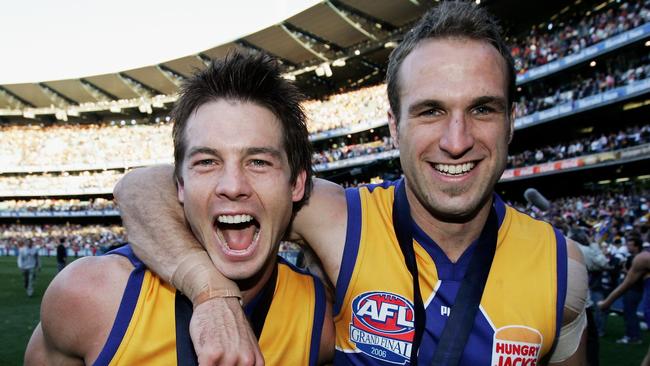

Dual Brownlow medallist Chris Judd’s post-footy career kicking goals as a funds manager

The former AFL superstar’s first funds management venture, named after a famed athletics coach, has returned 25 per cent to investors by following what Chris Judd did best in footy.

Percy Cerruty is part of Australian sporting folklore, having coached middle distance running legend Herb Elliott to a string of world record performances, culminating in an Olympic gold medal at the 1960 Rome Games.

Cerruty pioneered athletes embracing natural diets, training in natural surroundings and working on mental strength and stimulation.

Curiously, he only started running in his 40s and had turned 50 before he completed his first marathon.

It was all these traits that caught the eye of AFL dual Brownlow medallist and premiership captain Chris Judd when he first read Cerruty’s biography, aptly titled “Why die”.

“I guess the correlation for me was someone who was late to his profession, who didn’t believe conventional wisdom at the time and was a first-principle thinker. Into his 70s he was still running personal best times for marathons. So he was someone who could put up with a lot of pain,” Judd says of his decision to name his maiden funds management business after Cerruty, who died at the age 80 in 1975 after a battle with motor neurone disease.

“Our fund is not looking to smooth volatility month to month. We are looking to make long-term bets on secular trends that we like.

“Those trends invariably often take years to play out, and it’s never in a straight line. While some funds really anchor on that month-end performance number, we really want to take a longer-term view. Our investors will get rewarded for that, putting up with that volatility over the long run.”

Judd’s Cerruty Macro Fund, which he set up with business partner Thomas Galanti, has just had its first birthday after delivering an annual return to investors, post fees, of 25.38 per cent.

It outperformed its benchmark by almost 15 per cent by backing companies with strong cashflows, robust balance sheets, and clear catalysts for revaluation.

Its high-conviction strategy is focused on 15 to 40 stocks, including micro caps, investing in themes such as what Judd terms “the electrification of everything”. It has done well out of Canadian copper stocks, increasing electrical grid requirements, cost of living pressures, the impact of population growth, ageing demographics and currency debasement.

“The companies we like are in fairly boring industries like healthcare or childcare, where population growth means they can keep raising prices and keep growing,” Judd says.

Two of Cerruty’s best picks have been somewhat left field: One is Vysarn, a Perth-based listed company that provides production critical services and solutions to the resources, construction and utilities industries. It is run by former Fremantle Dockers AFL footballer James Clement.

The other is Southern Cross Electrical Engineering, Cerruty’s best performing stock pick, whose shares have risen more than 150 per cent in value over the past year.

That firm is one of the nation’s biggest providers of electrical work, especially to the booming data centre sector, which is growing rapidly due to cloud computing and AI developments.

Cerruty currently has around $26m under management from high-net-worth individuals, family offices and self managed super funds.

Judd says his goal is to grow that to $150m within five years, although he stresses there is no hard time frame if it takes longer.

“The long-term goal would be to close it at $150m, grow the capital to $300m and give half of that back to our investors and then start again,” he says.

“So you preserve that edge of being small and being able to invest in small companies.”

Proving financial doubters wrong

Judd was one of the greatest players of the modern AFL era yet, unusually, was a voracious consumer of the financial press throughout his professional football career.

It started as a form of escapism when he played for glamour club the West Coast Eagles in what he has previously termed the “fishbowl” of AFL-mad Perth.

In 2013, when he had returned to his home town of Melbourne to play for Carlton, he and wife Rebecca teamed with a group of investors to purchase the triathlon brand named Jaggad and set about transforming it into an activewear brand.

Their fellow investors in the business, which celebrated marked its 10th birthday last year, include former Carlton board member Ryan Trainor, Just Jeans founder Craig Kimberley and ex-Hawthorn player Steve Greene.

In 2015, after his retirement from football, Judd spent 18 months as an analyst at Giant Leap, a Melbourne-based venture capital fund backed by the Liberman family that invests in start-ups.

He also started a video and podcast interview series, featuring chats with a wide variety of local and global fund managers.

