Legal-services tech sector boosted by Covid pandemic work from home rules

Technology companies that specialise in catering for the legal services market have come through the pandemic high in business confidence.

Technology companies that specialise in catering for the legal services market have come through the pandemic high in business confidence, saying the lockdowns were good for revenue and client retention. They are equally positive about this calendar year.

“The pandemic has positively boosted our business due to the improved user engagement experienced [with] our products,” one of the 148 companies which responded to the Global Legal Tech Report that launches on Monday said.

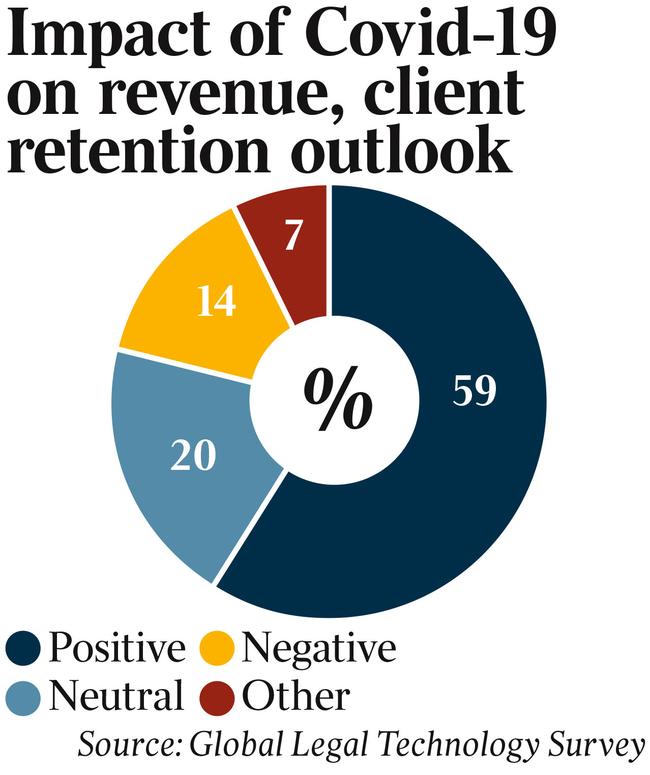

The company, among the 59 per cent that identified Covid-19 lockdowns as positive for business, said legal and judicial clients had been “mostly compelled by social distancing measures to leverage legal-tech solutions for their work productivity.”

Another said: “Working from home collaboration software was fundamental to client success.”

While the legal technology segment of the legal services market dates back to LexisNexis in 1970 and the global annual revenue is estimated at $US18bn ($25bn), 73 per cent of the businesses surveyed by the Australian Legal Technology Association were founded in the past five years. This newness was a contributor to the negative or neutral Covid-19 effect observed among 34 per cent of businesses.

“The pandemic has not really affected the company since we are … in our very early stages,” one owner said. Another said it had been “challenging to achieve traction as an early-stage start-up”.

The association’s survey, produced with lead researcher Alpha Creates, is in its second year, and so was able to draw its first comparisons.

The first survey’s positive revenue outlook from 78 per cent of firms rose to 84 per cent, while the client retention outlook was stable, with 61 per cent of companies saying the prospects were “great”.

For the second year running, those whose products were based on database programs made up about 40 per cent of firms, but those selling artificial intelligence-based products dropped from 26 per cent to 22 per cent of respondents.

Despite that, business confidence in the AI legal-tech subset of the overall market – 51 of the respondents – was up by 13 percentage points to 86 per cent, reflecting better access to funding to invest in product and market growth, client retention and intention to acquire other companies.

A director of New Law at PwC, Eric Chin, said while there had been exaggerated claims AI could replace lawyers, in fact it would simply augment their work.

“The human specialists – lawyers – understand the context of the case or deal and are able to incorporate new sources of information,” Mr Chin said. “That is as well as having the capacity to adapt and correct errors and use creativity and lateral thinking to solve problems. AI offers total and quick recall of information with the ability to process thousands of pages of documents in minutes, with the ability to identify trends based on data inputs, algorithm and memory.”

The global survey was conducted between October 2021 and February 2022, and the top five countries responding were Europe (35), Australia (24), the UK (16), Brazil (11) and the US (10).

Legal-tech businesses tend to have been founded by small teams from a younger demographic: 90 per cent were started by one, two or three people, and 57 per cent had 10 or fewer employees. A typical workforce was about 8.5 full time equivalent employees, although the average was 21.5 FTE (skewed by the 6 per cent with more than 100 on staff).

Of those surveyed, 37 per cent of founders were aged between 31 and 40 years old, with another 25 per cent aged 41-50. Founders under 30 and those over 50 were in balance at about 18 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout