Slater & Gordon cuts personal injury exposure

SLATER & Gordon has revealed a continuing steady reduction in the firm’s relative exposure to personal injury law.

THIS week’s bumper profit by listed law firm Slater & Gordon revealed a continuing steady reduction in the firm’s relative exposure to personal injury law.

While this area of practice is still dominant and growing, Slater’s annual accounts show revenue from other areas of practice is expected to grow faster within Australia and in Britain.

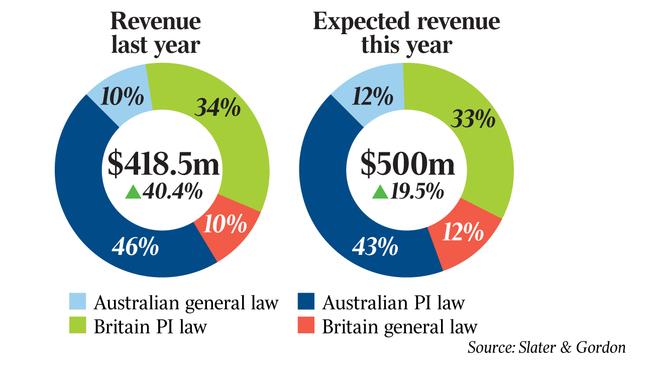

The accounts show Slater made a profit last financial year of $61.1 million — an increase of 47.2 per cent — after revenue jumped by 40.4 per cent to $418.5m.

Revenue this financial year is expected to grow by another 19.5 per cent to $500m.

“It’s a very satisfying result,” said managing director Andrew Grech.

It indicated that the integration of the recently purchased network of British firms was succeeding.

The British firms contributed $182.5 million in revenue last financial year.

“One of the reasons we wanted to grow and diversify the practice across Australia and now into the UK was really to insulate our clients and people from the disruption caused by legislative change,” Mr Grech said.

This strategy had helped ease the impact of legislative change to workers compensation arrangements in Queensland that had an adverse impact on the earnings of the firm’s Queensland practice.

Mr Grech said the firm knew that legislative change happened regularly and the duty of the firm’s management was to ensure the business was strong and agile enough to thrive regardless of the legislative environment.

“We have a long-term goal of changing the ratio in revenue terms,” he said.

The accounts show the firm expects about 24 per cent of its revenue to come from the general law business this financial year, up from 20 per cent last financial year.

“We see that as an ongoing trend and we are making good progress both in Australia and Britain in building up areas like family law, conveyancing, wills and estate planning and professional negligence.”

But while the Australian personal injury practice had been affected by the disruption of legislative change in Queensland, the underlying trend indicated that the Australian personal injury business was still growing.

“It grew organically by 9 per cent in revenue terms,” Mr Grech said.

“In an environment where most businesses are lucky to match GDP growth, that is nearly three and a half times GDP growth.

“That indicates it’s a very robust business that still has lots of growth capability left in it.”

Mr Grech said the target of $500m in group revenue was ambitious “but we pride ourselves in delivering what we promise and we are very reluctant to make forward looking statements unless there is good evidence and support”.

It was based on the expectation that the Australian practice would produce about $270m in revenue and the balance of $230m would come from the British practices.