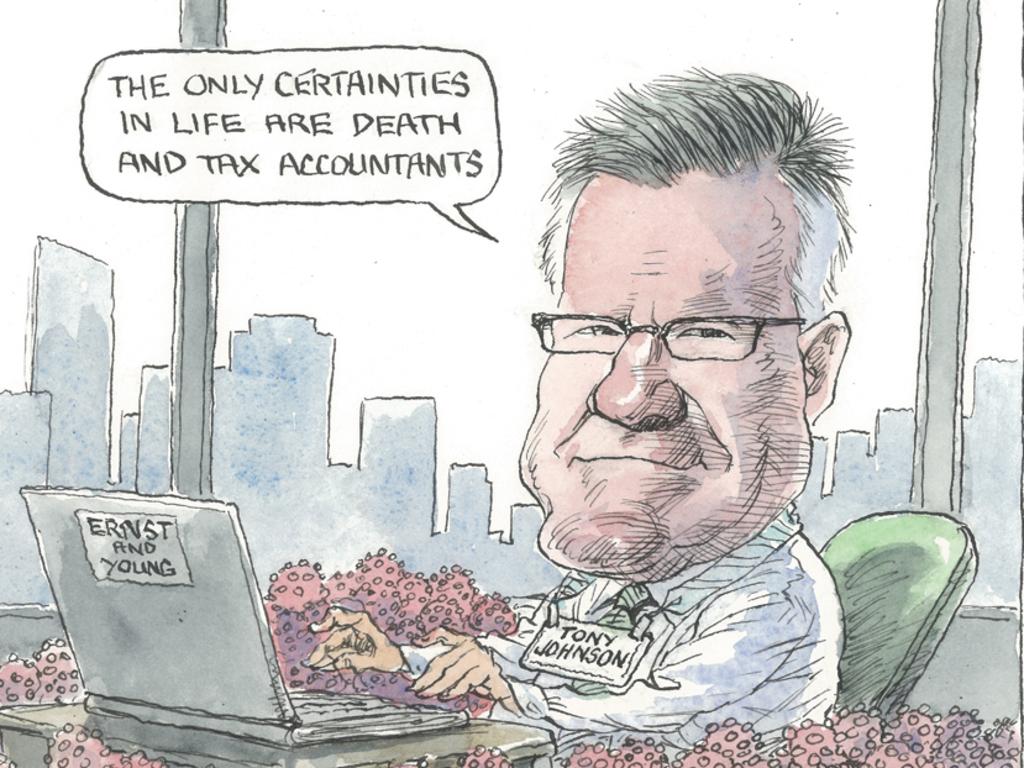

Victorian crisis carries national price, says EY chief Tony Johnson

The confusion caused by Victoria’s stage 4 lockdown is unprecedented and there will be national implications for mismanagement in the state, EY’s Tony Johnson says.

EY chief executive Tony Johnson says the confusion in the Victorian business community in the 48 hours ahead of the stage four lockdown has been unprecedented and warned that the looming supply chain and distribution issues in the state will have implications.

“The confusion of the past 48 hours has been immense and it is the most confusion I have seen in a crisis, including the GFC,’’ said the Melbourne-based Mr Johnson, who is working from home and hasn’t been into the firm’s city office since the end of March. The office remains closed.

“I think in Victoria we are going to see more businesses close and not re-open … Unfortunately the scoreboard shows (the latest lockdown) hasn’t been managed well. You need management and some good luck in dealing with this pandemic. Clearly the way quarantine has worked was not good management. But we have to move forward.”

He said EY in Melbourne had been working through the state government’s definitions of essential services “and what that meant about our people working safely on client premises.

“But the significant piece is the impacts on the economy. They will be real, material and it is not just going to be Victoria which is impacted. The supply chain and distribution issues will impact Australia nationally.”

“Revenue is our friend. If we can keep people busy, we don’t need to make job cuts.”

Mr Johnson said EY was forecasting revenue growth of “5-6 per cent” for 2021 after on Thursday announcing $2.13bn in revenue for 2020, up 12.7 per cent.

“Revenue growth will be slower in the first half and we are hopeful in the second half that we come out of it. But it is so uncertain at the moment,’’ he said.

“The uncertainty on the health front and when we are going to sort that means you can’t be certain about what we will do and when we will do it on the economic side.”

Mr Johnson said revenue for the firm in July was up year on year, underpinned by the seasonal growth in the firm’s audit business.

EY’s assurance practice grew by 10 per cent in 2020, commencing work on two new notable appointments as auditors of BHP and Origin Energy during the year.

Unlike the other big four accounting firms, EY has not cut staff amid the impact of the pandemic crisis.

“Since March we have not seen the cliff that we might have thought was possible,’’ Mr Johnson said.

Partner pay was cut by up to 25 per cent and 25 per cent of staff were cut to working four days at 80 per cent pay.

A portion of those cuts were repaid in June, meaning the annualised cut for those on 80 per cent hours and pay was 2.3 per cent for the 2020 financial year.

“We have had no firm wide reductions in pay or redundancy programs. Revenue is our friend. If we can keep people busy, we don’t need to make job cuts,’’ Mr Johnson said.

“We had strong momentum going into COVID. We have a strong assurance business, which is recurring work. There is no doubt existing strong relationships with clients was very important. It is very hard to build new relationships in a digital world.”

The firm’s financial services business grew by more than 20 per cent in 2020 after advising clients on complex transactions, actuarial, financial crime, cyber and assurance programs.

“Financial services benefited from really strong demand and that is continuing. On the transaction front, private equity is quite strong. We are still of the view that there will be growth in our transaction related business through 2021,” Mr Johnson said.

The strategy and transactions business grew by 6 per cent last year, affected by some slowing and deferral of transactions in the second half of the year but the firm retained its mantle as the number one M & A advising accountant for both deal value and deal volume.

In the year ahead Mr Johnson said the key priority for the firm was focused on digitising its business, as well as providing advice to clients on how they could digitise faster in the wake of COVID and the shift to working from home.

EY recently purchased boutique Sydney-based strategy outfit Port Jackson Partners. “Growing out and building a world class strategy business is certainly a priority for us,’’ Mr Johnson said.

In 2020 risk advisory, including internal audit and the actuarial business, grew by more than 20 per cent, as did consulting services focused on supporting clients navigate uncertainty through large-scale technology transformation, digital, data and analytics services.

Tax, including people advisory services and EY law grew by 8 per cent, with a focus on technology, tax outsourcing, leadership and culture advice and services.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout