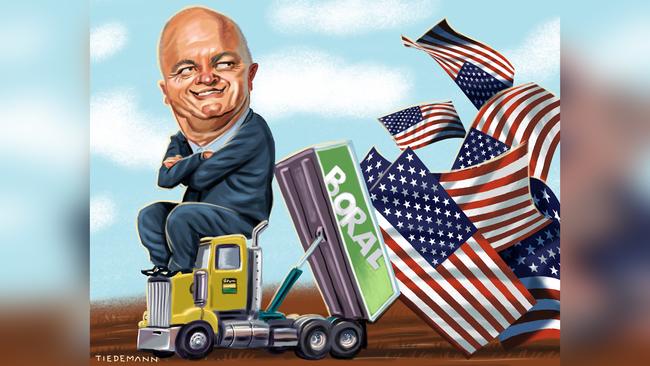

A big group of Boral shareholders want the company to sell its US operations but the company’s board has dodged the issue and chairman Kathryn Fagg says it is up to new boss Zlatko Todorcevski to decide.

He starts on July 1 and says he will be in a position to make a call in October after reviewing the state of play, including a report on the issue by internal strategist Ramesh Karnani.

Todorcevski was appointed some four months after outgoing boss Mike Kane signalled his intention to retire in February and by now you will get the feeling nothing happens quickly at Boral.

Fagg has been in the job for two years, presiding over five profit downgrades, and Kane, who formally leaves in September with $2m in termination pay, has presided over a 63 per cent total shareholder return underperformance in his eight-year term. Return on funds from the US operations is 5.3 per cent against total company cost of capital of 8.6 per cent, so clearly it is draining capital.

If the board sees any upside then so be it but if it wants to sell then it doesn’t need to wait much longer.

Fagg could take a look at Woolworths and note chairman Gordon Cairns pulled the plug on the Masters disaster before formally appointing Brad Banducci as boss in 2016. The point being company boards are there to make decisions, not sit around watching shareholder funds flow down the drain waiting for someone else to make the call.

The decision to pay outgoing boss Kane a $2m farewell gift was it seems a contractual arrangement even though he will satisfy the six-month notice period for an orderly retirement.

Plenty would gladly swap positions to a company where a $2m gift was payable on retirement.

Fagg told 10 per cent shareholder Ryan Stokes of Todorcevski’s appointment on Sunday before telling the rest of the market on Monday to what she said was universal support.

The 52-year-old has not worked as an executive for four years and filled mainly finance roles in his previous jobs at BHP, Brambles and Oil Search.

He will step aside from his position as deputy chair of rival Adbri as well as other board posts at Coles and Star and is clearly highly regarded in the market.

The concern is he has filled mainly finance roles, which, while varied, is not the same as running the shop.

Boral comes with a share register that is at least 25 per cent activists, albeit supportive, including Perpetual, which on Monday said it had increased its stake from 5.5 to 6.5 per cent; Seven Group with 10 per cent; Tanarra Capital with around 3.5 per cent, and L1 with 2.5 per cent.

Fagg is to be commended for actually moving on the chief executive in what has been a tough time to make executive calls and the shareholders will give Todorcevski the benefit of the doubt.

But not for long and in the middle of a recession, running a building company covering three continents with different market cycles in an industry dominated by global behemoths is no easy task. For Fagg’s sake, let’s hope her surprise choice surprises everyone on the upside.

Flushed with success

Sydney-based manufacturer Kimberly-Clark has survived the COVID-19 toilet-paper hoarding and now an ACCC full Federal Court challenge to its flushable wipes claims.

In a decision on Monday, the full Federal Court rejected the ACCC arguments that the manufacturer was guilty of false and misleading statements over its flushable wipes. The good news is by the time the ACCC launched its first case in 2016, the company had stopped selling the product and replaced it with an alternate “flushable wipes”. It also dropped claims the wipes were made in Australia when in fact they came from South Korea, Germany and the UK.

The ACCC has shown when it shines a light on issues it tends to get the right results even if its court track record is not 100 per cent.

ACCC boss Rod Sims argues the court imposes too high a hurdle on his concerns in both competition and consumer cases. Competition lawyers say that if the ACCC says the company’s statements are wrong, then it’s up to it to prove that.

The Federal Court originally said the ACCC had to prove the flushable wipes “had in fact caused or contributed to real harm in particular instances”.

The ACCC had argued that the flushable wipes did not dissolve, as claimed, and produced myriad evidence from water authorities to show they caused a risk to sewage systems.

If you flush golf balls down the toilet they will probably create havoc for the system but proving actual damage may also be tough.

Still the full Federal Court backed the trial judge’s decision.

It did note the ACCC’s actions had focused public attention on the issue and perhaps the answer was a new standard to say what was flushable.

The ACCC had argued unsuccessfully there was evidence of the risk of harm these wipes posed to the sewerage system, and the trial judge was wrong to say it needed actual evidence that these particular wipes had caused actual harm.

The ACCC had noted it was aware of problems continuing to be reported by Australian water authorities as a result of non-suitable products, such as wet wipes, being flushed down the toilet and contributing to blockages and other operational issues.

Fitbit test looms

The ACCC faces a test of its concerns about Google’s market power on Thursday when it is due to hand down its decision on the $US2.1bn Fitbit acquisition.

The regulator is expected to hand down a statement of issues expressing some concerns pending a final decision which will come after US and European reviews are completed.

Google and Fitbit don’t directly compete, with the latter big in the so-called wearables market, but the concern is with 28 million customers Google would benefit with the increased health data available. The Google decision comes as the ACCC is working on its draft code of conduct controlling how Google and Facebook will compensate media companies for their content used by the digital platform giants.

On Thursday, the ACCC will also hand down its decision on the global merger between US-based Elanco Animal Health and Bayer’s animal health division.

Elanco has offered an undertaking to sell certain competing products.

Overkill on water

At month’s end the ACCC will hand the government its report on the Murray-Darling water market, which will help decide what action is needed.

Given Prime Minister Scott Morrison’s admirable push for deregulation and efficient government, why does he have the ACCC doing the report and the Productivity Commission doing an ongoing study into the national water market?

It seems like overkill.

Separately the Senate report on the Inspector General of Taxation due Monday is now due on Wednesday.