While acknowledging the reality of flexible working arrangements post-COVID, Deutsch made a conscious effort to keep the firm’s offices open, in part as a place of refuge for staff who were suffering from domestic violence or simply wanted to get to a new place.

While the Victoria lockdown has knocked confidence, in an interview with The Weekend Australian he took an optimistic note saying “75 per cent of the economy is in a different place (for the moment)”.

Deloitte took early action when COVID hit, chopping 7 per cent of staff or 700 people whose sector coverage had simply run out of work.

The firm overall had a relatively good year, posting a 10 per cent increase in revenue to $2.5bn with strong growth in key areas like digital technology, mergers and acquisitions, cybersecurity and analytics.

Business he says is working on activities brought into focus by COVID such as digital, the cloud and the importance of effective workplaces.

The pandemic he says has forced Australia to relook at what the “Lucky Country” means and what must be done.

This wake up call started with the bushfires but became mission critical in March with COVID.

The Australian economy is being supported by the government and hopefully by March will be in a better place.

This includes working out how to reboot immigration while borders are shut, using some innovative solutions to increase student numbers for a start.

Deloitte is taking much of this into its own hands and has established a program called “stepping into the future”, which is an online platform through which staff can build technology skills, down to coding, how to work better with the cloud and other technology basics.

The aim is to upskill to gain in house micro credentials.

Rio heads must roll

According to UK press reports Rio chair Simon Thompson is in the final stages of deferred prosecution agreement (DPA) talks with the UK Serious Fraud Office over its 2011 payments to Francois Polge de Combret to help on its work with the Guinea government over the Simandou iron ore project.

Rio referred the matter to the SFO in 2016 not long after Sam Walsh was replaced as chief executive by JS Jacques.

A DPA means the company is charged with a criminal offence but proceedings are suspended subject to a court-approved deal.

That same year Andrew Harding, who ran iron ore for Rio from 2013 to 2016, left the company to run Aurizon in the wake of Jacques’s appointment as boss.

Harding will release the Aurizon results on Monday.

On Friday, the Perth-based Walsh declared he had opposed work on the Juukan Gorge site in the Pilbara and made that decision known to all concerned. Assuming the publicity is any more than obvious backside covering by Walsh, then Harding as his replacement running iron ore would know all about it.

If the decision was broadcast, the very fact Rio management continued to work on the project for seven years, then in May this year blew up what on its own description was the “most important archaeological site in Australia”, tells you something about the company.

If the boss guy said don’t do it and the people down the line ignored him and for seven years continued to work out how to get the eight million tonnes of quality ore ready for China, what does that say about lines of responsibility and accountability within Rio?

Jacques told a parliamentary inquiry on Friday his legal team had found no evidence of Walsh’s directive.

Committee chair Warren Entsch is worried about the quality of governance of the traditional owners and Rio has made clear it intentionally didn’t impress on their representatives that it planned to blow up 46,000 years of their history for the magical eight million tonnes of ore.

Any lack of governance ability on the other side of the negotiations simply underlines the importance and need for Rio to simply do the right thing.

In a landmark speech back in 1995 former Rio (then CRA) boss and Westpac chair Leon Davis called on the mining industry to back the Native Title Act, saying there were “major opportunities for growth in outback Australia, which will only be realised with the full co-operation of all interested parties”. He said Rio would establish “innovative ways of sharing with or compensating traditional owners”.

Under JS Jacques, having stored the artefacts from the gorge in the back shed, Rio blasted away 46,000 years of history, over the objections of traditional owners.

Jacques, it should be noted, is well aware of the significance of what has happened and has sought counsel from BHP’s Mike Henry and others. Henry was no doubt thankful it was Jacques and not him in the firing line as he easily could have been.

The man in the street may not be demanding accountability but Rio chair Simon Thompson, after sorting through the Guinea bribery issues, may well consider if the company can do what Davis said it would and do the right thing.

That means the people responsible for the blast including Jacques must walk.

An alternative view says Jacques has made his mistake and learned, which is how good governance starts.

AustralianSuper said in a statement on Friday that “Rio’s actions are totally unacceptable”.

The issue is not just about Rio it‘s about the Australian mining industry’s future.

Earnings season

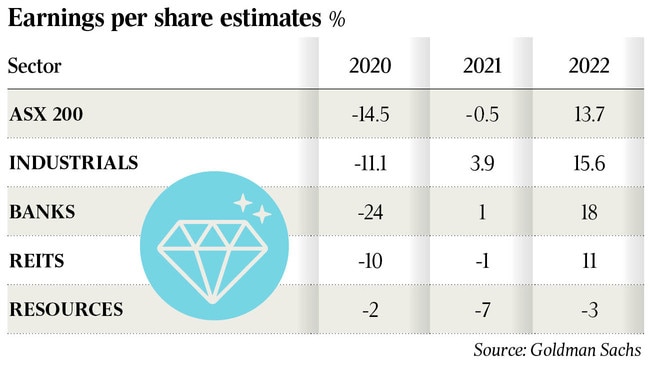

The accompanying table from Goldman Sachs shows consensus forecasts for the coming dismal earnings season which will be updated weekly to show how estimates move in the wake of profit results.

Today’s table includes 2022 as a guide because it’s not until then the market is expecting growth to return.

Any forward-looking commentary will be gold but one key will be asset writedowns to boost future growth through lower depreciation charges.

Deloitte Australia boss Richard Deutsch sees a role for professional services firms like his as a business workshop forum for ideas and collaboration.