Lowe softens his rate rise warning as the RBA opts to take a breather

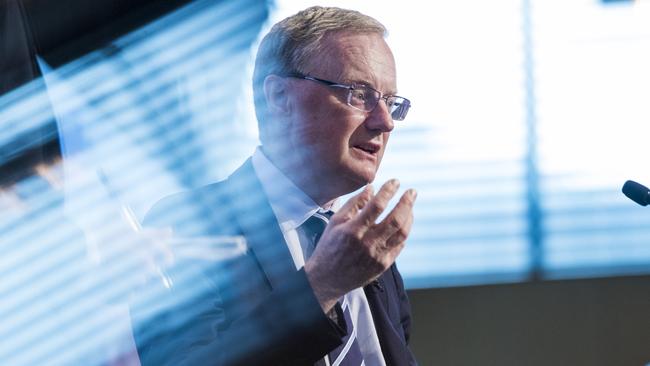

RBA Philip Lowe has moderated his warning of potentially more rate rises but says ‘some further tightening of monetary policy may well be needed’.

The Reserve Bank has left the door ajar to more interest rate increases, while delivering a mostly expected pause in its most aggressive rate rises since the early 1990s.

The central bank’s decision to leave the cash rate unchanged at an 11-year high of 3.6 per cent after 10 consecutive increases was expected by a majority of financial market economists.

It was also priced as a strong chance by the money market after the recent banking crisis overseas and lower-than-expected monthly CPI data and tepid retail sales numbers in Australia.

But RBA governor Philip Lowe softened his warning on the potential for more rate rises, saying “some further tightening of monetary policy may well be needed to ensure that inflation returns to target”.

Shares reacted positively, the S&P/ASX 200 rising 0.2 per cent to a more than three-week high of 7236 points. The dollar dipped from US67.85c to US67.42c. Bond yields were little changed.

Dr Lowe said that the decision to hold interest rates steady this month “provides the board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty”, in a reference to the overseas banking crisis.

“The recent banking system problems in the United States and Switzerland have resulted in volatility in financial markets and a reassessment of the outlook for global interest rates,” he said.

“These problems are also expected to lead to tighter financial conditions, which would be an additional headwind for the global economy.” But the Australian banking system was “strong, well- capitalised and highly liquid. It is well placed to provide the credit that the economy needs.”

He also noted that “monetary policy operates with a lag and that the full effect of this substantial increase in interest rates is yet to be felt”. The decision to hold interest rates steady would give more time to “assess the impact of the increase in interest rates to date and the economic outlook”.

Rents are rising at the fastest rate in “some years” due to low vacancy rates, and utilities prices were “also rising quickly”, but a range of information, including the monthly CPI indicator, suggest “inflation has peaked in Australia”, Dr Lowe said.

Goods inflation was expected to moderate on global developments and softer domestic demand, and the economy had “slowed”, with “below trend” growth expected for the next couple of years.

“There is further evidence that the combination of higher interest rates, cost-of-living pressures and a decline in housing prices is leading to a substantial slowing in household spending,” he added.

“While some households have substantial savings buffers, others are experiencing a painful squeeze on their finances.”

Dr Lowe is due to address The National Press Club at 12.30pm (AEST) on Wednesday.

“Overall, we think they’ve delivered a reasonably dovish hold here, albeit still prudently leaving the door open to further hikes if needed,” RBC chief economist, Su-Lin Ong said.

“Of course, subsequent to the March board meeting we had both a Lowe speech and the minutes explicitly countenancing a pause, so together with global financial system developments, markets had plenty of preparation for a change in tone from the RBA. But the RBA has managed to take a more dovish bent than we and many others expected.”

Ms Ong said she believed the RBA “would like to end the cycle soon”, but inflation was the main issue. If core inflation doesn’t fall much in the March quarter, the RBA “may be left with no choice but to hike again”. Her base case remains that the RBA will lift rates to a terminal rate of 3.85 per cent next month.

“We think inflation will prove slightly stickier than the RBA is currently factoring in,” she said.

ANZ continued to expect the RBA to lift the cash rate to a peak of 4.1 per cent. While noting the softer tone from Dr Lowe in his statement, ANZ senior economist Felicity Emmett said this change in language was necessitated by the pause in rate rises.

“It would be odd of the board to have left rates unchanged if they were sure more rate hikes were required,” Ms Emmett said. “Lowe has expressed a strong desire to preserve the gains in the labour market made over the past couple of years. This objective likely contributed to the decision to pause and give time to assess the data, but we continue to think inflation will prove persistent enough to require the RBA to tighten monetary policy further in the months ahead.”

NAB said the RBA’s less forceful tone on interest rates suggested it had downgraded its forecasts for growth and inflation since the February Statement on Monetary Policy, when it saw a cash rate of 3.75 per cent as needed to get inflation down to 3 per cent by mid-2025.

“This may well reflect the temporary surge in the CPI around the end of 2022 associated with changed pricing of travel and accommodation and its subsequent reversal in January and February,” NAB economists said.

A 3.6 per cent rate “may well mark the peak of interest rates” this cycle due to “considerably slower growth in the second half of 2023, moderating inflation and an increase in the unemployment rate”. The RBA had noted there was further evidence of a substantial slowing in household spending, which was not “something the RBA has reported before to this magnitude,” NAB said.

Westpac chief economist Bill Evans said the RBA’s decision was “consistent with the classic approach that policy needs to move swiftly to push rates into the contractionary zone but, once there, a central bank that meets as frequently as the RBA can pause to assess the cumulative impact.”

He expects one final interest rate rise in May.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout