Good results for law firms but demand is slipping: Thomson Reuters Institute survey

Robust legal firm performance in the first half of 2021-22 was moderated by the drop in demand that followed, a survey shows.

Double-digit growth in revenue and profit for law firms in the 2022 financial year came with rising uncertainty as demand for services dropped in the second half, with clients concerned about interest rates, inflation and geopolitics.

Revenue increased by a near-record 10 per cent, compared to 3.8 per cent in the year before, according to new analysis of the legal market by Thomson Reuters Institute. Profit rose by 12.6 per cent, compared to 19.6 per cent in the previous year.

However, while growth in demand for services rose 6.4 per cent in the first half of the year to December 31, 2021, it dropped in the second half for an overall annual increase of 2.1 per cent, compared to 2.2 per cent the previous year.

The fourth quarter was “one of the worst quarterly contractions since 2013”, the 2022 Australia: State of the Legal Market Report warns. Financial data for the analysis was drawn from 16 law firms operating in the country, including some of the largest by lawyer headcount.

Among concerns was “whether weakening demand could create revenue-generation issues in the short term, and how to address talent recruitment and retention problems”.

Year-on-year growth in demand also fell in the US (from 4.3 per cent in the first half to 1.1 per cent in the second) and in Britain (from 8.3 per cent in the first half to zero in the second).

“Over the past few months, the legal world has become awash in uncertainty,” the report says. “Buffeted by inflation, international conflict, and chronic shortages of legal talent, law firms across the world have gone from smooth sailing to facing down yet another storm. The Australian market has been no exception.”

However, the demand for legal services in the local market held up during the pandemic, unlike in the US and Britain, so the Australian sector has done well to record growth until the past six months, it says.

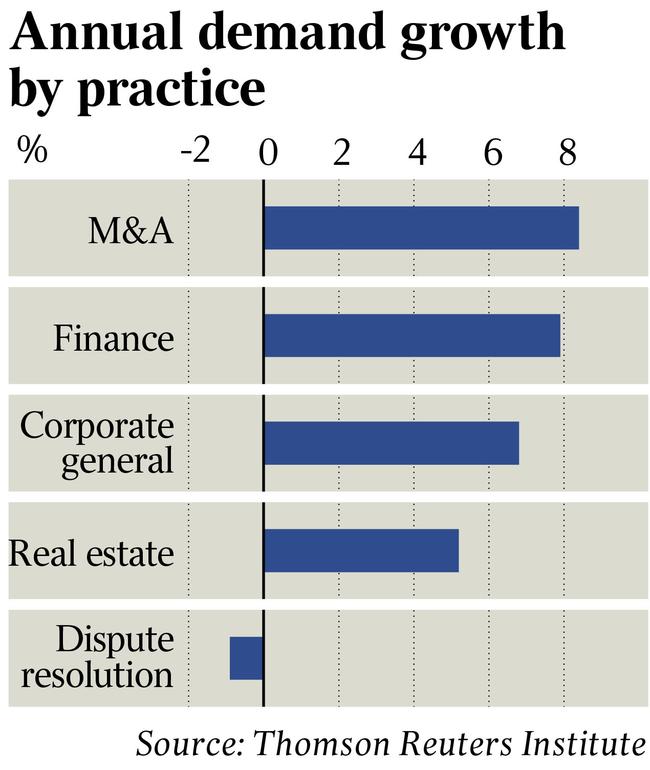

Part of its strength has been the spread of activity across practice areas: tax and real estate grew by 5 per cent, regulatory work by 6.2 per cent and corporate practice demand has broken records, driven by “cheap liquidity in capital markets and government stimulus”, the report says.

Demand for corporate general work grew by 10.6 per cent in the first half but by only 2.9 per cent in the second half, and mergers and acquisitions went from 19.8 per cent growth in the first half to a 3.1 per cent contraction in the second.

Problems for local firms include concern about rapidly increasing expenses – mostly staff compensation, office costs and recruiting – legal staff turnover, the potential for partner burnout and development and implementation of technology.

Although associate compensation is up by 8.3 per cent for the year, this is “relatively in check” and well below the 11.7 per cent increase in the US, the report says.

Lawyer turnover was more than 20 per cent over the year, and even higher at associate level, which averaged at 31.6 per cent across all firms in the sample compared to just under 25 per cent in the US.

The report included a mix of other global data, including the Thomson Reuters Stellar Performance global survey of 2457 “standout” lawyers (as nominated by clients). The 98 Australia-based standouts expect even higher associate turnover for the 2022 calendar year.

Globally, lawyers from diverse backgrounds – women, under-represented demographics and LGBTQ+ – presented a higher flight risk than others and gave “notably lower-than-average marks in both their own wellbeing and their leadership demonstrating the importance of diversity, equity, and inclusion as compared to lawyers with non-diverse backgrounds”.

Australian firms were managing this “potential talent crisis” so far, but it could become a problem because standout lawyers did not appear to think their retention a priority: only 7.3 per cent of Australian standouts think the firm leaders should focus on demonstrating the importance of diversity compared to the global average of 12.9 per cent, which includes 15 per cent in Britain and 12.6 per cent in the US, the report says.

The report speculates that some of the “talent challenges that Australian law firms are currently facing can be mitigated through greater adoption of technology and an increased focus on creating a culture of innovation within the firm”, and that “bringing in new partners who may be more familiar with these types of technological operations may well be a boon as well”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout