Troubled Melbourne fund may have traded while insolvent, report says

Administrators of Melbourne-based funds management company Keystone say it may have traded while insolvent, as they rejected a bid for control of the company.

Administrators of a troubled Melbourne-based funds management company say it may have traded while insolvent, as they shot down an 11th-hour bid for control of the company.

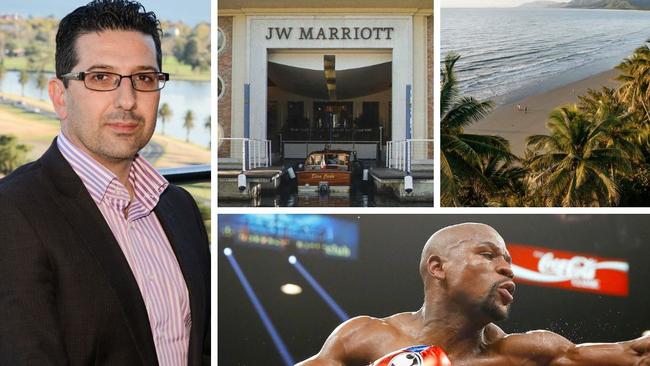

Deloitte administrator Jason Tracy released his report to Keystone Asset Management creditors ahead of their second meeting on December 2, while the Australian Securities and Investments Commission probes the company that managed it and its former directors, including property developer Paul Chiodo.

“Our investigations, whilst extensive, are preliminary and we have formed the view that the company may have been insolvent from 27 July, 2024,” the report said. “We consider that causes of action for trading whilst insolvent, voidable transactions and breaches of director duties may exist.”

Mr Tracy said based on Deloitte’s analysis, Keystone cannot pay its debts – which includes a tax debt worth of than $206,000 and disputed statutory demands of more than $215,000 – and “as and when they fall due”.

“Ending the administration would result in control of the company being passed back to the directors. There are no reliable plans in place to address the company’s financial difficulties,” the report said.

Instead, the administrators said “it is in the best interests of creditors to resolve to wind the company up”.

“This will result in liquidators being appointed who are then in a position to complete the investigations undertaken thus far and consider pursuing any or all of the potential legal recovery actions in order to maximise the likely return to creditors,” the report said.

Deloitte also revealed Mr Chiodo lobbed a proposal to take back the company, which they opted to not present to creditors due to Mr Chiodo’s refusal to provide additional information.

As well, Robert Filippini – whose money has also been frozen amid the saga – submitted a bid late last week but did not allow sufficient time for the administrators to consider it.

The report indicated Keystone’s directors handed over “limited books and records”.

“To date we have not received a response from the Company’s directors regarding access to email servers,” the report said.

The revelations came after a series of hearings in the Federal Court where ASIC secured orders to freeze assets belonging to the Shield Master Fund, which is managed by Keystone Asset Management, amid concerns about “the management and operation of Shield and the associated risks to investors”.

The corporate cop fears Mr Chiodo spent $6.8m of investor money on personal expenses and hundreds of thousands of dollars on celebrity boxer appearances.

As well, it is alleged one of Mr Chiodo’s company’s handed more than $160m worth of building contracts to Robert Filippini via oral agreements and despite Mr Filippini not holding a building licence until May this year.

In his 200 page report to creditors late on Monday, Mr Tracy shot down a proposal from Arbitrium claiming it could return 90c in the dollar to creditors within two years and will not recommend creditors adopt it for reason that include a dodgy valuation of a luxury hotel project in Venice, Italy.

The report said Arbitrium used a valuation of the hotel, JW Marriott La Sessola Hotel, provided to them by the Chiodo Corporation which claimed a value of more than $403m. But Deloitte estimated an actual value of more than $253m.

“Arbitrium relies on a valuation prepared by Colliers Valuation Italy … as of 31 December 2023 for Chiodo Corporation,” the report said.

“Colliers does not rely on the actual financial performance of the Venice Hotel in valuing the asset, but instead confirm that they considered both market benchmarks and analyses provided by the Client (Mr Chiodo’s company).”

Deloitte reported an even lower value of about $140m, based on “actual historical performance” and cast doubt over the vendor’s willingness to proceed with the sale.

“Investment in this asset may therefore result in further significant losses to unitholders and investors,” the report said.

The Deloitte report estimated Keystone has an asset position of just $1.2m with liabilities of $900,000.

He estimated at worst case, 61c in the dollar could be returned to creditors, and in the best case that 83c in the dollar could be returned if the company were wound up.

According to the report, Keystone’s directors blamed their financial difficulties on freezing orders obtained by ASIC and reduced management fees.

The administrators said Keystone’s directors “possibly” broke the law by breaching the Corporations Act.

“From our investigations to date we have also formed the view that the directors may have acted dishonestly and/or fraudulently in the exercise of their powers and discharge of their duties,” the report said.