Bowen will also join the Transurban board, which Maxsted chairs, but signalled Maxsted that intended to step down during his present term.

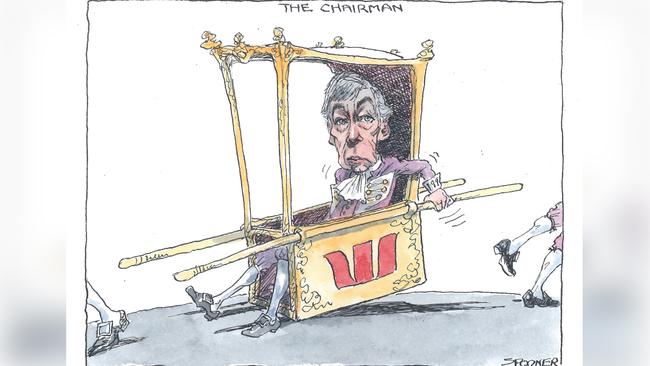

The moves come as Maxsted nears the end of his time as Westpac chairman, which was signalled late last year in the wake of the Austrac litigation.

While Maxsted is stepping aside from public company board life, he reportedly plans to continue an active role at his private advisory group Align Capital, which advises private equity and other companies on finance alternatives.

One of his clients is Irish-based Coolmore Stud, which also happens to manage his racehorses.

Friends say retirement is not in his present plans. Maxsted didn’t return calls to his holiday base in Portsea on the Mornington Peninsula outside Melbourne.

BHP’s decision to make the announcement on Tuesday during a traditionally quiet news time was unusual and may well have been prompted by Maxsted himself to clear the air on his future roles.

The Westpac board is looking at Maxsted’s replacement with internal candidates, including former KPMG boss Peter Nash and former Morgan Stanley Australia boss Steve Harker.

A decision on the new chair will come sooner rather than later to clear the way for a formal appointment of a new chief executive.

Nash followed Maxsted to the top at KPMG. He has strong banking and regulatory credentials for the position.

Internal chief executive candidate, former CFO Peter King, has a good chance of being appointed long term, given the time taken to find a suitable external candidate. He has indicated a preparedness to stay on until a permanent candidate is found, deferring a previously announced plan to retire.

The board moves come amid alternate choices by executives on whether to take high-profile company board posts.

The fact Bowen, a BHP board colleague, is following Maxsted on to the Transurban board will be seen as an internal shuffle that does little to promote diversity.

Maxsted last year announced his decision to step down from the Westpac board in the wake of the Austrac scandal, along with chief Brian Hartzer.

Shareholders demanded a public show of culpability from the Westpac board.

BHP maintains a strict governance rule requiring directors to step down after nine years on the board and this year marked Maxsted’s final term.

The company has annual director elections as mandated by UK governance rules. The nine-year rule saw highly regarded director Carolyn Hewson step down last year, but her move was not formally flagged separately as Maxsted’s was on Tuesday.

Former Wesfarmers finance chief Bowen, and former Macquarie boss Nicholas Moore, are sailing opposite tacks as they chart a post-executive career, with the former sticking to large corporations. Neither needs to work financially, so the issue is mainly one of interest.

Moore has chosen to join the well-run, not-for-profit The Smith Family, and a growing software group Willow, as his starting base.

He has 3.1 million Macquarie shares worth about $360m and paying $16.3m in dividends, so the rent is covered.

Like a lot of senior executives, he appears to have decided to keep well clear of listed companies for any non-executive role he takes.

Moore was a former corporate adviser working closely with big company boards, so the attraction of continuing to do so after stepping down from his executive career is limited.

Former Deutsche adviser Scott Perkins is one of the few mergers and acquisition bankers who has hit the public board trail, with positions on the Woolworths, Origin and Brambles boards.

Corporate lawyers such as David Gonski and former colleague John Green have, of course, pursued successful non-executive careers, along with Nicola Wakefield Evans, Christine McLoughlin and others.

The thinking by some is that big company boards are high-risk with little upside and too much focus on compliance and little in the way of strategy.

This depends on how company chairs handle the role, which is why due diligence is needed by both sides.

Moore would much rather join something he can be closely involved in and where he can be part of the team, like Willow.

Former CBA boss and now AMP chair David Murray took the view he didn’t want to be on the board of a company over which he had little influence.

The revival of AMP is a challenge and one in which he can clearly play a big role.

Bowen, by contrast, enjoys big company boards and has relished his time at BHP, being Ken MacKenzie’s first appointment.

The company on Tuesday said Bowen would take Maxsted’s place as chair of the key audit and risk committee.

Bowen will also join the Transurban board and is on the path to take over from Maxsted as chair.

Bowen, in contrast to Moore, likes working with big public companies and his BHP experience has proved invaluable as the company transfers to a new chief executive, Mike Henry. His role at private equity concern BGH Capital is also changing to a lesser one now former KKR executive Matt Claughton is on the job.

After travelling from his Perth base for 38 weeks last year, he is keen to travel less.

The key, he figures, is to do your own due diligence and in BHP and Transurban he has two well-run companies in very different sectors.

If, as expected, he assumes the Transurban chair, his key task will be to find a replacement for Scott Charlton, who after eight years in the top job is due to step down shortly.

It should be noted the Transurban board has not made a decision and another highly regarded internal candidate would be Christine O’Reilly.

A good CEO generally lasts between seven and 10 years, but the average tenure is 4.8 years.

The conflicting career paths come down to a question of choice, with different people seeking different roles.

While public company boards are seen as being all downside, there are plenty who enjoy the experience that comes down, in part, to having a good chair and board and a well-run management.

Private companies have their share of snafus. It’s just we don’t always hear about them.

Tough decisions ahead

Amid the changes at non-executive level, Boral chair Catherine Fagg has some decisions to make, with the market expecting chief executive Mike Kane’s term to be cut short.

He was due to step down in 2022, but in the wake of the financial problems at the company’s newly acquired US business, shareholders say they want action sooner rather than later.

The board is due to meet towards the end of this month where the financial irregularities at the US business will be considered along with Kane’s term.

Kane came to the top job at Boral in 2012 when former chair Bob Every showed Mark Selway the door amid an internal executive revolt.

Kane joined Boral two years earlier and was running its US operation after a career in the sector in the US.

Since then, he has gone some way to streamlining the business, getting rid of bricks and moving closer in Asia with the Knauff joint venture - but, through his $US2.6bn ($3.7bn) Headwaters acquisition, Kane went against trend.

The internal management was reshuffled at the start of last year to prepare for succession, with CFO Ros Ng given wider duties, Ross Harper placed in charge of operations, and Wayne Manners installed as Australian boss.

If Fagg wanted a read on fund manager support for Kane after a 52 per cent underperformance in his seven years at the helm, November’s Sims Metals annual meeting told the story.

The proxies were running strongly against Kane’s appointment to the board and his nomination was withdrawn to prevent embarrassment.

Lindsay Maxsted is stepping back from public company boards, with BHP confirming he will retire at year’s end and be replaced as audit committee chief by former Wesfarmers CFO Terry Bowen.