Lew set to confront board at Myer AGM

Disgruntled Myer shareholder Solomon Lew says he will attend the embattled company’s annual general meeting and seek a spill.

Myer’s biggest investor, rebel shareholder Solomon Lew, is set to appear at the department store’s annual general meeting in Melbourne this morning to face off against Myer chairman Gary Hounsell and rally shareholder support for a spill of the Myer board.

While it was believed last night that Mr Lew and his Premier Investments had the votes needed to deliver a second strike against Myer over its remuneration report, the billionaire businessman would fall short of the 50 per cent of votes needed to turf out the entire Myer board in a subsequent spill motion.

Mr Lew told The Australian he planned to be at the shareholders’ meeting in Myer’s prestigious and historic Mural Hall this morning, where 18 months of public and bitter brawling between himself and the Myer board will come to a climax as the two sides trade blows in front of other shareholders.

Mr Lew did not turn up to the Myer AGM last year, when he successfully lobbied for a first strike against Myer, which requires a 25 per cent vote against the remuneration report.

His presence today is likely to inject further colour and angst into a corporate brawl now in its second year.

“I’m hoping to (turn up). We will be there in one shape or form and our votes will certainly be there as well as shareholder votes,’’ Mr Lew said after Premier Investments’ shareholder meeting.

Last night, it was confirmed that Myer chairman Hounsell and chief executive John King would not be holding a press conference at the conclusion of the AGM — a highly unusual step for a public company — with the Lew camp interpreting that as a possible tip that Myer has seen the early proxy votes and knows it would lose the vote on the remuneration report and rack up a second strike.

But with Investors Mutual, which has a 10 per cent stake in Myer, and veteran fund manager Geoff Wilson, who holds 5.5 per cent, likely to not support the spill motion, the Myer board should be able to keep their jobs today, forcing Mr Lew to maintain his public campaign to seize board control in the new year.

Yesterday, after the AGM for Premier Investments, which is chaired by Mr Lew and is Myer’s biggest shareholder with a stake of 10.8 per cent, Mr Lew further prosecuted the case to dump the entire Myer board, although he did give support to Mr King.

Underlining Mr Lew’s confidence in the new Myer boss, and possibly trying to drive a wedge between management and the Myer board, Mr Lew said Premier Investments would vote in favour of a resolution tomorrow at the Myer AGM to award Mr King options.

“The board is the issue, not the CEO,’’ Mr Lew said.

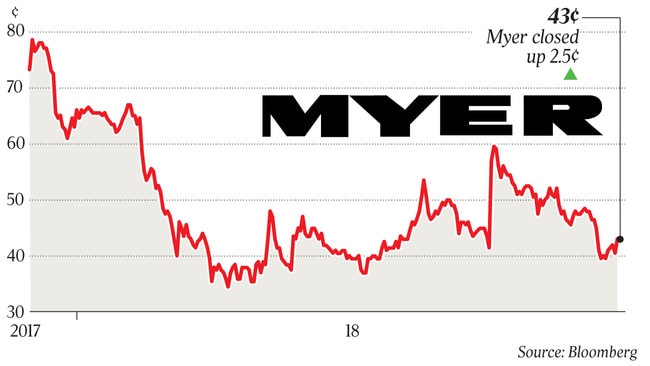

Premier Investments is down about $60 million on its Myer shares and the billionaire businessman again lashed out at the Myer board for standing by as the once great department store declined.

“It gives me no pleasure to provide an update on our investment in this once iconic Australian department store,” Mr Lew told his shareholders.

“As I recently wrote to Myer shareholders, I had hoped that, by now, the Myer board would have seen the writing on the wall and resigned in favour of a new independent board with proven retail experience, a clear direction and a coherent strategy to help support the new Myer management.

“As you know, Premier has not been standing silent as the situation has deteriorated.

“We have long been calling for the Myer board to be replaced with a new independent board with the requisite skills to actually deliver for shareholders … Boards exist to create value, not to destroy value while rewarding themselves.”

Mr Lew engaged in some racing metaphors, saying that while Mr King was a “decent jockey” the problem was with the trainer — “the failed Myer board”.

“Myer is being trained by people who don’t know one end of a horse from the other!

“We need to change trainers. We need Bart Cummings, not more shortcomings.”