He likens his move into the finance world to eagles who extend their lifespans by removing their beaks, talons, and feathers in order to grow new ones.

“I guess that is a little bit of the feeling of a professional athlete who goes into a new career,” Judd says.

“It is a steep learning curve building a new skill and testing yourself out all over again and going through that feeling of the unknown.”

For decades he says performing at the top level of elite sport took a “huge amount of headspace”. That left a mental vacuum after he retired.

“I can still remember that feeling of relief listening to the first macro-economic podcast I ever heard, which was from the great macro-economic thinker Grant Williams. While I had been investing in equities for years, there was something about macroeconomics that just really filled that void,” he says.

Judd has never doubted his own ability to transition from football to investing, but at times has struggled to convince some in the finance world of his credentials. He recalls being laughed out the door at one early meeting.

“I get there is a natural tendency everyone has that when you see people, you associate them with one thing. But I have been amazed at the amount of people I meet whose first question is, ‘How can you manage money? You’re a footballer’,” he laments.

“The last game of competitive football I played was nine years ago. But that’s just the way it is and our fund acknowledges that we have to earn our stripes. Over a long enough time frame, I believe the numbers will tell the story.”

He also stresses there have been plenty of people in the finance industry who have been “brilliant, warm and open to help and share ideas”.

As a footballer Judd was never comfortable with consensus. He always wanted to break the mould. He has carried that spirit into investing.

“My natural disposition is one that is highly disagreeable. If I’m engaging in an activity like football and we are doing the exact type of training as every other team, I’m always really uncomfortable with that,” he says.

“Because you want a different outcome. If you are just following best practice of the day like everyone else, it makes no sense how your outcome will be materially different to everyone else. That was certainly the way things played out through my footy career. That is now how things have played out as an investor.

“I don’t like throwing up a stock idea at a dinner party and having everyone agree that it’s a really great idea. I’d rather people look at me like I am an idiot, because if I’m right, it’s really not in the share price. So we look for those things that are non consensus. Not all the time, but they are our favourite types of investments.”

As a footballer Judd also didn’t dwell on errors.

“You never want to review your game while it’s happening. You can see that throughout games now, particularly with young players where they make a mistake. You can see them replaying it in their head for the rest of the game, thinking about what it means and what they should have done,” he says.

“Whereas the right thing to do in the game of football is to focus on the next contest in the game.

“There’s some real similarities with investing. No one ever sells at the high and no one ever buys at the very bottom. Investing is an imperfect game, albeit one that goes a lot longer than a football career.”

Family treads its own path

One of Judd’s investment heroes is American billionaire investor, philanthropist and former hedge fund manager Stanley Druckenmiller, whose strategy was focused on analysing and predicting macroeconomic trends and events.

Judd says Cerruty does the same, generating investment ideas from macro trends.

“What I admire most about him is his ability to change his mind really quickly. ‘Strong ideas, loosely held’ is one of his lines that resonates and his ability to make money in different markets,” Judd says.

“So in the current environment where government debt to GDP is so massive, we think having that flexibility to both change your mind, but also to change your investment style, is going to be really important for the next five to 10 years.”

Judd muses that his wife Rebecca, a qualified speech pathologist, television host and former model – who for more than a decade has had her own fashion and lifestyle blog – works in a different professional world to his.

The couple lives in a $7m mansion in the affluent Melbourne bayside suburb of Brighton.

“There are too many deliveries coming to our house for me to work from home much, so I go into the office,” Judd says with a smile.

While he is inherently someone who prefers to stay out of the limelight, he welcomes his wife’s prominent social media profile.

“I thought when I’d stopped playing footy. I’d never be in the media again. But she’s got a really public profile and she’s done a great job. You look at the world of influencers, it gets portrayed as if it’s not a job,” he says.

“Well it is a job, it is a skill set. She does it well and she enjoys her work. I don’t think I’m at risk of becoming a male influencer myself. But she is doing something she is good at and what she loves doing.”

The couple has four children, one of whom plays in the football team Judd coaches, the Under 13s East Sandringham Zebras – the junior team he once played for – in division one of the South Metro Junior Football League.

“I love the coaching, it’s been great fun. It’s great to have that connection to football still and the kids are at a nice age where they really want to get better,” he says.

He dismisses any concerns about his children bearing additional pressure in football carrying the Judd name, describing the challenge as a “first world problem”.

“Some kids don’t even known who their dad is. It depends what you are attached to. If you attach to that then you could convince yourself it is the world’s biggest challenge. But in the big scheme of things, it is pretty immaterial to me,” he says, noting he has zero expectation of any of his children making their name in AFL football as he did.

“Not at all. I don’t put expectations on them,” he declares, before quipping, with a wide smile: “After all, there are easier ways in life to make a quid.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout