Troubled Keystone fund to be liquidated, witnesses may be compelled to face court

Creditors have voted to liquidate a troubled fund linked with Keystone Asset Management, with a number of assets likely to be carved up.

An ambitious property developer from Melbourne with investments in luxury projects spanning Queensland’s Port Douglas to Italy’s Venice has lost a fight to control his troubled fund, with creditors voting for the company to be liquidated.

Deloitte’s Jason Tracy and Glen Kanevsky were appointed liquidators of Keystone Asset Management on Monday after a second creditors meeting that lasted three hours.

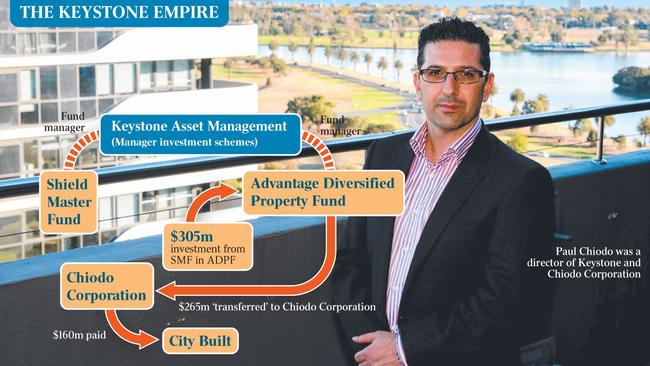

It is understood creditors overwhelmingly voted to liquidate, despite multiple and last-minute takeover bids including from the company’s former director Paul Chiodo and a building contractor Robert Filippini.

It is now possible witnesses will be compelled to front up at court, and liquidators are likely to want to speak with “lead generators” who were allegedly paid $65m by a company linked with Mr Chiodo to entice new investors to put their nest eggs into the Shield Master Fund, managed by Keystone. The bulk of money invested in projects linked with Keystone and Mr Chiodo comes from Macquarie and Equity Trustees, who are creditors.

Mr Chiodo said he was “disappointed with the results” and said his takeover proposal “was to provide immediate funds to creditors and investors”.

“Liquidation will now mean that all funds are locked up for many years in litigation and future appeals,” he said.

Mr Tracy obtained orders from the Federal Court in October to freeze about $110m worth of assets belonging to Mr Filippini, in his capacity as administrator. And Mr Chiodo has also agreed to give the corporate cop two weeks’ notice if he plans to travel overseas, amid a probe into the affairs of Keystone and its directors.

Concerns about Keystone and the Shield Master Fund were first revealed in February and again in June after the Australian Securities and Investments Commission alleged Keystone failed to lodge audited financial statements for the 2023 financial year.

ASIC told The Australian its investigation into the matter was continuing. The watchdog previously alleged “a large proportion of the funds held by Shield have been directed to a fund which made loans to various companies associated with Mr Paul Chiodo, a former director of Keystone Asset Management to fund property developments”.

One of those developments included a luxury resort in Port Douglas called the Fairmont, but ASIC revealed it was concerned the Queensland planning and environment court refused Chiodo Corporation’s plans to build a “luxury, five-star resort complex”.

As well, ASIC alleged in December 2023, Keystone agreed to lend Chiodo Corporation €152m ($252m) for a refurbishment of the JW Marriott luxury hotel on a private island in Venice, Italy.

At the time, Mr Chiodo was a director of Keystone and Chiodo Corporation and about $26m worth of investor money could be tied up in a deposit.

In his bid to freeze assets, Mr Tracy alleged that since April 2022 a property development fund called Advantage Diversified Property Fund – which received investor money including superannuation money from Keystone – paid a company linked with Mr Filippini, City Built, “at least” $158m, according to a statement of claim lodged in October and seen by The Australian.

While the purpose of the money was for property development loans, Mr Tracy alleged that Mr Filippini did not hold a building licence until May 29 and there are no written contracts between him and Keystone or a company linked with Mr Chiodo. “City Built was not required to and did not in fact submit any tenders or quotes for any of the work it undertook for Chiodo Corporation on the ADPF developments,” Mr Tracy alleged in court documents.

“The City Built/Robert Filippini Payments were not exclusively expended by City Built and Robert Filippini for, or exclusively referrable to the ADPF Developments and, to that extent, were dishonestly misappropriated by City Built and Robert Filippini,” the documents claim.

Mr Tracy alleged the money was paid to other companies linked with Mr Filippini and his family members.

As well, Mr Tracy claimed Mr Filippini’s company City Built issued 1495 invoices to Keystone for construction expenses connected with the ADPF developments where “significant invoices have been issued and payments made to City Built for work relating to projects that are either at the pre-development stage or, in other cases, where less than 50 per cent of the work has been completed”.

Some of the ADPF developments, which are now likely to be eyed by liquidators, included apartments in Port Douglas and properties in Victoria including in Bentleigh and Ashburton.

Separately, ASIC has also said it had concerns for a proposed luxury resort in Fiji, in which Keystone entered into a loan agreement with a company called Luxurious Resort linked with Chiodo.

The Australian has attempted to contact Mr Filippini’s lawyer for comment.