He says it’s just a coincidence but Monday’s legal action against Google was superbly timed for the finalisation of the proposed code of conduct on media content compensation.

The ACCC draft report on the issue is completed and is now awaiting Treasurer Josh Frydenberg’s green light to release for discussion before legislation is introduced late next month.

After talking up a legal assault on Google Sims, before yesterday, had delivered just one action, which like the latter one centres on alleged misleading conduct under the ACCC’s consumer powers.

It has proved more successful with consumer cases than competition law breaches and more are promised.

Sims warned Google and Facebook on Monday “you won’t be too far ahead of us”.

The latest legal action suggests Sims and the ACCC have lost patience with the big platforms and want to use court actions to set the boundaries for their operation.

The litigation is also aimed at increasing consumer awareness about how Google is making big money from their personal information.

Past performance suggests the government release will come via selected briefings to shape interpretations rather than an initial open discussion to set the stage for legislation proposed by the end of August on a mandatory code of conduct.

News Corp, the publisher of this paper, is keen to have direct negotiations between the platforms and the media companies with settlement by way of final offer arbitration, which means the arbiter selects one or the other but not an in between value.

The ACCC is also likely to offer collective bargaining for smaller publishers given the aim of the exercise is to provide more equal bargaining power.

The ACCC also has a misleading claim action against Google which is due to be heard in November centring on its privacy promises.

This action centres on the $8bn ad tech market through which Google and Facebook dominate the digital advertising space through their control of personal information.

The market is subject to a separate ACCC inquiry with a draft report due in December.

Sims also flagged more litigation against Google from last year’s digital platform inquiry.

The DoubleClick legal action is the ACCC’s first venture into adtech and the promises made by Google which have been described as deception by design.

When Google first acquired DoubleClick for $US3.1bn in 2007 it did so with contracts in place so it would know who taps into what website when.

At the time there were contracts in place to ensure the website data would be kept separate but in time those contracts expired and Google combined the data into its own network including its search powers.

This means if you look for sporting wear, Google knows it and if you buy the sporting wear online Google knows it and that makes its advertising more valuable for sporting wear retailers.

That is what happens when a company with market power buys one without that power.

The same is happening now with the ACCC and others looking at Google’s $US2.1bn acquisition of wearable device company Fitbit with a final decision due on August 13.

That will give Google access to your personal health data which can be added to its treasure trove of data maximising the value of its advertising revenue potential.

The European Commission is now negotiating with Google over the terms of that deal and Google is making all sports of promises about what it will and won’t do.

In the wake of the DoubleClick experience the promises will be treated with some scepticism

Through DoubleClick Google knows every website you log onto including the ACCC’s own site.

The key issue in the latest case is through its data control Google increases the value of its advertising business which shows how the company uses data to boost its own bottom line.

The ACCC legal action is one more bit of pressure on Google.

Sims said in a statement: “Google significantly increased the scope of information it collected about consumers on a personally identifiable basis. This included potentially very sensitive and private information about their activities on third party websites. It then used this information to serve up highly targeted advertisements without consumers’ express informed consent.

“We allege that Google did not obtain explicit consent from consumers to take this step.”

Sims added: “The ACCC considers that consumers effectively pay for Google’s services with their data, so this change introduced by Google increased the ‘price’ of Google’s services, without consumers’ knowledge.”

Rolling the dice

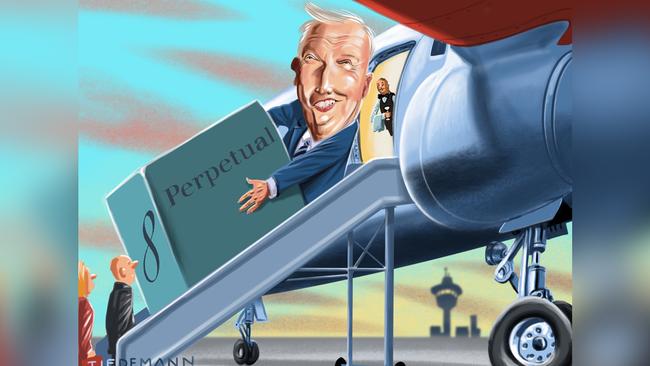

Perpetual’s Rob Adams is rolling the dice, having spent over $500m this year expanding his US funds management operations to the US through Barrow Hanley in a deal which on paper looks okay.

A note of caution is necessary given the vendor is the canny hedge fund manager John Paulson through listed vehicle Bright Sphere, which went for a run in the US on Friday ahead of the deal.

The 16 per cent increase in the stock tells you investors were not unhappy about the deal, and neither it seems was the legendary Paulson.

There are some people you would prefer not to be on the deal table against you and Paulson is one so it remains to be seen whether Adams escaped unhurt.

The firm came to Adams‘ attention via Perpetual’s private wealth managers who apparently had some funds invested through the US manager.

Consider also the fund manager has recently lost a $US40bn mandate from Vanguard which while being a low value mandate has been replaced with just $US365m in new funds.

Adams of course talked down the loss of funds, selling it as a business opportunity, which is a big call.

Still at 0.75 per cent of $64bn on funds under management and eight times earnings the $465m deal value is okay and good enough for Admas to promise 20 per cent earnings per share growth.

Adams came to Perpetual in September 2018 with a mandate to grow the business and diversify risk which this deal does in spades.

Australian stocks have gone from 46 per cent of funds under management to 14 per cent, global equities increased from 5 to 11 per cent, US equities will be 42 per cent and fixed income stays steady at around 27 per cent.

That in a heartbeat minimises concerns over fund outflows in Australia and diversification is welcome to minimise risks.

That depends on how the international assets perform and Adams has wisely let the US team keep their 25 per cent stake in the business.

The big issue in financial services is managing the cultures and that remains to be seen in this deal.

Adams made his name in the game at Challenger in the early part of last decade buying 10 boutique managers to grow under minority corporate ownership.

He left in 2012 to run the local arm of former AMP fund manager Janus Henderson before joining Perpetual.

He has taken bold steps to completely reshape the business, now comes the interesting part as he makes those assets deliver better value for shareholders.

Separately Cbus has chosen a proven pair of hands in Justin Arter to lead the $60bn fund, replacing David Atkins.

After a career in stockbroking at McCaughan Dyson and what became Goldman Sachs Australia, Arter was head of Blackrock‘s local office before moving offshore with the manager and more recently working with ANZ.

ACCC chief Rod Sims has made clear he and other international regulators have lost patience with Google and its empty promises which he said could described as “deception by design”.