Alex Turnbull, the activist fund manager based in Singapore, has quietly bought an investment property in Sydney’s eastern suburbs.

His hillside $5.2m Bronte acquisition was an off-market deal over the summer break that settled recently with funding from HSBC.

Margin Call gleans there are no plans for Turnbull and his wife, Yvonne Wang, the parents of Isla and Ronan, to return anytime soon.

But they would find that Bronte has become a bit of a fund manager magnet.

Investment legend Seumas Dawes owns the suburb’s most expensive home, while John Hempton, who named his fund Bronte Capital after the suburb, has been there for 12 years.

Alex Turnbull’s acquisition last sold for $5m in early 2018, so the deal reflected a subdued annualised 2 per cent price growth for vendor Cheryl O’Neill, wife of ASX general manager Grant Lovett.

With a contemporary sandstone facade, the three-level duplex, with 220sq m of internal living space and beach and ocean views, has a plunge pool.

Turnbull established Keshik Capital in 2015 after a stint at Goldman Sachs. The hedge fund, which invests in debt and equity, is based out of a co-working space in Raffles Place tower.

It was parents Malcolm and Lucy who were first looking on behalf of Alex in 2016.

The purchase price is almost as much as the $5.4m that Malcolm and Lucy paid for the original portion of their current harbourfront abode in 1994, when they secured the house then known as La Gai Soleil from Klara Saunders, the widow of shopping centre tycoon, John.

Banker’s yoghurt exit

Former Goldman Sachs banker Adam Gregory has resigned his directorship in another company fronted by George Calombaris. This time Gregory has exited Made By Yo-Chi, the frozen-yoghurt chain.

The Calombaris-backed Made Establishment group acquired the four-store company in 2018. The company, launched in 2013, has stores in Carlton, Balaclava, Hawthorn and Malvern. The frozen yoghurt was also sold in Made’s Jimmy Grants venues.

Last month, Gregory quietly resigned his directorship of Made a few weeks before it collapsed.

Gregory’s latest directorial departure was lodged in an ASIC update by remaining company director Radek Sali on Thursday. Through the years Sali had poured some $9m into the group, with a further $2.5m in recent times, including $300,000 this month to ensure staff got their full entitlements.

Margin Call gleans there are last-ditch talks to save the flagship Gazi restaurant.

Perrys square off

The trademark fashion case involving Sydney designer Katie Taylor, who has long traded under her maiden name Katie Perry, and the US singing sensation Katy Perry continues, some 10 years after first flaring.

The pair’s legal teams locked horns this week in the Federal Court.

Taylor accuses Perry, whose real name is Katheryn Hudson, of unauthorised use of her trade mark, claiming the singer had ventured into similar-styled branded merchandise at Australian retailers including Target and Myer.

The legal matter before Justice Brigitte Markovic delved into whether correspondence from Perry enjoyed “without-prejudice privilege”. The pop star has rejected claims of trademark infringement, saying the designer “encouraged or acquiesced to” the singer’s use of her name on the clothing.

The dispute kicked off given their near dual-name problem in 2009.

It was a year after Perry shot to fame with her I Kissed a Girl single when Taylor posted a video to YouTube, seeking to interact directly to come to an agreement.

Taylor had started her fashion label at Paddington Markets.

“I am absolutely no threat whatsoever to you,” Taylor said in the 2009 video she shot with the Opera House in the background. “The only people who are making any money on this are the lawyers.”

The case was dropped, two hours before its hearing.

This week Katy Perry had Emma Bathurst, instructed by Corrs Chambers Westgarth, representing her company, Killer Queen, while Silberstein & Associates filed the paper work for Taylor, who has been assisted in case funding by Litigation Management.

The parties reconvene next month.

Appster goes to court

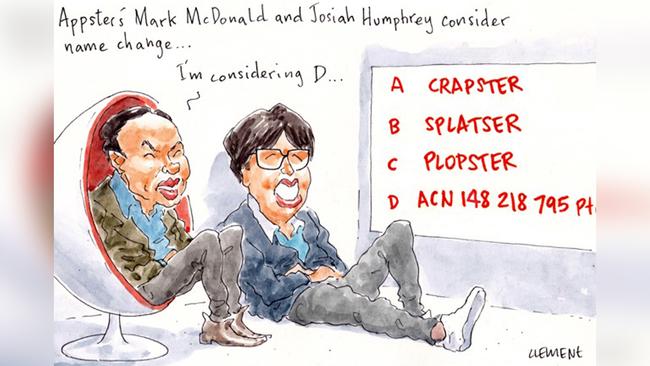

Mark McDonald and Josiah Humphrey, the Gen Y whiz kids behind NAB-backed Appster, face a Federal Court hearing.

Some 14 months after the collapse of the app-development firm, the liquidator Paul Vartelas from BK Taylor & Co has filed compulsory examination proceedings against the company founders.

The duo have not bobbed up anywhere since the demise of what was often referred to as the “next Apple”. And the company name reverted to ACN 148 218 785 shortly after the collapse as the liquidator suggested to the creditors it was in their best interest.

Appster is being investigated as to whether it briefly traded while insolvent.

Auditor Tracy Driver, a partner at KPMG, has been asked to provide details on the start-up’s 2017 audit.

The examination will also look at payments made to its offshore entities in the US and India in the weeks before its collapse.

Creditors are claiming $2.3m.

Having met online at 13, Humphrey and McDonald launched Appster in 2011 with $3000 in their pockets. Their business peaked at $19m annual revenue. They starred in the Forbes magazine top 30 under 30 for entrepreneurs in 2017.

Artful sale

There’s whispers Judith Neilson, who has one of the world’s most significant collections of Chinese contemporary art, has expanded her holdings in Sydney’s Chippendale. The terrace just across the road from her White Rabbit Gallery has sold for $2.235m, but been shrouded in secrecy, given it was bought using a shelf company entity directed by trustee lawyers. The shelf company has since lodged plans for a $770,000 upgrade by Atelier-Andy Carson.

Curiously, the shelf company was the same purchasing entity used in four other recent acquisitions. Margin Call senses there’s a family wealth office somewhere using the shelf company for clients seeking confidentiality to keep the identity of the buyer a mystery to the vendor, and then the prying eyes of the press.

The same shelf company was first used to buy a $14m Watsons Bay home for the Lowy family.

AMP chief cashes in

AMP boss Francisco De Ferrari has cashed in on the wealth manager’s post-results share price pop, selling some $2.5m worth of his portfolio on the market. At the same time he picked up $1.86m worth of share rights that have now converted to shares. The sale, AMP says, was in order to meet expected tax obligations. AMP shares are up 13 per cent since it released its full-year result this month.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout