Diversity key as Citigroup battles against tech giants

Citigroup investment and corporate banking chief Tony Osmond says the sector must lift its game to attract and retain women.

Citigroup investment and corporate banking chief Tony Osmond says the sector must lift its game to attract and retain women and diverse ethnicities as it attempts to better reflect more varied company boards and fend off the allure of technology giants.

Investment banks and the finance sector more broadly are fighting harder to win over university students as companies like Google and Tesla sharpen their pitch for the best and brightest interns and graduates.

Osmond says diversity is a big focus at Citigroup given the volumes of research that it improves a company’s performance.

He is also aware local company boards and executives are demanding diversity from their investment banking advisers.

“If we turn up to a meeting with a client and all we have is Australian white males on our side of the fence our clients look at that and say we are not going to get the best outcome or service,” Osmond adds.

This year, after sifting through more than 1000 applications, Citigroup’s investment bank and markets division awarded summer internships to 35 students in their penultimate year of study. The gender split was better than in 2017, but still only 40 per cent female.

The overall intake this year was up from 27 interns in 2017.

Osmond says the firm is making a “concerted effort” locally and globally to ensure a more even gender intake.

“We have made it very clear the target is 50/50,” he says.

Ethnic diversity is, however, harder to measure.

“We don’t really track the (ethnicity) statistics because we don’t ask people to put themselves into a box,” Osmond says.

Internships are fiercely competitive in Australia because they are perceived as the best way to start in the investment banking sector and secure a graduate position.

Intern programs typically run for 10-12 weeks and usually start around November. Winter internships are increasingly popular, with Morgan Stanley, JPMorgan and Macquarie Group among those offering the option.

But despite all their efforts, the large global banks are not among the five most prestigious internships for 2019, with the top of the list populated by Google, Apple, Microsoft, Tesla and Facebook. Goldman Sachs, which was in the top five last year, has slipped to sixth spot.

Ratings and career site Vault.com’s latest survey included about 400 companies and compiled responses from more than 13,000 interns.

Still, banks are not giving up and Osmond says improvements in work/life balance initiatives are important, including not allowing staff to work on Friday nights and Saturdays unless they receive management approval. Citigroup is also encouraging employees to take sabbaticals.

Other banks have similar measures in place after the industry suffered a string of reputational issues relating to a culture of gruelling hours. In 2013, the death of London-based banking intern Moritz Erhardt after working 72 hours straight shone a spotlight on investment banking culture.

The Me Too movement, which has gripped sectors including entertainment, technology and banking, has also underscored the importance of a company’s culture.

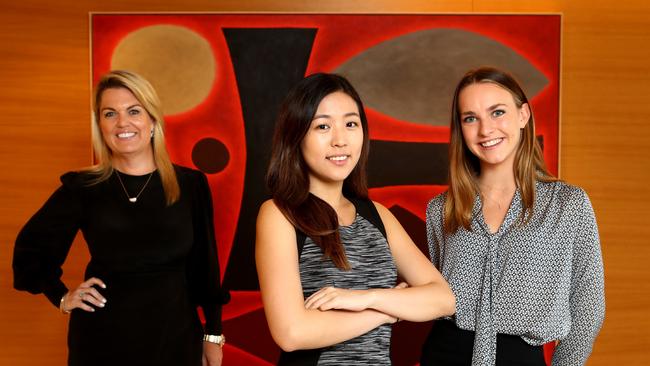

Locally, the banking royal commission and high-profile misdemeanours by the big four banks and Macquarie have not helped. University of NSW student Boyang Jiang — a Citigroup 2018 intern who has also been employed at accounting firm Ernst & Young while studying — says both firms have “good cultures”.

“Corporate culture is everything,” she says. “My expectations were already very high, but reality has already exceeded my expectations.”

University of Sydney student Alice Crammond — another of Citigroup’s 2018 interns — says meeting the senior bank staff helped to “break down any of those (finance industry) stereotypes”.

In 2018, the bank awarded nine Australian scholarships to female students in their second last year of university.