Under the ownership of private equity giant Blackstone things are turning around at disgraced gambling empire Crown Resorts, but the controversial operations are not out of the woods yet as a critical few months loom for the group.

Impending critical regulatory hurdles have seen the directors of Crown, which is chaired by US casino industry veteran Bill McBeath and led by experienced chief executive Ciaran Carruthers, warn in Crown’s latest financial accounts that “there is a material uncertainty that may cast significant doubt on the group’s ability to continue as a going concern”.

The uncertainty relates to approaching assessments by Crown’s myriad gaming regulators as to its suitability to hold a casino licence.

The two-year term of Stephen O’Bryan, the special manager at Crown Melbourne, expires at the end of this year. He will lodge his final report on Crown to the regulator shortly after that, with the regulator then deciding if Crown should keep its licence.

Similar processes are then set to unfold in Sydney and Perth, with Crown indicating “a decision is not expected until early-mid 2024 for Crown Melbourne and Crown Sydney, and later in 2024 for Crown Perth”.

“The outcomes of the regulator’s decisions and the financial implications to the group give rise to the existence of a material uncertainty that may cast significant doubt on the group’s ability to continue as a going concern,” the company’s accounts warn.

Crown lost about $200m in the 2023 financial year compared with about $1bn the year before. Revenues are back up to $2.78bn, from $1.9bn in the year prior, but the group’s auditor KPMG has agreed with the board’s assessment of the coming months and issued its own warning about the “material uncertainty” around Crown’s “ability to continue as a going concern”.

Crown’s financials were audited by KPMG partner Rachel Gatt.

All in all, the scene is set for a tense few months ahead.

Ghost of the past

It’s getting close to 20 years since Roget Corbett ran Woolies. For context, he left the year before Apple released the first iPhone.

Still, the 81-year-old ghost from the past turned up at the retailers’ annual meeting at the Fullerton Hotel in Sydney’s Martin Place on Thursday to deal himself back into the $43bn company’s affairs.

Now playing shareholder activist, Corbett has fallen in behind his billionaire mate and business partner Bruce Mathieson’s tilt to install Corbett’s old right hand man at Woolies, Bill Wavish, on to the board of Endeavour. Mathieson is Endeavour’s biggest investor and his son, Bruce Jr, is already on the board.

The drinks and pubs group was spun off from Woolies in 2021, with the retail giant still Endeavour’s second-biggest shareholder with 9.1 per cent.

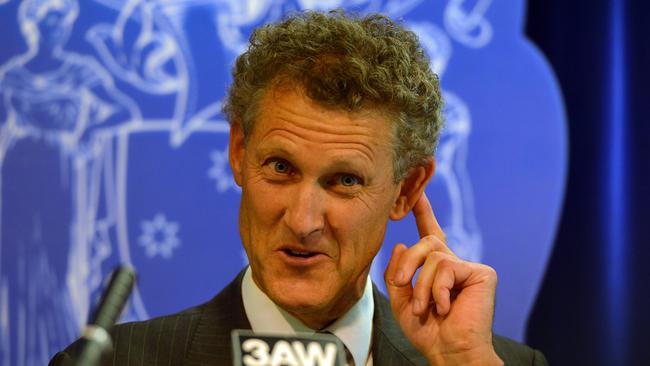

Corbett opened his time on the shareholder megaphone reiterating his policy of not commenting on Woolworths or its operations, which would be terrible form as a former CEO, before adding that he thought current management (led by Brad Banducci) had done a superb job.

Chair Scott Perkins thanked “Roger” for his comments, indicating Corbett could resume his seat if he wished – which amused the crowd – only for the octogenarian to plough ahead on the topic of Endeavour.

Woolies isn’t supporting Wavish’s nomination and that’s got right up the nose of Corbett, who wants his old shop to use its muscle to engineer change at Endeavour, which owns Dan Murphy’s, BWS and 354 pubs.

“The status quo is so bad,” Corbett declared to Perkins.

“Woolworths has lost circa $200m on the investment and I think there are a lot of us here who are Woolworths shareholders and Endeavour shareholders. We, sir, have lost a lot of money.

“What are the circumstances, how much worse does it need to get than a 40 per cent reduction in the (Endeavour) share price for Woolworths to use its 9 per cent to protect its own investment, but alas sir, our investment?”

Endeavour’s annual gathering is next Tuesday, also in Sydney. That’s also the night of Halloween. What’s the bet Corbett dressed as a ghoul turns up to haunt there too?

Tony times

What is it about swarthy European blokes by the name of Tony that seem to draw the attention of mining billionaire Gina Rinehart?

There’s a pattern emerging here that is not going unnoticed by keen observers in the west.

Latest to capture the attention of Australia’s richest woman is Azure Minerals boss Tony Rovira, with Rinehart in the market on Thursday for a stake in the listed lithium miner that had just announced it was the subject of a $1.6bn takeover bid by SQM.

Before that on Rinehart’s radar was Liontown Resources chief Tony Ottaviano, who runs a company that was (but is no more) being bid by Albemarle, with Rinehart acquiring a 19.9 per cent stake and ultimately thwarting the deal.

But do folks remember the year Rinehart took a spill down the stairs of the Emirates marquee at the Melbourne Cup at Flemington?

It was 2016 and Rinehart was tripping about the Birdcage with friend Tony Bellia, who it was reported had also been along with Rinehart that year aboard the luxury ship that cruised the Mediterranean for fellow billionaire Lindsay Fox’s 80th birthday. Bellia at the time was described by friends as “a real ladies man” and “the life of the party”.

Fast forward seven or so years and lithium doesn’t sound like anywhere near as much fun.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout