Super fail: Grieving family waited a year for Cbus death payout

After giving a grieving father the run-around for a year before paying out his son’s death benefit, Cbus is still refusing to give him key details about the make-up of the payment.

Industry super fund Cbus gave a grieving father the run-around for a year before paying out his son’s death benefit and is still refusing to disclose key information to him on the make-up of the payment.

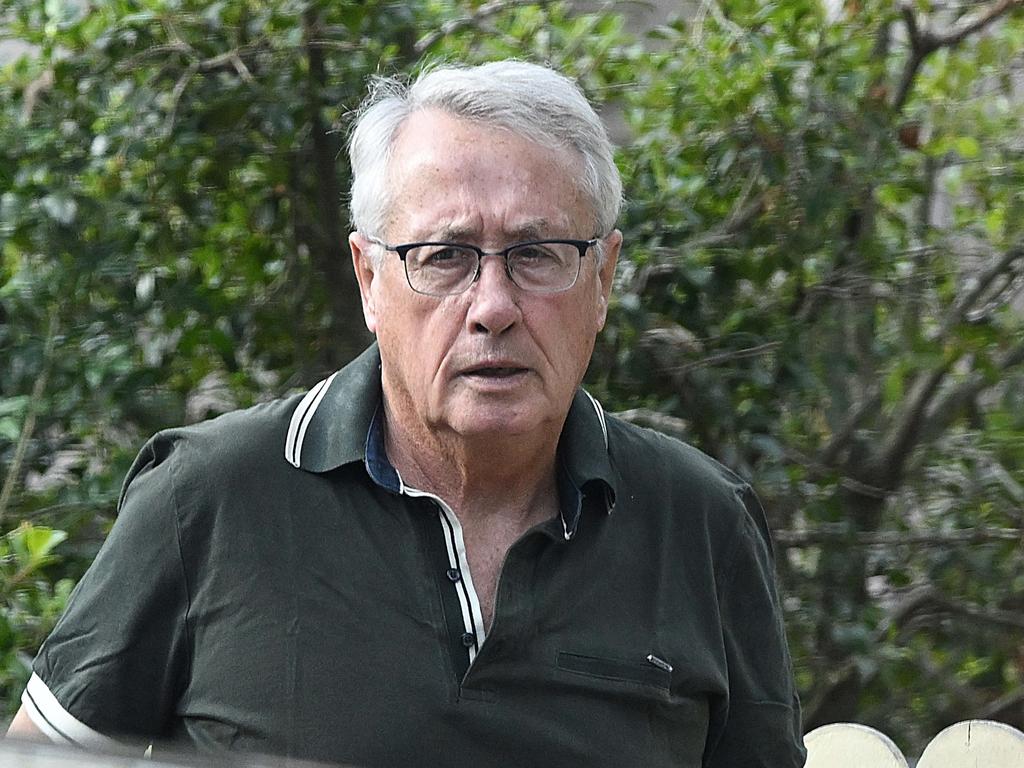

Ian Martis is one of the more than 10,000 Cbus members and claimants whose death and disability insurance claims were excessively delayed – many for 12 months or more – in a scandal that has rocked the $4 trillion super industry, with further allegations of claim delays across numerous funds.

After his 28-year-old son died suddenly in his sleep in February 2023, Mr Martis battled for 12 months to get Cbus to pay out his super savings and death benefit.

His son was working as a plumber in Brisbane before his death and didn’t leave a will so Mr Martis hired a solicitor to help sort out his estate.

Cbus was difficult to deal with from the start, Clifton Beach-based Mr Martis said. For months, both he and his solicitor struggled to get any answers from the fund over the delays in processing the claim.

“This took an emotional toll on me as I struggled with my grief while staying strong for the rest of my family,” Mr Martis told The Australian.

“Every time I rang Cbus because my solicitor wasn’t getting any response from them, I was stonewalled. They were constantly passing the buck, saying (the claim) was with the claims department.”

The fund would put the blame on his solicitor, saying it was waiting for further information from her, but Mr Martis says this was not true and that his solicitor provided everything the fund needed, without delay.

Having to make phone call after phone call to the fund, and having to explain the situation each time to different people caused further anguish for the grieving father.

