Benjamin Hornigold’s board shrugs off Keybridge Capital attack

Junior investment outfit Benjamin Hornigold, which is suing its former boss over $4.1m in loans, has dismissed a bid by Keybridge Capital to drastically cut its board fees.

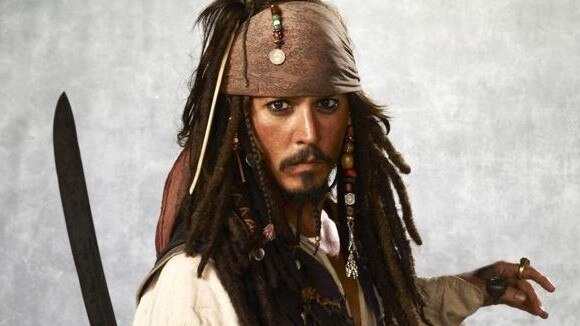

Benjamin Hornigold, a junior listed investment company named after an 18th century English pirate, has shrugged off a bid by Nick Hopton’s Keybridge Capital to drastically slash its board remuneration.

Keybridge, which has had its own shares suspended from trade since March 1 pending it providing a satisfactory response to the ASX which raised questions over its half year accounts, built a 20 per cent stake in Hornigold before launching a bid to slash directors’ fees.

If successful, the bid would have cut the directors’ fees at the $6m Sydney firm from $450,000 per year to just $40,000, or $13,333 per director.

The resolution was overwhelmingly voted down at a meeting this week, with only 7.75 per cent of votes cast in its favour.

Mr Hopton told The Australian that Keybridge did not believe the company held the meeting in an appropriately constituted manner and hence did not attend or vote its shares in the proceedings.

The attack comes at a time when Hornigold is suing companies associated with its former investment manager and executive chairman Stuart McAuliffe, over $4.1m in loans made to the companies between 2017 and 2019.

The corporate regulator has also brought criminal charges against Mr McAuliffe, alleging last year that he “failed to act in the best interests of Benjamin Hornigold regarding payments made between June 26, 2018, and June 29, 2018, totalling $3.8m, to John Bridgeman Limited, a related entity and investment manager for Benjamin Hornigold’’.

“ASIC also alleges that Mr McAuliffe caused misleading information to be provided to the Australian Securities Exchange in August 2018 about the payments.’’

Mr McAuliffe has said he will vigorously defend the criminal claim.

The criminal matter is scheduled to return to court on October 24 for a directions hearing while a related claim against the company’s former chief financial officer Samuel Elderfield, will return to court on Friday, August 16.

ASIC alleges that Mr Elderfield also failed to act in the best interests of the company.

Benjamin Hornigold listed in 2017 under the control of Mr McAuliffe, with its prospectus indicating it would execute on five to 10 high-conviction investment ideas, after raising up to $20m.

The fund manager was to be paid 3 per cent per year plus GST, and a performance fee of 27 per cent subject to hurdles.

The company’s shares were suspended by June 30, 2018, and in June 2019, the board, including Mr McAuliffe resigned.

A new board relisted the company on June 25, 2020.

The company’s current board, including chair Michael Glennon and Sulieman Ravell, said Keybridge’s bid to cut their fees “is neither usual practice, nor is it commercially viable, for the company to reduce the maximum fees payable to its non-executive directors’’.

“The company has no employees and accordingly relies on its directors for the conduct of its affairs,’’ the company said.

“Further, the current directors continue to progress complex litigation for the company.

“The success of that litigation is, in the board’s view, in part dependent on the company continuing to retain individuals familiar with the various complex transactions, background and legal issues ventilated in the proceedings.’’

Hornigold’s board pointed out that Keybridge had failed to explain the reasons for its own suspension, and said when the company took control of Yowie Group, Mr Bolton was appointed as chief executive on a salary of $US522,600, plus incentives.

Mr Bolton declined to comment on the ASX matter, and said the board of Yowie Group appointed him and he would be judged on his performance.

Hornigold’s board also pointed out that it was currently only paying its board $167,250 in total, plus “special exertion fees” of $125,000 plus superannuation.

Benjamin Hornigold shares last traded at 23c, valuing the company at $5.55m.

.