AACo’s new beef king Joe Lewis rules from afar; Myer payday for Solomon Lew

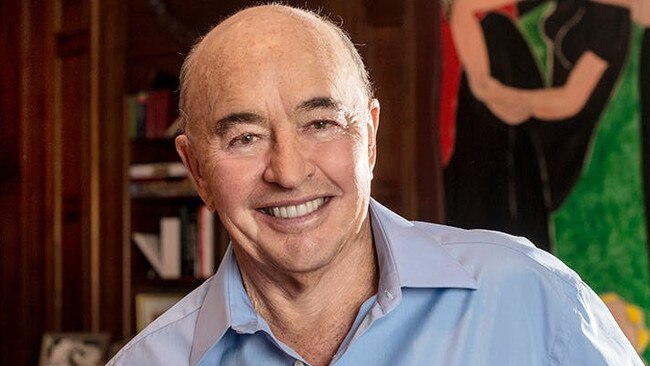

So much for Australian-owned. News that billionaire tax exile Joe Lewis has secured more than 50 per cent ownership of Australian Agricultural Company is causing no end of ruction among some shareholders, especially those eager to establish how he sailed through the usual benchmarks for foreign investor scrutiny.

Notwithstanding the usual concerns surrounding the national interest, it’s been about two decades since Lewis’s last visit to Australia, or so we’re informed. In that time he hasn’t invested a dime in this country, as would be required if he were angling for a Significant Investor Visa.

AACo would not confirm if he’s even sighted one of its cattle stations and, if that’s not bizarre enough, he’s currently residing on a superyacht that looks like the Event Horizon and which is currently at anchor along a canal in Bordeaux.

But forget about all of that. The British currency trader now comfortably owns a majority of the nation’s oldest and largest beef producer, giving him theoretical control over a huge swath of Queensland countryside, or more than 1 per cent of Australia’s total land mass.

Achieved, we might add, through a steady buy-up of shares over the past month using his Tavistock/AA Trust, incorporated in the tax haven of the Bahamas, and culminating in a sweeping purchase of 5.8 million shares last Friday.

From what we understand, the reclusive Lewis spends most of his time holed up in Aviva – his floating palace, to be sure – and is surrounded with fine artworks on board that are said to be of, ah, questionable provenance.

Not that he doesn’t own priceless art, somewhere, but would it be prudent to keep a genuine Francis Bacon on the walls of Aviva’s lower deck? Would not the salty brine – to borrow a memorable phrase from the execrable Tom Wambsgans – quickly corrode its gilded frames? Better to keep a fake and tell guests they’re authentic, eh?

Quite how AA Trust received the regulatory approvals to proceed with the share purchases, as reported by the Financial Review, is a mystery causing no shortage of noses to be cracked out of joint.

Even Anthony Albanese briefly weighed in during an interview with 6PR on Thursday, hinting that further examination of this transaction may be required.

“A purchase such as this is substantial and that requires examination under the regulations that are in place,” the Prime Minister said.

AACo’s other deep-pocketed shareholder, with 17 per cent of the business, is Andrew Forrest via his Tattarang investment vehicle. Comment was sought from Tattarang but it was declined, although Margin Call understands Forrest is mightily displeased about the Lewis matter.

As far as this column is aware, Lewis’s only connection to Australia has been a tenuous one. His daughter, Vivienne, had been engaged for almost two decades to Craig Johnston, the former Liverpool midfielder recently living in NSW, although that union appears to have ended.

Lewis himself did not respond to a request for comment.

–

Brown exit talk

Speculation was building on Thursday night that Amy Brown, the NSW bureaucrat responsible for appointing John Barilaro to a US trade role, would announce her resignation as a department secretary as early as Friday.

Brown, the secretary of the Department of Investment, Enterprise and Trade, is understood to have begun telling colleagues of her intention to stand down from the role.

She previously held a second appointment as CEO of Investment NSW, but relinquished that position in August following immense scrutiny of the Barilaro trade appointment. She then embarked on a period of leave, which is due to end on Monday.

–

Filtering feedback

Our apologies to anyone growing weary of reading about the utterances of Jayne Hrdlicka, but we cannot in good conscience ignore remarks made by a CEO that are so egregiously divorced from reality.

Appearing at the annual CAPA airline summit in Adelaide on Wednesday, the Virgin chief was asked from the floor how she handles “pile-ons” from the cheap seats of social media, especially those in response to branding campaigns and other guff.

Her response was textbook corporate banality. She said: “We love feedback, right, so whether it’s positive or negative, we love feedback and we don’t want to filter that feedback.”

She continued: “I don’t really want to be in a position where we’re posting things on social media and we only get positives because that isn’t real. We’re living in the real world.”

Are we? Perhaps it hadn’t occurred to Hrdlicka that Virgin has a track record of proactively censoring commentary on its Facebook and Instagram platforms. It did so throughout July, just as the airline was enduring some of its most blistering criticism for cancelling daily flights.

Readers may recall that during this period Virgin was ranked the worst airline for cancellations out of 19 global carriers. We can assure you there was certainly no shortage of robust feedback from patrons in the lead-up to the commentary blackout.

Presumably the digital team at the airline could only endure so much moderating, with the ban lasting about six weeks and lifted only in early August.

A Virgin spokeswoman reiterated Hrdlicka’s unswerving support for free speech, but confirmed the comments were switched off so staff could occupy more battle-stations during the July crisis period. “During a heightened period of disruption during the July school holidays, we made the decision to turn off all comments on our posts, regardless of the nature of the feedback, to allow our community management team to best focus on servicing the high volume of guest bookings which is their core role,” the spokeswoman said.

–

Payday for Lew

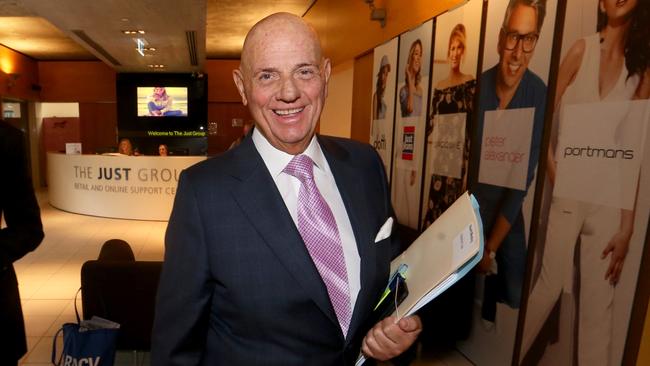

After all these years without a crust, retail billionaire Solomon Lew finally has something to show for his growing stake in department store chain Myer.

The company declared a final dividend of 2.5c that stands to bank $4.7m for Lew’s Premier Investments, of which he owns a 38 per cent share. That’s about $1.8m directly into his pocket after five years of bubkes.

It’s likely that Lew will angle for a representative seat on the Myer board at the upcoming AGM, given his 22.9 per cent holding. But presumably such concerns are out of mind at the minute; he’s currently aboard a cruise liner for the 85th birthday of trucking magnate Lindsay Fox. Last we heard, revellers were at Halifax, Nova Scotia, having left the Big Apple over the weekend.

Margin Call revealed the bulk of the cruise itinerary in July, the highlight of which – by our measure – is a pyjama party that will see all guests wear Peter Alexander sleepwear, donated by Lew.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout