All eyes on Ken Henry’s next move at NAB

Hasn’t that summer gossip about board mates counting numbers to roll NAB chair Ken Henry taken a sharp edge all of a sudden?

After the “H-bomb” exploded yesterday on Australia’s perennially dysfunctional big four, it seems anything is possible: whether it be a board putsch against its chairman (which, in our opinion, still seems incredible) or the permanent departure of its vagabond CEO Andrew Thorburn (surely a more likely option).

Margin Call has learned the NAB board meets today, after a brief inspection of the bomb site yesterday. Should be an interesting gathering.

Sounding a bit like this column in recent years, Kenneth Hayne declares in his royal commission report that NAB “stands apart from the other three major banks”.

Ka-Boom!

“I thought it telling that Mr Thorburn treated all issues of fees for no service as nothing more than carelessness combined with system deficiencies,” wrote Hayne.

“I thought it telling that Dr Henry seemed unwilling to accept any criticism of how the board had dealt with some issues,” wrote Hayne, witheringly.

Team NAB knew Hayne’s report was going to be bad. But not this bad.

Hayne’s criticism asks a big question of NAB’s board: what now?

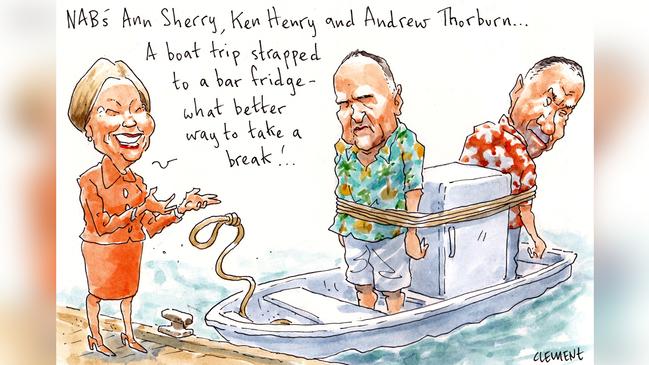

Two current NAB directors, former ANZ exec Philip Chronican (a favourite with institutional investors) and former Westpac exec Ann Sherry (chairwoman of cruise ship outfit Carnival Australia), are considered more than capable of taking over from Henry, a former Treasury secretary.

In normal times, the wombat-loving Henry — who has been in the job since December 2015 — would serve at least another two to three years and would oversee the appointment of Thorburn’s successor.

These are not normal times.

It’s possible Henry will decide it is in the best interest of the bank — worth $66.7 billion on yesterday’s pre-“H-bomb” closing price — that he steps down.

It’s also possible Henry, not a man short of ego, will decide his continuation as chairman is crucial to the bank.

And it’s also possible that his fellow NAB directors — which in addition to Sherry and Chronican include PwC partner Anne Loveridge, former PwC partner David Armstrong, former IBM exec Geraldine McBride, Link Group director Peeyush Gupta, Fletcher Building director Doug McKay and former Royal Bank of Scotland exec Anthony Yuen — may soon be having some very difficult conversations.

Interesting times.

Pack your bags

All the while, Andrew “Endless Summer” Thorburn is preparing to go on holiday again.

Kenneth Hayne wasn’t exaggerating when he said NAB is like no other bank.

In coming days, as the bank’s Docklands HQ smoulders after the H-bomb attack, Thorburn is scheduled to change out of his pinstripes and set off for another month’s leave.

He’s been back at work for six days.

Outside of the NAB bubble, no one in banking or politics or the media can believe that Thorburn is taking off again from his $4.4 million job, nor that his chairman Ken Henry has allowed him to.

Before popping into the office last Wednesday, Thorburn had been on holiday for 5½ weeks.

Margin Call is told that Thorburn spent much of the summer in New Zealand fishing. Nothing wrong with that: indeed, it seems like a perfect way to unwind before a big year.

But the second act of his holiday remains as unclear as his and his chairman’s future at the bank.

Spinners at NAB — whose purgatory looks set to continue for another year — are still not able to verify whether Thorburn is off for a reflective stint at a theology school in Vancouver.

They weren’t sure when we asked ahead of the Christmas break.

Six weeks on, they still don’t know.

Something’s up.

Cook feels the heat

The H-bomb was also terrible news for NAB’s chief legal and commercial counsel Sharon Cook. A former King & Wood Mallesons partner, Cook was in charge of leading NAB’s royal commission response.

Cook was pretty chuffed about that role, even starring in a vanity story about NAB’s “war room” in the AFR’s Boss magazine (which has a rich tradition of giving its corporate interviewee enough rope).

As of Bloody Monday, it’s probably not a passage she’s going to underline on her CV.

Cook is also in charge of NAB’s corporate affairs team, which Margin Call has heard will be the site of great change in the near future.

Hope we’re wrong.

Baird to the bone

The H-bomb didn’t get in the way of NAB exec-most-likely Mike Baird’s Monday. Despite some speculation he might pull out, Baird kept his commitment as the headline act at a Liberal boardroom lunch fundraiser yesterday for NSW Treasurer Dominic Perrottet.

Margin Call was told Baird didn’t once mention the royal commission, the H-bomb or anything banking-related in his speech.

The relaxed gathering — held in the Sydney offices of Richard Deutsch’s hospitable Deloitte Australia — was a $1500-a-head (plus optional $500) affair, whose guests included Sydney Institute chairman Nicholas Johnson.

Meanwhile, we spotted Baird’s University of Sydney contemporary Cameron Clyne in News Corp’s Sydney office yesterday.

A tanned Clyne was passing through the foyer just after lunch, off to talk Australian Rugby Union, the sporting body he chairs. Clyne was Thorburn’s predecessor as NAB CEO, but the bank’s mess hasn’t been his concern for years.

No wonder he looked so relaxed.