Australian CEOs brace for a second coronavirus wave

Corporate Australia is bracing as Melbourne’s spike in infections rattles already fragile confidence

Corporate Australia is bracing for a potential second wave of the coronavirus outbreak, with a spike in infections across Melbourne’s suburbs rattling already fragile confidence.

As major companies, including National Australia Bank, told Melbourne-based staff to again work from home, chief executives have warned that a resurgence in the virus could set back an economic recovery that has been founded on government stimulus packages, low interest rates and a sharemarket bounce.

Top banks, insurers and developers are relatively optimistic about Australia’s position on a global scale and emphasised they are keen to invest in positioning businesses for the next cycle, even as they take COVID-19-related losses.

However, AMP chief executive Francesco De Ferrari acknowledged the importance of slowing the virus spread before it had a broader economic impact.

“Governments are doing everything they can to ensure that they contain this, because if this really spirals into a significant recession that’s going to be impossible to grow out of all the debt that governments are writing,” he said.

But he cited the success of local policies, which have limited the spread of COVID-19, as compared to more affected countries.

“I am more positive personally … for Australia than other parts of the world,” he said.

“Australia is the first or second-best OECD country in terms of infections. This country did a phenomenal job, and without the draconian impact that I’ve seen in other countries.”

Mr De Ferrari said the pandemic had hit quickly and it was hard to predict the rapidly changing economic consequences. “When we look at how to forecast this crisis and how it’s going to play out, the only certainty we have is that we are going to get it wrong, because it is an unprecedented thing,” he said

“The hardest part … is how do you deal with a demand shock where you have half the world in lockdown and people aren’t consuming all of a sudden.”

Lendlease chief executive Steve McCann said it was unknown how many waves of the virus there would be and how long the recession would last.

He said the sharemarket was trying to look through spikes in the virus and companies could invest capital perhaps faster than in the drawn-out recovery after the global financial crisis.

“We’re somewhere nearer the bottom of the cycle than the top now; there’s been a rapid adjustment and asset values are correcting and there are opportunities to invest capital,” Mr McCann said.

He pointed to the Australian 10-year bond rate at below 1 per cent, a striking contrast to levels in the GFC of about 5 per cent, with the low cost of debt creating the opportunity to invest at attractive returns.

While Lendlease has struck recent deals with global pension funds and development companies on its massive projects, including at Sydney’s Barangaroo, they are readying for temporary stimulus packages to be removed.

“One of the things we need to be conscious of is that the sophisticated investors around the world know that the economic environment is not a real environment today,” Mr McCann said.

“Once the government stimulus comes out of the system, that will tell us exactly where we are, and so there is a bit of caution in buying assets now as people are struggling with where valuations will land.”

Suncorp CEO Steve Johnston said he was concerned about the prospect of a second wave of the pandemic, with the experience offshore, particularly in the US, showing the likelihood of a “material impact”.

“Like (Scott Morrison) said, we are going to have to live with this until we can mitigate it in some way, like with a vaccine,” Mr Johnston said.

“So we have to balance the outcomes with some level of economic activity.”

The property industry has already been hit hard by the crisis, with shopping malls in affected areas in Melbourne emptying out as stricter restrictions apply.

Lendlease’s Mr McCann said the coronavirus crisis had struck much faster than the GFC, dubbing its arrival “very sudden and unanticipated”, along with the response of governments around the world.

“While the pandemic itself is uncertain — we don’t know how long that impact will last — we do think the investment appetite will probably re-emerge faster,” he said.

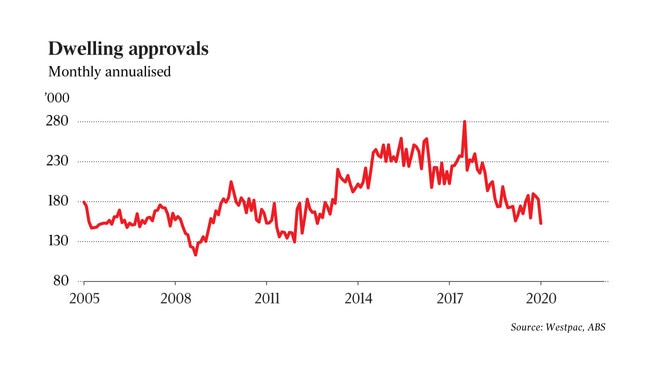

But short-term volatility is afflicting critical areas such as new-home construction, weighing on employment.

Building approval figures deteriorated in May, with national total dwellings falling a sizeable 17 per cent on the previous month in seasonally adjusted terms.

Declines hit all sectors, with houses dropping 4 per cent, while a 35 per cent correction in attached dwellings sent approvals plunging to their weakest level since 2012.

“The COVID-19 shock was broadly felt across all major states, with Victoria and NSW the hardest hit,” BIS Oxford Economics economist Maree Kilroy said. National building approvals were forecast to continue trending downwards in the coming months, with the hit biggest for apartments, she warned.

“Although restrictions have eased and stimulus has arrived, many headwinds persist for new dwelling demand,” she said.

“The federally funded HomeBuilder program stacked with state level incentives will provide a boost, but won’t begin to show through in the approval data until late 2020.”

HIA economist Angela Lillicrap put the plunge down to the impact of COVID-19 restrictions impeding the flow of new building projects.

“The decline in approvals in May is only the start of the COVID-19 shock in home building. We anticipate building approvals data will continue to decline for a number of months, due to the lag in the approvals process,” said Ms Lillicrap, who warned of a grim outlook.

“This sector faces very difficult market conditions.”

Additional reporting: Richard Gluyas

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout