Businessman engaged in ‘unconscionable’ conduct in stoush with Aqua Botanical inventor

A court has found a Melbourne businessman abused his position in a business that turns vegetable waste into clean drinking water.

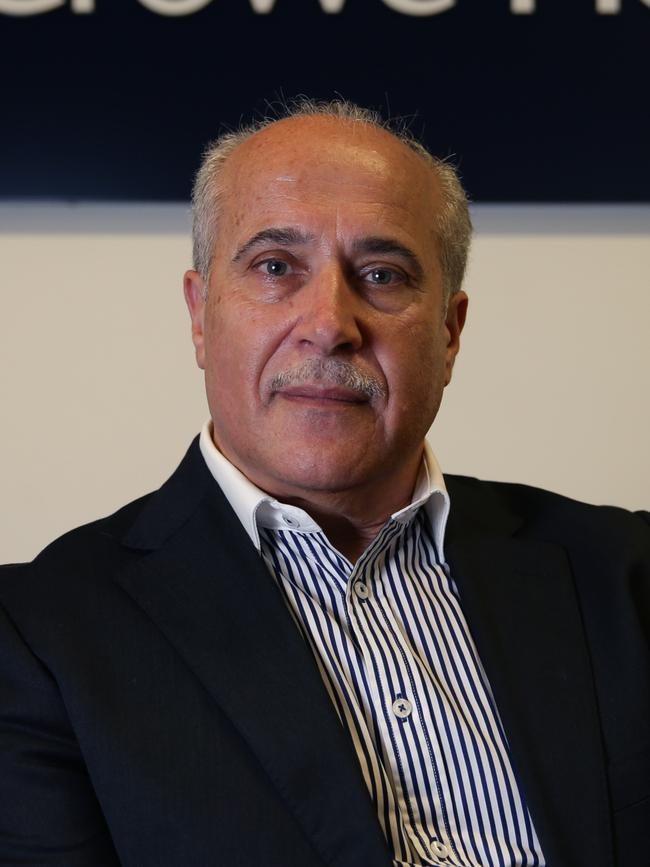

A court has found Melbourne businessman Terry Paule engaged in “unconscionable conduct”, and that he abused his position in a bottled water business that turned vegetable waste into clean drinking water.

As a result he has been ordered to pay former business partners almost $US15.8m ($24.4m).

The NSW Supreme Court found Mr Paule, who chairs Melbourne-based financial advisory operation Findex – part owned by private equity players Mercury Capital – used a complicated series of transactions to split the intellectual property behind the waste-to-water technology from its inventors.

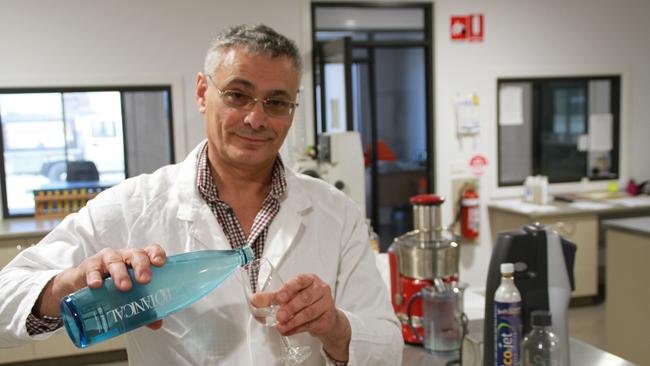

Justice Michael Ball found Mr Paule misused his position and breached his fiduciary duties after investing in the waste-to-water bottled water business, Aqua Botanical. The bottled water play, which made a splash several years ago, touted technology which offered an answer to millions of litres of water otherwise wasted by commercial distilling, brewing and juice-making businesses.

Aqua Botanical allowed companies which produced juice concentrates, sugar or waste water to capture millions of litres and purify the product.

The technological innovation was feted in the media, but behind the scenes the struggling bottling start-up born in the Victorian regional centre of Mildura was struggling.

Its inventor, chemist Ambrosios “Bruce” Kambouris, was living in a room at the Lamattina Beverages factory on the outskirts of Mildura, while its chief executive, David Driver, had lent the company at least $680,000 in a bid to see the bottling business survive its incubation.

The need for cash resulted in Mr Paule entering the scene along with his brother, Findex chief executive Spiro Paule, who recently spent $40m on a Toorak estate. The two men took a 25 per cent stake in Aqua Botanical through a jointly controlled commercial entity MyCo.

The court documents show the Paule brothers at the outset pushed for a half stake in the company, despite having not yet invested any funds in Aqua Botanical. Justice Ball said it “was unacceptable” to Mr Driver and Dr Kambouris.

Justice Ball noted despite Mr Driver’s early funding of the business, Terry Paule agreed to bankroll Aqua Botanical in May 2019, attempting to engineer a 50 per cent stake in the company which was again barred by Dr Kambouris, who instead suggested the brothers increase their stake to 37.5 per cent.

Although he increased the brothers’ stake, court documents show Mr Paule then refused to fund Aqua Botanical, telling Mr Driver his intention to stop funding the business would “embarrass yourself” and demand payments.

This was despite MyCo, the Paule brothers’ company, taking on the running of the company with plans to appoint Adam Priester, who is currently engaged in separate legal action against Mr Paule, as CEO and managing director.

Justice Ball said that by early 2020 Mr Driver and Mr Paule were no longer on speaking terms, and Dr Kambouris gave evidence he “highly distrusted” the Findex chair.

Findex, one of Australia’s growing financial advisory businesses has, been rapidly expanding after Mercury Capital’s investments into the operation snapping up the Avance and Schuh Group as well as Microsoft’s business applications practice FiveP’s and Gillespie Advisory in Canberra.

Former prime minister Malcolm Turnbull even sat on the firm’s board for almost six months, before being ousted in a leadership tussle after KKR sold its stake.

Court documents show Findex was used to do much of the administrative heavy lifting for a plan to relocate the intellectual property behind Aqua Botanical to a UK-based business, something Mr Paule pitched to his business partners.

But the court heard this manoeuvre allowed Mr Paule to strip control of the technology from Mr Driver and Dr Kambouris, after the two were not appointed as directors on the UK operation.

The court heard Mr Driver and Dr Kambouris were concerned about the Findex chair’s reorganisation, despite assurances the men would be appointed to the board “in due course” failing to eventuate.

Instead, the court heard a capital raising on the UK entity – which brought in investments in Aqua Botanical from high-profile figures including Andrew Liveris – resulted in Mr Driver and Dr Kambouris diluted to just 49.8 per cent, and neither men were “given any information about the allotments before they occurred”.

The court found the Paule brothers also awarded themselves 6912 shares from the raise, writing off loans to the Australian trading entity worth almost $501,601 and taking up shares at a $72.57 valuation, well shy of the $US295.31 some investors were charged.

Soon after this Dr Kambouris and Mr Driver were removed as directors of the Australian entities they no longer controlled.

Despite launching their court case in 2021, Mr Paule engineered a sale of the technology to MyCo for $120,000 in March this year, leading to a collapse of the UK business.

Justice Ball found the corporate manoeuvres breached duties Mr Paule owed to Dr Kambouris and Mr Driver, noting the two men were “vulnerable to abuse by Mr Paule of his position”.

“Although Dr Kambouris and Mr Driver were not unsophisticated, they did not have the necessary experience or connections to perform the work undertaken by Mr Paule,” he found.

Justice Ball found the capital raising promised to the two men was “quite different” to the one that occurred, benefiting the Paule brothers and not the inventor of the technology or his early business partner.

The court also heard Mr Paule spent more than $1m raised to fund Aqua Botanical instead on fighting the two men in the NSW Supreme Court, with Dr Kambouris alleging this was “oppressive”.

In just judgment, Justice Ball said Dr Kambouris and Mr Driver both gave evidence, while the Paule brothers only tendered affidavit statements and were not called to appear before the court.

Mr Paule, who describes himself as an “inspiring leader with a wealth of knowledge and experience, and a contagious passion for life” continues to advertise his positions in three Botanical Water companies on his website.

Mr Paule said he was “deeply disappointed with the findings against me personally” noting he had “held an array of directorships without blemish” in the past.

The Findex chair said he would “pursue all available options to challenge the court’s finding, including through an appeal”.

“I maintain, as I have from the outset of this matter, that we have followed all appropriate processes and have always acted in the best interests of the Botanical Water Technologies business and its stakeholders,” Mr Paule said.

The matter returns to court on November 21.