Adriana Benhamou Weiss creditors queue up; faction fiction over Katherine Deves

More on the ensuing court battle between the corporate regulator and Adriana Benhamou Weiss, the socialite charged with falsifying records at her company, Benhamou Designs, which collapsed in 2018.

Margin Call understands the interior design consultant is facing at least 56 creditors, including suppliers based in Singapore, Britain, Hong Kong, Qatar and across Australia.

Aggrieved customers include womenswear designer Rebecca Vallance, as well as Jeff Singh, the founder and managing director of Chase Corporate Advisory, an investment firm established with ATO chief Chris Jordan and ASIC chairman Tony D’Aloisio.

Singh is understood to have contracted Benhamou Designs in 2017 for interior design work costing up to $100,000.

Asked for comment, he told Margin Call: “I’m not interested in chatting.”

But the list goes further to include a substantial number of small business owners – moving companies, a builder, an architect, a joinery outfit, etc – as well as Benhamou Weiss’s former employees at the company.

“She just wouldn’t pay me,” one worker alleged to Margin Call.

The company folded owing $8.1m to its creditors, the largest one being the ATO.

But with the case not back before the Downing Centre Local Court until June, there has been ample time for Benhamou Weiss to sojourn in Paris with Dominique Romano, a French businessman whose recent activities are worthy of closer examination.

Back in 2016, Romano’s companies, Guibor and Omega 26 Investments, were accused by the US Securities and Exchange Commission of using stolen press releases, provided by Ukrainian hackers, to inside-trade on companies including Boeing, Caterpillar, DuPont, HP, Netflix and others, securing profits of $6.1m.

The SEC settled the matter with fines for both companies totalling almost $8m.

Meanwhile, Margin Call has learned of a curious payment made in 2013 to HB Interiors, an exclusive yacht and home design company run by Benhamou Weiss’s mother, Helene, and which is currently the subject of strike-off action in Britain.

There is no suggestion that her daughter was affiliated with the company or aware of its financial activities.

The company received a $192,963 payment from Zibar Management in 2013 for the purpose of refurbishing a super yacht, with the entity since linked to Russian organised crime figure Dmitry Klyuev in a criminal complaint filed to Britain’s National Crime Agency by Hermitage Capital Management in 2016.

Klyuev was named on the US sanctions list in 2014, and in Britain last year.

Hermitage argued in the complaint that Britain had been used by the Klyuev organised crime group as a “hub for money laundering shell companies, as a source for nominee directors to turn a blind eye … and as a destination for laundering illicit proceeds through purchases of industrial equipment, luxury goods, real estate and yachts”.

Comment was sought from Benhamou Weiss.

–

Faction fiction

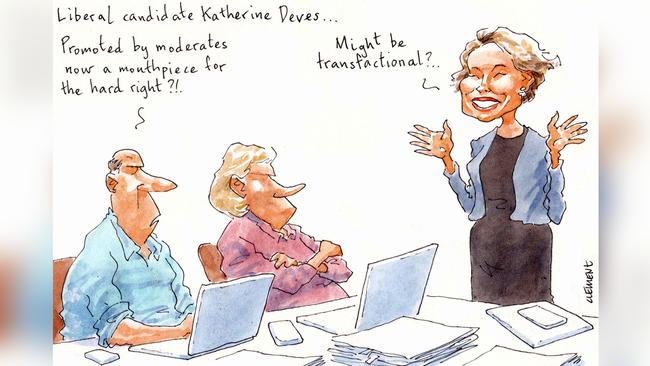

Katherine Deves has been a bug-light for scandal ever since she received endorsement for the seat of Warringah earlier this month, owing to a surfeit of fossilised tweets dug up on the subject of trans-athletes in women’s sport.

Political operatives dredging her accounts have hit paydirt, already scoring two grovelling apologies from Deves and calls for her resignation via moderate-faction poobah Matt Kean, who blasted the musings as “vile” and “horrendous”.

Foreign Minister Marise Payne, a godmother to the moderate faction, took a cooler approach during Sunday’s Insiders program, deflecting questions of whether Deves should resign but agreeing – with sphinx-like diplomacy – that the candidate’s remarks were untidy (our words, not Payne’s).

For the record, Deves described transgender children in one post as “surgically mutilated and sterilised”, while in a second – since withdrawn, but also breathtakingly stupid – she compared her ongoing activism on the subject to the heroics of French Resistance fighters during World War II.

Given the outpourings of support received from the usual stable of conservatives, including Tony Abbott, it’s little wonder that Deves has been tagged as right-wing warrior.

However, in reality, she is very much a product of the very moderates now calling for her resignation.

Margin Call has confirmed that not only is Deves a member of the Balgowlah-Fairlight branch of the Liberal Party, regarded as the most politically moderate branch in the Warringah electorate, but that she has told party officials her membership was sponsored by Jane Buncle.

Buncle, a moderate who controls the branch with NSW Environment Minister James Griffin, was slated to contest Warringah but withdrew shortly before Scott Morrison ordered a federal intervention into candidate selections for critical seats.

Comment was sought from Buncle and Griffin.

Warringah conservatives had actually backed an entirely different candidate, Lincoln Parker, a China hawk and member of the Liberal Party’s defence and national security policy branch, whose application was declined by the state executive. Did we mention the executive is stacked with moderates?

Deves’ application was ultimately put up to the state executive despite the fact she hadn’t been a paid-up member of the party for the six-month probationary period.

How she was framed to the Prime Minister, who chose her as his captain’s pick, remains unclear. That moderates are now deserting her, however, is rich with irony.

–

Better late than never

Oh how the mighty fall, but at least disgraced Kiwi businessman Ron Brierley is trying as best he can to keep up to date with his paperwork.

The 84-year-old looks to have been spending his time productively since his release from Long Bay Correctional Centre in mid-February, after having his sentence for possessing child abuse material trimmed.

A scratchy, handwritten change in substantial notice for Sandon Capital Investments lodged last week revealed the fallen corporate raider’s stake in the active fund manager, held via Siblow Pty Ltd, had decreased from 24.29 per cent to just under 22 per cent.

Sandon is worth about $125m on market, valuing Siblow’s stake at about $27.5m.

The note from Brierley, however, was somewhat tardy, with the size of the share changing up until 20 December last year, but the form not being filled until the end of March and only filed to the exchange a week ago.

Brierley has been otherwise indisposed in recent months, and might have found himself remaining so, save for his legal team’s challenge to his jail term, citing a deterioration in the ageing businessman’s medical condition.

He was jailed in October for 14 months and served with a non-parole period of seven months, which was due to expire on May 13.

However, he was deemed eligible for release three months early after the NSW Court of Criminal Appeal allowed a challenge on February 1.

No surprise, in that case, as to why he only recently found the time to address the backlog of forms and files waiting for him on the outside.

Margin Call also noticed the sudden exclusion of his usual honorific, “sir”.

Probably the right call.