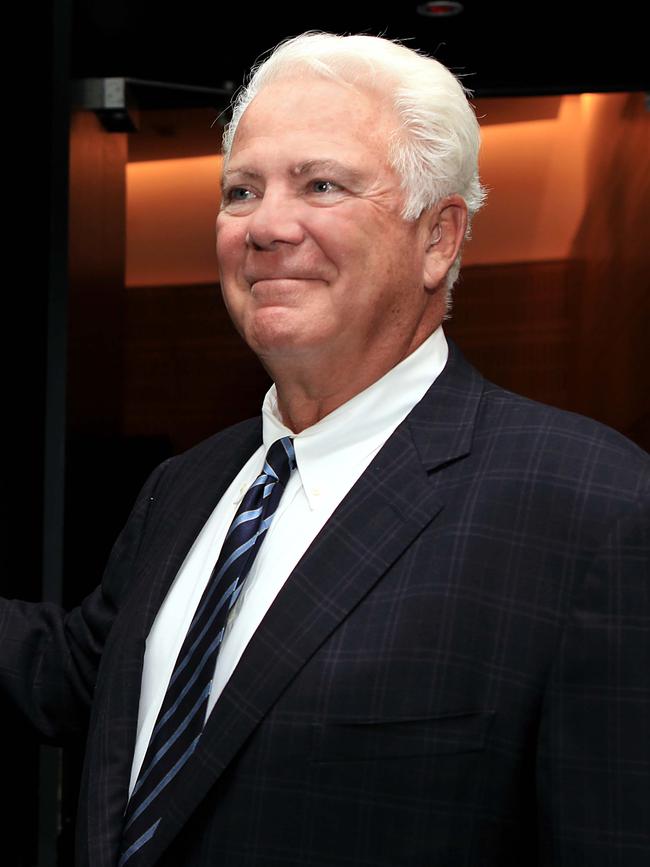

James Hardie chair Mike Hammes did his best to gloss over his own mistake in appointing Truong to the post less than three years ago by unveiling a profit upgrade on the same day he showed his chief executive the door.

The interim replacement, Harold Wiens, is like Truong and fellow director Moe Nozari an alumni of the illustrious 3M management school, which has excelled in delivering innovative product development.

Management turmoil, it should be noted, is not new to James Hardie. Former boss Louis Gries delivered standout returns while running a revolving door for his direct reports.

At this stage, we have just the board’s side of the story but it documents what directors saw as a breakdown in management evidenced by “intimidating, threatening and humiliating” executives in clear breach of the company’s code of conduct.

Like Mark Selway at rival Boral a decade ago, the Hardie board was faced with the prospect of an executive walkout because of the alleged lack of emotional intelligence from Truong.

Hammes, a former Ford executive, had used headhunters Korn Ferry and lawyers Skadden Arps to try to school Truong. And while the financial results were on the board, the management lessons and warnings failed.

With a PhD in chemical engineering, Truong came to the company from Electrolux and a two-decade career at 3M.

He arrived James Hardie in 2017 as someone who saw himself as a change agent. “I saw a business that was doing things one way and the market had changed,” he said at the time.

Selway took the same attitude. Both tried to change without bringing management with them.

Lean management techniques were introduced to bring manufacturing plants up to grade and – in the words of Hammes in 2019 – Truong was fully aligned with “a well-defined strategy” from board and management.

Hammes clearly missed what he now confesses was his candidate’s inability to work with his team to produce sustainable performance and, by definition, failed the key job of being a company chair.

The slump in James Hardie’s stock price reflects the board failure just when the external environment in the US and Australia is booming for building products.

Road to concentration

In a recent presentation, Transurban boss Scott Charlton noted that over the past three decades the number of tier-one construction companies in Australia has fallen from eight to three.

Leave to one side a dispute over the facts, there is some irony in Charlton, who controls 87 per cent of Australian toll roads, pointing to increased concentration as a complicating factor in the Australian infrastructure industry.

The concentration he has noted makes it more difficult for buyers and governments

Charlton has managed Transurban superbly, exploiting its market power with great skill, as evidenced by its earnings margins averaging 70.3 per cent across the company and peaking in Melbourne at 81.6 per cent.

The troubled $6.7bn Westgate project in Melbourne has suffered a $5bn cost blowout and long delays in its expected completion, but still Charlton keeps the perks including a 10-year extension of his monopoly control on the CityLink toll road to Melbourne airport until 2045 and a two-year extension in higher mandated price rises until June 2029 of 4.25 per cent.

Long-term price rises are dictated by CPI increases.

Charlton’s skill is in suggesting projects like Westgate to the Victorian state government in return for such entrenched perks.

He has the same leverage over the NSW and Queensland governments and as the incumbent across the eastern states is best placed to know which projects are best suited to ease traffic concerns.

While in NSW, under Australian Competition & Consumer Commission directions, he must share traffic data, incumbency offers barriers to competition.

When asked why he cleared Charlton’s successful purchase of the remaining 49 per cent of Sydney’s WestConnex toll road, outgoing ACCC chairman Rod Sims told this column that you had to understand the difference between competition policy and law.

What is desirable in policy terms is not always achievable in legal terms and toll roads in particular hold challenges. They are used by millions of consumers each year who must bear the cost rises long after the politicians bask in the glory of trumpeting infrastructure projects.

Governments control the price (negotiated with Transurban), which means the company is arguably bound to accept what is on offer and technically if you want to travel an extra hour you can use alternate routes.

Sims wants the law tightened, arguing “instead of asking the question of ‘why not allow this acquisition’, our merger control system should be requiring merger parties to convince us or an appeal or review body ‘why the acquisition should be allowed on competition grounds’.”

He wants to minimise the power of the courts to intervene in the less than 2 per cent of cases that are challenged.

Sims quoted former Federal Court judge Ray Finkelstein as saying, “the view that undue concentration results in anti-competitive effects is the government’s policy that lies behind s50. The insistence that there should be positive proof of anti-competitive effects thwarts the operation of the section. The reality is there will be many cases where it is simply impossible to obtain evidence to prove the merger’s anti-competitive effects and others where such evidence is non-existent.”

Sims wants the onus of proof reversed, making clear companies seeking merger approval must furnish all required information at the time of their application.

“This negates the game conducted now, where companies planning acquisitions involving businesses in Australia decide what information to provide to the ACCC upfront and then the regulator must seek additional information, either voluntarily or via compulsory information gathering powers.”

Sims finishes his term in March and will be replaced by the highly respected lawyer Gina Cass-Gottlieb. Just whether she has a similar reform platform remains to be seen.

Charlton is right to note the problems faced by governments because the construction sector has narrowed to just three players – two Spanish owned (Acciona and CIMIC) and the Chinese-controlled John Holland.

The industry disputes his claims, noting the likes of Samsung, Ghella, Laing O’Rourke, Gamuda, Ferrovial, WeBuild and GS Engineering are all tier-one players. The existence of the others on Australian projects is clear – it’s just an issue over the size of their local workforce.

Either way Charlton’s concerns on industry concentration back those of the ACCC’s Sims.

On paper, Jack Truong ticked all the boxes – except the one that counts. That’s the one that says a CEO delivers best by producing excellence from his executives.