Rival bidder Cyrus Capital is said to be still looking for partners, and while the two have similar plans, supporting management’s own ideas for the $7.1bn debt-burdened carrier, the ability to execute holds the key.

Cyrus’s primary $US4bn fund would normally only support a bid of about $400m, well short of the expected $700m to $1.2bn final bid, but administrator Vaughan Strawbridge was clearly satisfied to let it reach this level.

The circa $1bn bid would cover some creditors but the reality for the $2bn owed to unsecured bond holders is they will get at very best the 10c in the dollar the bonds are now trading at, and probably less.

Some of the 9500 staff would probably lose their jobs, but union support is key to get the deal over the line and then run the airline with the old-style more relaxed culture.

Bids for Virgin close next Monday with a decision expected mid-week and then a frantic month for the winning bidder to negotiate deals with the myriad debt holders, such as the expensive contracts with GoGO for the in-flight Wi-Fi, caterers Gate Gourmet and Boeing.

The final deal is due to go to creditors for approval on August 22.

The airline will probably be based in Brisbane, with a hefty sweetheart deal from another state needed to cover the cost of moving the head office.

Still, the Queensland government surprised observers recently with its support for sometime partner Alliance Aviation to expand regional Queensland routes.

The rival bidders have similar plans for the airline: return it more to a Virgin Blue-type hybrid between Jetstar and Qantas. This backs the plans presented by Paul Scurrah, with a much shorter time frame to reach the goal.

Scurrah is certainly a key player, at least for the short term, but whether he stays longer-term remains to be seen.

There are some areas, like IT, where increased investment is needed.

Now is the time for the final touches to be made before Monday’s deadline.

Recovery from 2021

AustralianSuper is preparing for a long-term financial market recovery from 2021, according to investment chief Mark Delaney.

Present cash levels of around 9 per cent are higher than normal and he will be looking to reduce them when the time is right.

Delaney said the recent market turmoil had meant more care had to be taken to protect its liquidity, with foreign exchange and US stocks seen as providing liquidity.

He told a Bloomberg investment conference on Tuesday the fund had received 300,000 requests for early withdrawals and paid out $2.2bn.

The fund has $178bn under management, and Delaney said from the fund’s perspective it hadn’t been a problem but would need to be addressed by the investors.

AustralianSuper manages $30bn in Australian equities in house, with another $6bn in passive funds managed by IFM.

Delaney said the fund had expressed its strong concerns in talks with Rio Tinto over the explosion of sensitive ancient artwork in the Pilbara, but at this stage had taken no other action.

CBA drama

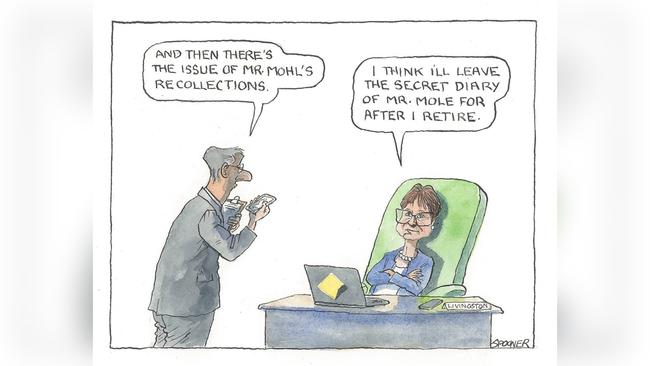

Just as dirty politics re-emerges in Victoria with branch stacking scandals, the business community joined the party, with CBA in the news amid allegations its highly esteemed chair Catherine Livingstone was selective in her memory in her royal commission evidence.

The market, it should be noted, was more focused on immediate concerns, such as reports of the potential for up to 25 per cent of the deferred home loans to be deemed in trouble, and fears the government’s $25,000 HomeBuilder scheme will be over-leveraged by the banks.

The focus of separate reports elsewhere on Tuesday was on the Livingstone evidence to the royal commission in November 2018

Things won’t be so settled in the CBA boardroom in coming months.

In November 2018, former director Andrew Mohl sent an email to past colleagues questioning whether the evidence accurately reflected what went on in the boardroom.

At the outset it should be said Livingstone’s position on the board is safe. She is regarded as doing a very good job at a tough time for the industry, and having been re-elected in 2018 has every reason to expect shareholders to back her to continue until 2021, if not longer.

Having joined the board in 2016, she is also regarded as being a cleanskin in terms of all the mud thrown at the CBA board and its governance shortfalls.

She is well known for being a details freak, and on that scale her former colleague Mohl would be regarded as being at the other end of the spectrum.

Some think her operating style is too intense, but those working with her now obviously are not complaining.

Those who have left clearly have their own views.

That said, insiders are asking questions, wondering just what prompted the leaking of Mohl’s email this week.

One explanation is that Austrac is now in the news again thanks to the Westpac case and the Livingstone testimony might have come up in conversations with former CBA folk, including Mohl and David Craig, who presently serves as the head of the audit committee at Lendlease.

Craig used to have carriage of financial crime at CBA when he was CFO in an 11-year term ending in June 2017.

Magic Matt Comyn was appointed as CBA boss in January 2018 and he, like Livingstone, is also regarded as being a details freak, so the two have something in common.

Mohl was his biggest cheerleader when Comyn got the CBA job, and Mohl, who now works as an executive life coach, is still a big fan.

The circulation of an old email relating to evidence of reactions when Austrac first hit CBA shows what an impact the regulator has had on the two big banks.

APRA has already raised questions about the poor governance at CBA, centring on the audit committee under former director Brian Long and the risk committee under former director Harrison Young.

Austrac representatives had lunch with the CBA board in June 2016 and, by all reports, there were few concerns expressed.

The following year, the Austrac litigation landed at CBA and apart from reputational damage ended up costing the bank $700m.

Austrac followed the same formula with Westpac, right down to amending its claim after the defence was lodged.

Negotiating skills to one side, the complaint from the banks is that it’s a one-way street dealing with Austrac.

In all, CBA has spent $2bn or more on compliance snafus, so governance wasn’t great in the pre-Livingstone era.

As stated, her position is safe and market reaction to the email circulation would be more questioning of the former directors.

That said, she would not enjoy seeing dirty linen being hung on the line or her own integrity being questioned, but that, it seems, is part of being a big bank chair.

Bain Capital’s Mike Murphy presents as the safe pair of hands with a team on the ground and at least $25bn in capital to apply should it win next week’s contest for Virgin.