Pubs whisperer Bruce Mathieson could be ready to roar with liquor spin-off

Billionaire Bruce Mathieson is famous for his disdain for those he calls ‘educated people’.

Billionaire Bruce Mathieson is famous for his disdain for what he calls “educated people”, a description which is usually accompanied by some well-chosen epithets.

He scoffs at consultants and solicitors and their inability to produce half-page briefs for clients and is known to hate having to sit through board meetings with directors who barely set foot in the pubs and hotels he’s made his vast fortune from.

This week, Mathieson pulled off a deal with Woolworths that could see him emerge with cash and assets of up to $2 billion from the merger of pubs and poker machines business ALH, in which Mathieson has been in partnership with the supermarket giant, and the Endeavour Drinks liquor concern featuring bottle shop chains like BWS and Dan Murphy’s.

As the dust settles on the agreement, the question is, did Mathieson strike a brilliant deal for him and his family and put one over those “educated people” he’s been in partnership with at Woolworths?

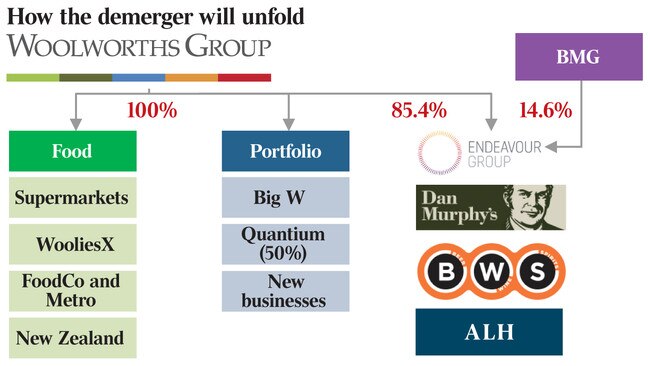

Mathieson gets 14.6 per cent of Endeavour Group and Woolworths keeps the remainder, under a deal that was being worked on for well over a year and codenamed “Project Swan”.

It is also the beginning of the end of the partnership given Woolworths will almost certainly exit its controversial link to poker machines when Endeavour Group is likely spun out and listed on the ASX next year.

Mathieson is a self-made made man who has dragged himself from poverty growing up in tough Port Melbourne to today dominating the poker machine and hotel market across the country with ALH, over which he has management control and owns 25 per cent.

He has made his vast fortune — recorded at $1.18 billion on The List — Australia’s Richest 250 — from his intimate knowledge of pubs, which goes back to the days when he’d put on acts like John Farnham and installed a huge disco at the Armadale Hotel in Melbourne in the mid-1970s, and then controlling hundreds of pubs with Alan Bond in the 1980s.

He would go on to partner Woolworths after meeting its then boss, Roger Corbett, at the 2000 Sydney Olympics.

Together they built a group with hundreds of pubs and 12,000 poker machines that came to worry Woolworths’ current management.

But what is less well known about Mathieson is his acumen in the property sector.

He owns the requisite mansions of any rich-lister but is also said to have property assets equal to or even higher than the value of his already substantial pub and hotel holdings.

Not only has Mathieson refurbished and revamped plenty of pubs in his time — they are prime property assets given their locations in CBDs and suburbs — but he personally owns huge swathes of land in Melbourne’s north and plenty of other holdings in Queensland and beyond.

It is that marriage of property and pub expertise that is expected to be unleashed when Endeavour Group is carved out from the Woolworths balance sheet.

The Mathieson camp and Woolworths have been at pains to say the deal works well for both parties, and the share price has risen since Wednesday’s announcement.

It is likely, too, that Woolworths shareholders will continue to share in the upside.

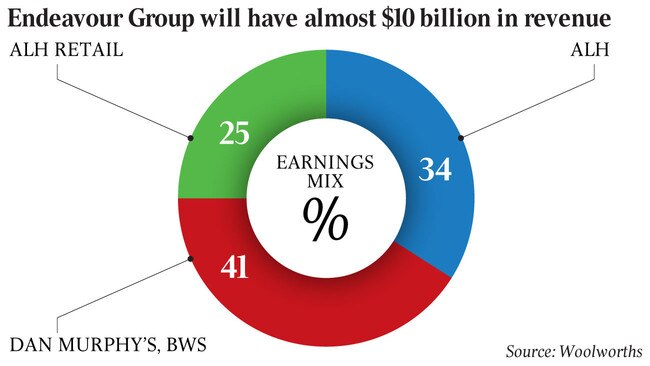

While private equity would undoubtedly be interested in the reliable earnings stream produced by Endeavour, which will have EBITDA approaching $1 billion and $10bn annual revenue, Mathieson has veto rights over any sale and likely wants Endeavour spun out next year.

That way Woolworths shareholders will gain Endeavour shares and will also benefit if there are future takeover tilts for the company.

But some analysts are unsure about the core Woolworths food and goods business left behind, with almost all those tracked by Bloomberg having “hold” or “sell” recommendations on the stock and 12-month share price targets well below current trading levels.

In a note to clients this week, Macquarie said Woolworths should have “captured a higher share” of the deal given it put the higher multiple Dan Murphy’s chain into the sale. “(Mathieson) likely landed a bigger claim on the business, given WOW were a motivated seller in our view (due to protests about poker machines),” Macquarie said.

Whatever happens, look for Mathieson to help unleash Endeavour’s potential.

Much of its focus in the past decade has been on building the Dan Murphy’s and BWS retail business at Endeavour. Now there is the opportunity to do some serious property developing.

Endeavour has 327 pubs, many of which have empty land next to them or adjacent space upon which apartment blocks can be built. Having apartment dwellers living next to a hotel offering meals all day, drinks and poker machines would be ideal for Mathieson’s business. He has also indicated the group’s existing 2500 hotel rooms could increase dramatically in the next few years.

Then there is the revamping and refurbishing of existing pubs. Mathieson is said to have been frustrated by the lack of capital allocated to ALH — Woolworths chief executive Brad Banducci admitted this week it had contributed 25 per cent of the EBITDA of Woolworths but only had 15 per cent of its capital expenditure — and would welcome the chance for Endeavour to control its own balance sheet.

Given land values keep going up and interest rates are falling, it would seem a good time for Mathieson and his family, including his highly regarded son and ALH boss Bruce Jr, to be scouring the market, looking for expansion and acquisition opportunities.

There would be hundreds of pubs Endeavour could acquire given it owns only 327 in a market of tens of thousands.

All of which is something Mathieson already relishes doing, as he hinted earlier this year in an exclusive interview with The Weekend Australian for The List. He and his wife Jill have for decades spent their weekends visiting pubs and scouring the markets for potential property purchases, and he has bought and sold more than 900 pubs in his career.

He is said to have built up plenty of market knowledge just by absorbing information on his travels, and also has an uncanny ability to size up a pub the first time he walks in — and calculate how much it should be worth and the amount of business it could be doing with a bit of extra love and attention.

“If you have good value and good facilities people will come. I love (pubs) more today than I have ever loved before.

“It’s a disease thing, I guess. You either love it or you hate it, and I love it. I love property, it is my thing. It’s like a bloke collecting stamps or cars.

“I think the bloke upstairs doesn’t make any more of this,” he said, gesticulating around at empty land next to his Gold Coast mansion. “So will it be worth more money in 100 years? I think it will be.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout