Shareholders, consumers lead charge of class actions

The class action risk confronting business has stabilised at record high levels and is shifting beyond listed companies.

The class action risk confronting business has stabilised at record high levels and is shifting beyond listed companies to focus on consumer-facing enterprises.

Once competing claims are excluded, national law firm Allens found that the number of companies facing new class actions last year was unchanged at the previous year’s record level of 41.

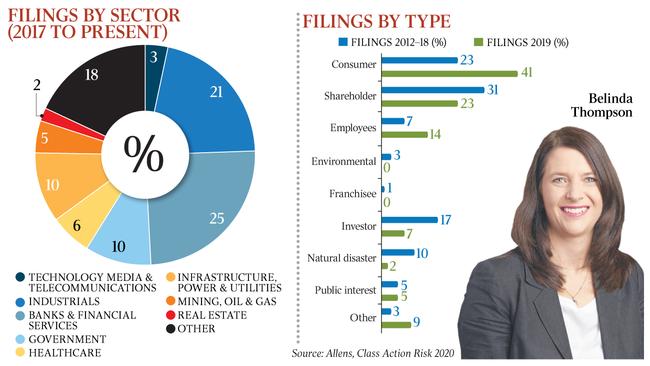

The latest figures confirm that the number of companies facing new claims has increased sharply since 2016 and that increase is almost entirely attributable to consumer and shareholder claims, according to the latest class action risk report from Allens.

It points out that even when competing class actions are included in the annual tally of new filings, the decline last year has not disturbed “a broader trend of increased activity compared with a few years ago”.

“Class action activity is at an all-time high as the cases filed in 2017 and 2018 (and before) make their way through the courts,” the report says.

The Allens report comes soon after the risk to the national economy from excessive litigation prompted the federal government to unveil a broad inquiry into class actions, litigation funding and Victoria’s move to permit class action lawyers to charge US-style contingency fees.

Attorney-General Christian Porter said the Victorian government’s move was inconsistent with the need for all governments — commonwealth and state — to do everything possible to support business through the economic threat and risks posed by the coronavirus and the recent bushfires.

Belinda Thompson, who is a co-author of the Allens report, said its findings were not good news for corporate Australia.

“It reflects a stabilising in the environment in the sense of what we are seeing is a pause in the rush to class actions,” said Ms Thompson, who is a partner at the firm.

“But I think we are still seeing a large amount of activity and what is clear is that if you are consumer-facing or if you are ASX-listed, class action risk is something that cannot be ignored and has to be kept on the radar.

“We have always said it’s not an avalanche and we should try to keep some perspective about it.

“But what we can see here for corporate Australia is growing preparedness in the class action landscape to look quite broadly at potential types of claims.”

The report says the most noteworthy change has been the rise of consumer class actions, which represented 41 per cent of last year’s filings compared with a long-term average of 23 per cent.

This reflected the significant number of claims against banks, superannuation trustees and insurers following the financial services royal commission.

And while consumer class actions had increased, shareholder claims were down — accounting for just 23 per cent of last year’s filings compared with almost 50 per cent in 2017 and 2018 and the long-term average of 31 per cent.

Between them, consumer and shareholder class actions accounted for 64 per cent of class actions started last year, the report says.

Conducting a consumer-facing business is now the biggest indicator of class action risk, but the report provides no relief for listed companies. It says they still face a “substantial risk” of class actions.

Those in the banking and finance sector “remain at high risk”.

About 60 per cent of last year’s new class actions were known to be financed by litigation funders, which is roughly on par with the longer-term average but down from 2018’s 75 per cent, the report says.

Ms Thompson said the figures indicated that the class action risk confronting business was not going away.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout