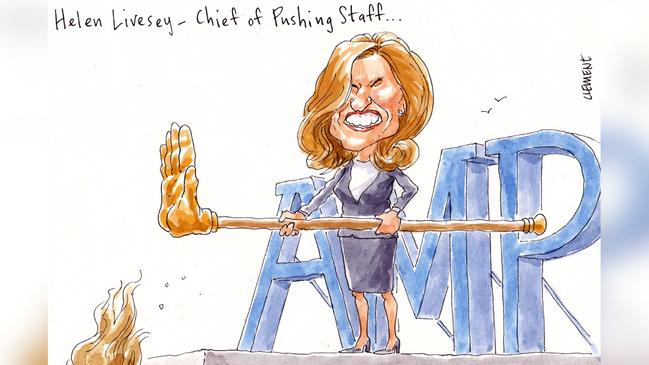

AMP chief of staff Helen Livesey delivered fatal blow

Whether she shares a hairdresser with her departed chair Catherine Brenner remains unclear, but you can take it to your royal commission-besieged bank that AMP chief of staff Helen Livesey was a central player in the faltering finance giant’s latest tragicomedy: “The Fall of Catherine of Centennial Park.”

Margin Call understands the now-exited AMP boss Craig Meller’s chief of staff Livesey was instrumental in bringing the issue of her 47-year-old chair’s two-year tenure in the $660,000-a-year gig to a conclusion over the past week.

To her credit, it seems the 50-year-old Livesey lives on Planet Earth, not AMP board land.

Following Brenner’s execution of the already walking-dead Meller on April 20, it was Livesey — a 20-year AMP veteran who is also group executive in charge of public affairs — who acted as the bridge between the AMP board and its executive team as big and small investors, proxy advisers and even politicians demanded corporate accountability over the misbehaving group’s fees-for-no-service scandal.

In the absence of a permanent chief executive and with existing director and just appointed interim executive CEO Mike Wilkins, 60, effectively conflicted over the issue of Brenner’s exit because of his potential role as her temporary replacement (reported by Margin Call on Saturday before being formalised on Monday morning), it is believed that it was his direct report of 13 days and counting Livesey who liaised in person and by telephone with AMP directors on the urgent need for Brenner to resign in the best interests of the company.

AMP’s market value has shrunk to below $12 billion after having more than $2bn pummelled from it in the royal commission.

The drop of almost 10,000 pages of material by Kenneth Hayne’s financial services royal commission to AMP days before wealth executive Jack Regan — in the full, grisly view of all watching in the Federal Court — focused the minds of senior management that the interests of the group were likely to diverge from the personal interests of directors.

Didn’t those executive minds read the tea leaves perfectly.

The hive mind of the AMP board took a fortnight to come to the same point of view.

And that was only after Livesey engaged with directors in the days following Brenner’s public hanging of the corpse of Meller.

It was a big task for the long-term AMP brand and reputation manager, who came into her role reporting to the CEO only in January 2017 after Matthew Percival (once an adviser to former Victorian premier Jeff Kennett) left the powerful gig after an extraordinary 16 years.

Like her now former boss Meller, Livesey commutes to AMP Tower at Sydney’s Circular Quay from Mosman, a safe distance from Brenner’s Centennial Park set.

Man of the moment

Tomorrow, interim AMP chair Mike Wilkins will have his other financial services blue-chip hat on as a director of the Marty Becker-chaired insurer QBE.

This year’s QBE annual gathering of shareholders at Sydney’s Westin is expected to be a tame affair, unlike the 2017 meeting at which then CEO John Neal’s love life with his secretary gave things a certain frisson.

To the best of Margin Call’s knowledge, there’s been no Pepe Le Pew behaviour from Pat Regan, the successor to the red-faced Neal, who remains on the QBE payroll until the end of this year.

While the global insurer shares with AMP a well-deserved reputation as a chronic ASX laggard, QBE has parted ways with AMP during Kenneth Hayne’s royal commission.

Unless Rowena “Shock and” Orr, Michael “Baby Face” Hodge or Mark “Danger! High Voltage!” Costello have plans we are still to discover — not impossible — QBE looks likely to sail through the inquisition without too much trouble.

QBE’s shareholders remain an understandably unhappy bunch. To that end, Regan recently forfeited 25 per cent of his bonus, worth up to $421,000.

A first strike against the remuneration report of QBE’s executive team — last year paid a stonking $US21.5 million — remains live.

But even with all that, the spiciest thing this time around is the presence of man of the moment Wilkins.

Margin Call understands that Becker, his QBE and the $13.5bn insurer’s long-suffering shareholders are — in their respective order — planning, agreeing and hoping that the former boss of rival insurer IAG Wilkins will succeed the American-based Becker as chairman in the $US610,000 ($812,400)-a-year gig.

But that was before AMP’s latest meltdown raised a host of still unanswered questions.

Will QBE’s miserable registry be collateral damage in the Hayne Show? Stay tuned. Its shareholders sure are.

It’s Garry, with two r’s

Myer’s crisis-busting executive chair Garry “Old Fashioned” Hounsell got the cheque book out yesterday to double his stock in the ailing retailer at a personal cost of just over $200,000.

And his $206,937 purchase — at an average cost of 41.4c by Margin Call’s calculations — sent the Myer share price up almost 12 per cent to 43c.

That’s how you grow a company the old-fashioned way!

The ASX announcement — promptly released at 3.52pm, just before the market closed — showed Hounsell leading with his chequebook.

It is understood “Old Fashioned” does not go in for the whizzbangery of Eftpos.

Clearly, the former Arthur Andersen auditor is chuffed with his appointment of veteran British retailer John King to be the retailer’s next CEO.

The Florida-based King will return to the workforce full-time in Melbourne, assuming Immigration Minister Peter Dutton gives him the required visa.

In addition to his Myer executive chairman duties, the 63-year-old Hounsell continues to juggle directorships at Joe Hockey-backed HelloWorld Travel, Paul Rayner-chaired Treasury Wines and Gladys Berejiklian’s tram builder-turned-litigant Acciona Geotech, all while running his own Victorian wine label Toolangi.

But that crowded roster doesn’t stop him getting out and about.

Yesterday at lunchtime, Hounsell was spotted in his Mercedes-Benz coupe (not his BMW family wagon with the personalised “TOOLANGI” plates) enjoying the sunshine in downtown Toorak and then popping into Brian Hartzer’s local Westpac branch for some personal banking. The ol’ chequebook a bit thin after the share buy?

The Toorak outing was just after Treasurer Scott Morrison — inspired by prudential regulator APRA’s damning report on Catherine Livingstone’s Commonwealth Bank — put Hounsell and the rest of Australia’s director class on notice.

“This should be a wake-up call for every board member in the country,” ScoMo said of CBA’s shame, adding that a directorship was “not a retirement job. It’s a very serious job.”

No arguments from the super-efficient Hounsell. There’s nothing retired about this former auditor.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout