$20m cash consolation for Packer after recent Ho blow

Every cloud has a silver lining, even for billionaire James Packer.

COVID-19 was blamed by the Aussie gaming mogul’s “brother-from-another-mother” Lawrence Ho earlier this month when the Hong Kong casino operator dropped plans to take his 9.9 per cent, $900m, stake in Crown up to 19.9 per cent.

The decision by Ho’s Melco has meant there’s $900m less in Packer’s pocket, but at least the Crown 35 per cent shareholder gets to keep the dividends that would have otherwise flowed to Ho from Crown’s interim results on Wednesday — if the share sale deal had proceeded.

Packer holds 237.03 million Crown shares that, at the group’s $11.80-a-share opening price, were worth $2.8bn.

Crown’s new boss, Ken Barton, declared a 30c interim dividend on Crown shares for a sweet income flow of $71.1m for Packer.

If the second 10 per cent tranche of Packer’s Crown stock had gone to Ho, the Aussie billionaire’s dividend would have been a lesser $51m-odd.

The extra $20.3m is sweet income for the troubled billionaire, with the Crown dividend now his major source of day-to-day play money.

Ho’s Melco will welcome its $20.3m payday from the dividend on its 9.99 per cent stake in the $8bn listed group, with the coronavirus that’s gripping the region taking its toll on Ho’s Melco operations.

Lonely at the top

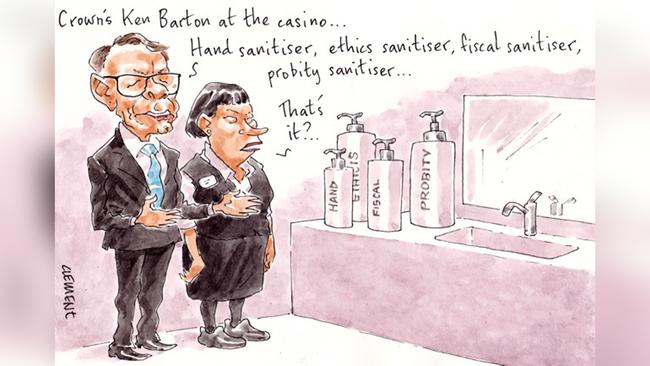

Freshly minted Crown Resorts boss Ken Barton rolled up for his inaugural results as head croupier on Wednesday, unusually accompanied by his new chairman Helen Coonan.

Without the former Howard government minister by his side, releasing the disappointing results would have been a lonely affair for Barton, who’s being paid a base of $3m a year to be both boss and head number-cruncher at billionaire James Packer’s $8bn gambling den.

When he was just a CFO, the Sydney-based Barton, 54, spent about 80 per cent of his time in Melbourne, where he’d rest his head at Crown instead of his Double Bay home.

But now that he’s the boss, Barton will get to spend more time at the harbour to keep an eye on Crown’s Sydney build, as well as the NSW gaming commission’s inquiry into the casino group, at which Packer is expected to give evidence.

Just three weeks since his appointment at the end of January to replace John Alexander, by Barton’s own admission on Wednesday, his biggest initiative had been the installation of countless hand sanitiser dispensers across Crown’s gaming floors as part of his own personal battle against COVID-19.

Revenue was flat at the group in the first half as punters stayed away.

But while Barton’s role has expanded, Coonan has finally given one of her myriad roles the chop so she will be able to devote enough time to the $8bn Crown.

She’s finishing up as a director of Snowy Hydro at the end of June.

But one gig Coonan was adamant she was keeping was her chairmanship of spin firm GRACosway, which represents Lawrence Ho’s gaming empire and now Crown 10 per cent shareholder Melco.

Cosy.

Penn’s friends

Telstra boss Andy Penn is spearheading a $22.5m rebuild of Victoria’s only children’s hospice.

Penn, who over the past month has watched the Telstra share price come close to breaking the $4 mark for the first time in more than two years before falling back again, is a life governor and board member of Melbourne charity Very Special Kids.

VSK is chaired by Challenger chairman Peter Polson and former treasurer-turned Future Fund and Nine Entertainment chairman Peter Costello, who is a life member, while another of its life governors is former Melbourne cricket club and Tattersalls chairman David Jones.

Now Penn has agreed to chair VSK’s hospice rebuild capital fundraising campaign, which has been two years in the planning. The current hospice is set to be demolished in December and then rebuilt.

Penn is being joined on the capital appeal committee by former Liberal MP for Higgins and minister for women Kelly O’Dwyer, who was integral last year in securing $7.5m in federal funding towards the rebuild.

The matriarch of the billionaire Fox family, Paula Fox — also a VSK life governor — and Just Jeans co-founder Connie Kimberley have also been appointed patrons of the capital campaign.

Rounding out the committee are Ernst and Young partner and Victoria Racing Club director Glenn Carmody and JBWere general manager Neville Azzopardi, as well as Very Special Kids CEO Michael Wasley and its patron Sister Margaret Noone.

Hot property

A renovation running behind schedule. Who’d ever guess! This one is the new offices of the interior decorator Thomas Hamel, whose Australian client book started with Malcolm and Lucy Turnbull in Point Piper three decades ago.

Hamel’s big black book of stylish clients includes the likes of the Packer, Lowy and Gandel families, and even Hollywood actor Russell Crowe.

In between his clients, the classy East Coast American-born Hamel has spent summer preparing his Surry Hills, Sydney office with a $600,000-plus fit-out.

It’s a castellated sandstone Victorian regency terrace, which he’d expected to move into this week from his prior Redfern premises.

It now looks like next month when the team moves into the Foveaux Street space, which was the former Sydney HQ for the global phenomenon, Uber Eats.

His team is making do in a co-working space.

Nestled between Riley and Crown streets, it cost Hamel $3.25m last year, which was less than its $3.525m sale in 2017.

The premises, once owned by an investment syndicate that included former Wallaby David Lyons, come with views that take in the Sydney Tower.

Until last Christmas, Hamel’s leased premises were on the top floor of the 1890s Redfern Electric Light Station.

It was the grand neoclassical building that he and then partner, the late antiques dealer Martyn Cooke, sold in 2013 to spin-doctor Sue Cato for $4.5m who had hitherto just occupied the lower floor.

Cato will now embark on incorporating Hamel’s former space into her enlarged residence, with $360,000 plans by Aileen Sage Architects. It will see the upper level converted into a master suite.

Meanwhile, Hamel’s South Yarra bolthole has been listed for sale for auction this weekend.

The Hawksburn Road home that cost $2.06m in 2017 has $2.86m hopes.

His last property disposals saw his Sydney CBD apartment sold to corporate adviser Simon Mordant and his wife Catriona in 2015. And before that Hamel’s Kildare Heights weekender was sold to the former managing director of Goldman Sachs Australia, Robert Esenin, and his wife Estelle in 2003.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout