Andrew Thorburn minder Rosemary Rogers resigns from NAB

There’s change right at the heart of NAB’s bunker in Melbourne’s Docklands: CEO Andrew Thorburn’s chief-of-staff Rosemary Rogers has resigned.

Rogers had worked in the all-seeing, all-knowing position for nine years, first under Cameron Clyne, then Clyne’s Kiwi successor Thorburn.

That gave her unrivalled intelligence on the bank’s executive team, its relations with the board and, of course, everything to do with the CEO.

Rogers’ 20-year stint at NAB ended last week.

She has been temporarily replaced by Sarah White, NAB’s executive general manager of talent and leadership, while Thorburn looks for a new permanent consigliore.

My oh Myer

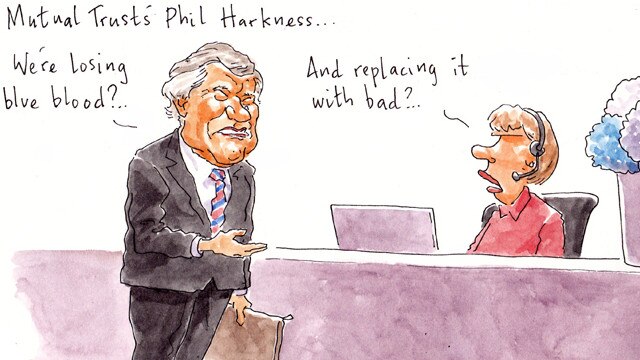

If you needed confirmation that the $3 billion “merger” between The Myer Family Company and the rival Baillieu family’s Mutual Trust was really a takeover of the former by the latter, then it would appear to come in the latest gossip doing the rounds among Melbourne’s richies.

The word is that Myer Family scion Martyn Myer has moved his affairs to the Luke Sayers-led PwC, which counts another billionaire scion, David Smorgon, among its advisory ranks.

And we hear other members of the Myer family might have also moved their business away from the newly merged group.

The MFCo-Mutual Trust deal, one of the biggest ever in the family office sector when it was announced in early June, saw the Myer family’s holding company MFI become the largest shareholder in the merged group — which has taken the name Mutual Trust — emerging with a 35 per cent stake.

But clearly some of the Myer clan aren’t too keen on their fellow blue bloods the Baillieus managing their fortunes.

MFCo has suffered over the past 18 months from a loss of key clients and an exodus of staff.

Last year MFCo hired Equipsuper chief executive Danielle Press as it battled for clients among Australia’s rich against Mutual Trust and smaller rivals including Koda Capital, Escala Partners, Evans & Partners, UBS spin-off Crestone and Hamilton Wealth Management.

Press didn’t survive the merger, making way for former E&Y partner Phil Harkness, who is now running the merged group.

Up, up and away

Qantas boss Alan Joyce and his Fairfax counterpart Greg Hywood have been on quite the journey these last four years.

There was no shortage of subjects for the two to discuss when they caught up for lunch at Rockpool in Sydney last week — days before Joyce was crowned the “business person of the year” in The Fin, Fairfax’s business paper.

Back in December 2014, Joyce’s airline made headlines when it pulled millions of dollars in advertising from Fairfax’s Sydney Morning Herald and The Age and dumped the papers from Qantas’s aircraft, gates and lounges.

There was a drinks trolley’s worth of reasons for that decision. Fairfax’s then aviation writer Matt O’Sullivan’s book Mayday: How Warring Egos Forced Qantas Off Course was one trigger. Another was a front-page story that called for Joyce’s resignation.

Hywood’s pointed decision to move Fairfax’s travel account to John Borghetti’s rival airline Virgin Australia dramatically increased the turbulence levels.

But all that is now ancient, aviation history, as evidenced by the two former sparring partners’ convivial lunch last Tuesday.

Joyce’s new gong is not the only bit of good news that the two outfits have shared this year.

In July, Qantas won back the Fairfax travel account from its bitter rival.

Virgin had run the account since March 2015, after Hywood switched the media company’s travel spend in a not-too-subtle riposte to Qantas’s advertising boycott.

We understand that Qantas’s new travel account is being followed by a notable increase in advertising by the flying kangaroo in Fairfax’s titles.

But we hear Hywood’s smooth sailing with Qantas has been accompanied by turbulence at Virgin.

It sounds as if Borghetti, now free from travel account-related constraints about where ads can be booked, might move a significant amount of Virgin’s Fairfax advertising spend to its media rivals.

Who knows, perhaps you’ll be reading all about that — in big, glossy, beautiful ads — in this masthead in the new year.

Back to the fold

Finally, George Brandis is London-bound.

The departing Attorney-General will replace Alexander Downer as our High Commissioner to the United Kingdom, one of DFAT’s best jobs — and one that’s more interesting than it has been for decades thanks to Brexit.

So what will Downer do when he returns to South Australia in the new year?

Resume the business advisory and non-executive director career he abandoned when he took up the plum London gig in 2014, say those close to the former Howardgovernment foreign minister.

His latest job won’t have hurt the former Liberal leader’s credentials with European-facing Australian firms.

Before he left, Downer was on the Australian board of Chinese telco Huawei. He also served on Gina Rinehart’s Roy Hill board.

While we’d be surprised if either of those gigs are resumed, returning to his former business colleague Ian Smith’s advisory business Bespoke Approach seems much more likely.

And fantasies about an entry into state politics will remain that.

Rather, his main political project will be helping his daughter Georgina get into federal parliament, in the tradition of his grandfather

Sir John Downer and father Sir Alick Downer and continue the family’s Liberal dynasty.

Early exit

Some happy news out of the Marngoneet Correctional Centre: former Victorian Liberal Party state director Damien Mantach is almost a free man.

The word out of the medium-security Victorian prison is that Mantach is on track for an early release due to good behaviour.

Mantach — who was arrested in December 2015 after defrauding the Liberals

of $1.55 million — is believed to have given lessons to his fellow inmates in civics and letter writing.

And it seems those good works have not gone unnoticed. We gather Mantach could be out as early as July.

That would allow the former campaign whiz to help out on Opposition Leader Matthew Guy’s Victorian state election showdown with Premier Dan Andrews in November. He could certainly help out with the Barwon vote.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout