Crown shares.

Last week’s change in shareholding could simply be the formalisation of that.

Or it may be that other assets have been traded between the intensely private siblings. Gretel’s quarter share of the family’s Ellerston property in the NSW Hunter Valley, for example, could be tempting.

The date of the $100m-odd change — November 30, last Thursday — was intriguing.

It was the day after the Crown billionaire made a quick visit to Melbourne for an interview with the Australian Federal Police, relating to a corruption probe into Israeli Prime Minister Benjamin Netanyahu.

Margin Call understands Packer also squeezed in a few Crown Resorts meetings during his brief Melbourne visit.

Did he also find time to meet his sister, or her advisers, as well?

Home in the clouds

Demonstrating Rio Tinto’s multinational character, the global miner’s CEO Jean-Sebastien Jacques was meeting investors in Sydney yesterday when the Britain-based Simon Thompson was confirmed as the miner’s new chairman.

Much has been made about the French-born anglophile JS and his wife Muriel Demarcus’s shared love of the Harbour City.

But for now they remain based in London — despite their recent acquisition of a $3m apartment in Sydney’s Walsh Bay.

“Home is London. I wish it was Sydney but it will remain London for a long time,” JS told The Australian yesterday, on his 10th trip to Australia this year.

As Margin Call flagged last month, Rio is understood to be on the hunt for a new office in Sydney — just the thing to go with the harbourside Walsh Bay pad.

But for now the Sydney office relocation and mooted expansion remain a work in progress.

“We have a small office in Sydney. That may change over time,” JS said, promisingly, yesterday.

The mining boss travels so much to Rio’s various far-flung operations that a few more bases outside of London wouldn’t go to waste.

Last week he was in the Pilbara. Next stop after Sydney is Rio’s Richards Bay subsidiary in South Africa.

Then next week he’s off to Canada before jetting back to London.

That makes him think the focus on the location of Rio’s head office is archaic for a global company operating in 60 different countries.

“If Lynchy [CFO Christopher Lynch] is on Etihad and I’m on Qantas, that’s where the head office is,” he pointed out.

Reshuffle at Seven

It could be some time before permanent replacements are found at Seven West Media for Tim Worne r’s departing executives Bridget Fair and Simon Francis.

Corporate and regulatory affairs boss Fair, who is off to run industry group Free TV Australia in the new year, will as of December 21 be replaced in an acting capacity by her second-in-charge Justine McCarthy.

Prince of the Dark Arts Francis, meanwhile, will have his Seven West duties taken over by City PR’s Tim Allerton, who will also look after Kerry Stokes’ private company Australian Capital Equity.

High net worthies

It’s happy days over at Rob Luciano’s Sydney hedge fund VGI Partners, which has

just punched through its $US1.25bn ($1.64bn) funds under management target.

Now Luciano, Doug Tynan and the gang can get on with picking world-class businesses with long-term growth potential (like the Nasdaq-listed

WD-40), as well as the more suspect outfits to short (the Copenhagen-listed fad jewellery company Pandora is VGI’s latest target).

The VGI crew — who caused a stir in the local market by triumphantly shorting Andrew Grech’s Slater + Gordon — used the ASX-listed vehicle VG1 to raise about $500m. Of this, we hear Leigh Birtles’ Crestone team came through with a notable $100m.

Richies to invest through the listed vehicle included Victor “John” Plummer, patriarch of the private Plummer family, who scooped up $1m worth, and Michael Crouch, the founder of the Zip tap empire, who bought $5m of stock.

Another reported investor in the secretive VGI fund is Michael Stock, the former Credit Suisse investment banker who now works in real estate.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout