BBY executive faces court on aiding and abetting charges over the collapse of the brokerage

A former manager of collapsed stockbroking firm BBY has appeared in a NSW court charged with helping her former employer engage in dishonest conduct.

A former manager of collapsed stockbroking firm BBY has appeared in a NSW court charged with helping her former employer engage in dishonest conduct.

Sydney-based Yat Nam (April) Yuen has been charged with aiding and abetting the firm by undertaking a series of bank transfer before it collapsed in 2015.

The Australian Securities and Investments Commission alleges that Ms Yuen, who held various roles including manager of strategy, instructed St George Bank to transfer $6.8m of client money out of its futures client segregated account to other accounts.

ASIC alleges these instructions had the intention of funding a margin payment to ASX Clear Pty Ltd, in breach of BBY’s obligation to hold that client money on trust.

ASIC further alleges that in March 2015, Ms Yuen instructed St George Bank to transfer $350,000 of client money out of the client segregated account and $1.6m of client money out of another account to BBY’s operating account held with National Australia Bank.

ASIC alleges these instructions had the intention of funding a corporate payment, in breach of BBY’s obligation to hold those client moneys on trust.

Ms Yuen appeared in the Downing Centre Local Court on Tuesday with the matter was adjourned for further mention in February.

The matter is being prosecuted by the Commonwealth Director of Public Prosecutions.

BBY was a former stockbroking and financial services business that was placed into voluntary administration in May 2015. Each offence carries a maximum penalty of 10 years’ jail.

ASIC suspended BBY’s financial service licence that month with the suspension remaining in place until its licence was cancelled in June 2021. ASIC’s investigation into BBY is ongoing.

Last month, former BBY chief executive Arunesh Narain Maharaj faced court in Sydney on two aiding, abetting, counselling or procuring fraud charges.

Mr Maharaj allegedly helped another BBY staff member to dishonestly obtain a financial advantage from St George Bank, ASIC said.

“The financial advantage was obtaining additional funding by way of improperly drawing down on an overdraft facilitation account, which BBY held with St George Bank which BBY was not entitled to,” the regulator said in a statement.

Fiona Bilton, the former head of operations at the failed firm, in June this year was sentenced to jail for 20 months after she pleaded guilty to three charges of dishonestly obtaining a financial advantage.

According to previous reports, 6000 customer accounts were caught up in the collapse of the company. Liquidator KPMG was tasked with delivering repayments to clients whose claims amounted to about $65m when the firm collapsed.

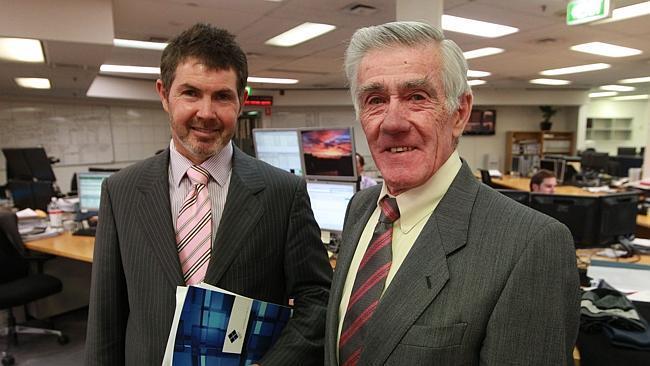

BBY’s chairman was Glenn Rosewall, the son of tennis great Ken Rosewall who was also a company director, and last year lost a NSW Supreme Court case over the failed stockbroker. He was ordered to pay liquidators $3.3m plus interest.