After more than a year of back and forth, and Mr Martis threatening to go to the ombudsman over the lengthy delays, Cbus finally came back with an amount it would pay the estate but refused to tell the family how much of it was his super savings and how much was life insurance.

“They refused to give me a breakdown, they just said it was a legal document. I said how do I know it’s correct? And they just kept saying it was a legal document. I still have no idea how the figure is made up,” Mr Martis said.

While a standard approach at super funds is for the account balance and insurance payment to be consolidated in a claim, The Australian understands a breakdown of each amount should be provided when requested.

“Cbus has cost me and the estate a lot of extra time, money through solicitors costs and a lot of emotional stress to get his estate sorted. It has taken a toll on me,” Mr Martis said.

Acknowledging the delays in finalising the claim, a Cbus spokesman apologised to Mr Martis and his family.

“We sincerely apologise to the Martis family for the unacceptable delays in this case,” the spokesman said.

“Cbus recognises the impact of death benefit claims delays on our members’ families at the most traumatic time of their lives. Cbus is committed to further improving management of insurance claims.”

The fresh claims against Cbus come as the corporate regulator sues the $94bn super fund for failing its most vulnerable members by delaying $20m worth of death and disability payments.

The board of the industry fund now faces a potential class action from members who were forced to wait more than a year for death and disability payouts, according to a litigation funder.

The potential action may arise if the Australian Securities & Investments Commission secures a court win over the $94bn fund, litigation funder Court House Capital said.

Cbus chairman and Labor Party national president Wayne Swan has previously said the industry has a “major” problem with third-party administrators who handle benefit payouts. Cbus’s own administrator, Link, has denied it was responsible for the massive bungle engulfing the fund.

While ASIC says it intends to pursue Cbus for penalties over the allegations, there is a risk that members may have to indirectly pay despite being the victims, if a fine is ultimately handed down by the court.

“In those circumstances, it may be that you could commence a class action by the members against the board for their failure to comply with their duties as directors,” Court House Capital chief investment officer Heather Collins told The Australian.

“Sections 180 and 181 of the Corporations Act require company directors to act with care and diligence, in good faith and in the best interests of the corporation,” she said.

“If the Cbus directors have been negligent in these duties by failing to monitor business activities (including outsourcing) and report adequately to ASIC, then a class action against the board of directors could be a logical strategy.”

Ms Collins said a class action against directors could avoid inadvertently penalising Cbus members. “A class action against directors would likely be attractive to litigation funders where the negligence is evident and the damages are quantifiable without requiring complex loss assessment,” she said.

“For example, loss could equate to any ASIC fine that may be levied without calculating reputational harm or other more nebulous collateral loss.

“Boards should be held accountable for corporate governance and, where they fail, other stakeholders such as customers, shareholders, employees or members should not be burdened with the remedy.”

ASIC commissioner Simone Constant this month warned big super CEOs the corporate cop would crack down on the $4 trillion sector over failures to track end-to-end death benefits claims handling times and “weak” practices.

This was after deputy chair Sarah Court said the regulator was “deeply concerned about this area”.

Cbus chief executive Kristian Fok earlier this month was unable to say whether any fines incurred in the upcoming litigation would be covered by its members.

He blamed a delay in thousands of payments on the fund “maturing” faster than it could hire staff, and the organisation’s administrator – responsible for claims handling – had also suffered from high staff turnover.

“The delays, as I indicated, have primarily emanated from our administrator. We are still responsible for it,” Mr Fok told a parliamentary committee hearing.

ASIC will allege in court that Cbus did not take appropriate action when it was warned about the massive failures – covering up to 10,000 claims – and that people to this day may be waiting for payouts.

ASIC has alleged that at December 31, 2022, Cbus failed to resolve more than half of its 7731 total permanent disability claims within one year.

More than half of 3622 death benefits claims had not been resolved within the same time frame. Just 11 per cent of processed claims were fewer than 90 days old, the watchdog alleged.

The blockbuster court case against Cbus comes as the fund faces fresh scrutiny over its appointment of CFMEU heavyweights Paddy Crumlin, Jason O’Mara and Lucy Weber to its board.

The move to appoint the union officials came after the militant union was investigated over alleged criminal links and despite the prudential regulator declaring it was “not yet satisfied” the fund had gone through the required licensing conditions, and suggested it may take further action.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout