Hedge fund giant Bridgewater in pay inequality row

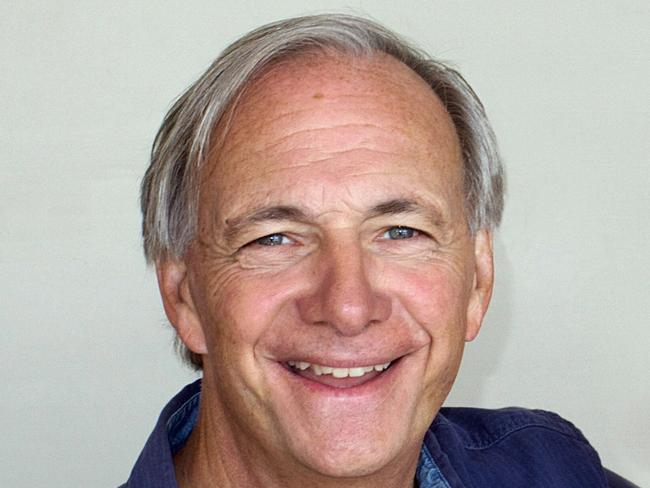

A top exec at Ray Dalio’s Bridgewater is the second senior woman there to complain she earns less than some male counterparts.

Karen Karniol-Tambour, the top-ranked woman at hedge fund Bridgewater Associates, is sparring with the firm over her pay after learning that she has earned less than some male counterparts, according to people familiar with the matter.

Ms Karniol-Tambour, 35, is director of investment research, a role that makes her essentially the fourth-most-senior investor at the world’s largest hedge fund. She made a formal complaint to top Bridgewater brass, including founder Ray Dalio and chief executive David McCormick, one of those people said. She asserted that men with similar or lesser responsibilities have been paid more.

The matter was unresolved as of this week, one of the people familiar said. Bridgewater was reviewing the pay history of some top male executives in light of complaints from Ms Karniol-Tambour and others at the firm.

A Bridgewater spokesman declined to comment on Ms Karniol-Tambour but said the firm regularly examines pay equity. “As of our annual audit in December 2019, we can confirm there are no outstanding discrepancies in how men and women are paid at Bridgewater,” the spokesman said. Ms Karniol-Tambour’s exact pay and that of her male counterparts couldn’t be learned.

Until earlier this year, the senior-most woman at Bridgewater, the world’s largest hedge fund, was co-chief executive Eileen Murray. Ms Murray left and accused the firm of gender discrimination and unequal pay in a lawsuit this summer. She alleges the firm owes her as much as $US100 million. Bridgewater has asked a judge in federal court in Connecticut to dismiss the lawsuit, arguing the dispute should be arbitrated. The firm hasn’t otherwise commented on Ms Murray’s allegations.

Ms Karniol-Tambour is a longtime Bridgewater employee who frequently speaks publicly about her fondness for the firm. She also appears on television to discuss Bridgewater’s investment outlook. In a text message after this story was published online, she said, “I have had ongoing conversations about compensation, but these conversations did not involve my gender.”

Bridgewater famously operates on what Mr Dalio terms “radical transparency,” a management philosophy in which all employees are said to have access to details on decision-making at high levels of the firm. Mr Dalio has said publicly that the practice doesn’t extend to personnel matters.

Ms Murray’s lawsuit broke the narrative around her departure. This year, before her lawsuit, she said in a statement that she had a “terrific 10-year experience at Bridgewater,” and the company said the terms of her exit were agreed to “a while ago.”

Co-chief investment officer Greg Jensen has told associates he hopes the hedge fund will reach a quick monetary resolution with Ms Murray, reasoning that a prolonged fight will cost more than it is worth, people familiar with the matter say. Mr McCormick favours taking a harder line.

What was particularly alarming to Ms Karniol-Tambour, said people briefed on her situation, is that she made less than several men in largely operational roles at Bridgewater. At most hedge funds, investment professionals can earn considerably more than those who perform back-office tasks or liaise with clients. As director of investment research, Ms Karniol-Tambour serves as deputy to the firm’s three co-chief investment officers. That makes her a relative rarity in the hedge-fund world, where women typically serve in lower-paid roles that don’t involve managing money.

Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout