Chair pay revealed: bosses cash in as pay soars above inflation

The chairs of Australia’s biggest companies have enjoyed a fee bonanza, with many seeing double-digit growth in annual income, outstripping wages rises for full-time workers.

The chairs of Australia’s biggest companies have enjoyed a fee bonanza, with many seeing double-digit growth in annual income.

The average fee rise over the past financial year was nearly 6 per cent for chairs of Australia’s 50 biggest ASX-listed companies who have been the role for more than a year – exceeding the pace at which wages for full-time Australian workers increased.

It is also common for chairs to serve on multiple boards – magnifying their salaries – while others are receiving perks such as free travel, paid parking and even a wine allowance.

The hike comes as the Reserve Bank and employer groups have urged wage restraint to reduce pressure on inflation.

About 17 chairs (roughly 34 per cent) received double-digit pay rises in the past fiscal year, with 10 of those the result of stepping into the top position on the board, according to remuneration figures collated by The Australian.

Among the biggest pay rises was for Newcrest’s Peter Tomsett who received a 41 per cent bump “in recognition of his increased involvement in the business during the CEO transition period”.

Mr Tomsett is no longer chair after the world’s biggest miner Newmont completed its takeover of Newcrest late last year.

About 30 chairs had total statutory earnings greater than Prime Minister Anthony Albanese’s $549,250 salary, comprising base salaries, short and long-term incentives, bonuses, and other income. The highest paid was ResMed chair Mick Farrell, who also serves as chief executive.

His total remuneration package was 17 per cent higher than the year prior at $US13,686,641 ($21.59m), though only $US1.1m of that was salary.

The next best paid chair was Richard Goyder who collected nearly $1.6m from his roles at Qantas and Woodside.

He received a 14 per cent pay rise from Qantas in the 2023 fiscal year to $750,000, while his remuneration at Woodside lifted slightly in the 12 months to December 31.

He also holds the chairman role at the AFL Commission, which has not disclosed how much Mr Goyder is paid.

Other highly paid chairs included Ken Mackenzie of BHP, who had a 3.5 per cent increase to $1.47m, followed by a $1.27m payday for Fortescue deputy chair Mark Barnaba.

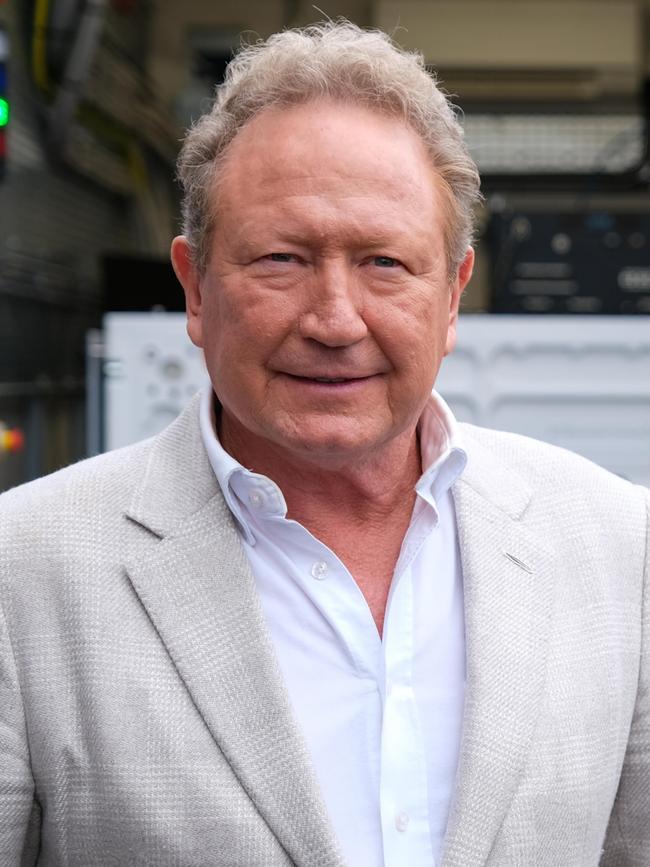

Fortescue executive chair Andrew Forrest opted to forgo director’s fees, but the company’s annual report showed that he owned 1.13 billion shares worth $25.82bn – making him the wealthiest chair.

Average weekly earnings for all Australian workers increased by 3.9 per cent in the year to May, according to the latest figures released by the Australian Bureau of Statistics. Full-time adult average weekly earnings were about $1840, while the average earnings for all Australians was $1400.

While companies such as Qantas moved to award the board and management big increases following a record profit, Australian Shareholders’ Association chief executive Rachel Waterhouse said that shareholders were no longer just looking at the company’s financials to assess whether the remuneration increases were right for those at the top.

“You do want them to get paid the right amount for what the job involves, which is why it makes sense for an independent external body to set pay,” she said.

“Our association looks at not just if the share price and profit is up, but at Woolworths we also looked at the health and safety record and how that is being managed to gauge whether their pay is worth it. Others are looking at the broad impact the board and company are having – it is no longer just about the finances.”

In total there were six individuals who were the chair of more than one of the top 50 largest companies on the ASX.

In addition to Mr Goyder, this included John Mullen who was the chair of Brambles and Telstra (before his exit at October’s annual meeting), Michael Chaney (Wesfarmers, Northern Star) and Scott Perkins (Woolworths and Origin).

Medibank chair Mike Wilkins, who is also the chair of QBE, received a 15.5 per cent increase in total remuneration for the past fiscal year to $451,125.

This came as the board decided to axe bonuses for its executive leadership team following 2022’s cyber attack when Russian hackers stole and published the sensitive health information of more than nine million customers.

Ms Waterhouse said investors often questioned whether individuals should hold more than one position, adding that listed companies should also ensure that the same people were not getting hired for the same roles. “Shareholders do wonder if they can have really good oversight of a company when holding multiple roles as chairs with other companies or not for profits,” she said.

“Companies should be looking to ensure they have a diverse board with different backgrounds and experiences. Having a variety of skills and experience by looking to new people allows for fresh takes and the ability to explore doing things differently.”

In addition to being awarded performance rights in the company, some chairs received additional perks.

Mr Goyder is in line to receive four international flights and 12 domestic flights free each year upon his departure from Qantas.

Treasury Wine Estate chair Paul Rayner has access to paid carparking and a $4000 wine allowance.

Rio Tinto chair Dominic Barton receives a $19,200 fund to spend on long-haul travel to attend board meetings.

Woolworths chair Scott Perkins also has access to travel benefits and insurance.

Dean Paatsch, a director at proxy adviser Ownership Matters, said that while those in chairman roles were the “highest paid casual labourers” in the country, it was also difficult to hold them accountable for decisions that were made.

“It is a difficult role, but they are the highest paid casual labourers in the country.

“Shareholders are right to expect that (chairs) are accountable to and perform, but sometimes it is very difficult to observe that,” he said.

“Unlike a council, board meetings are not televised, so all you can judge them on is decisions that sometimes take 10 years to play out. So it’s a very imperfect science, the question of trying to backfit board pay with company performance.”

He added that the chair was also incredibly influential because they had an “outsized role in selecting other directors”.

Of the 50 largest companies, annual reports show that 10 received no change in pay, including Goodman Group chair Stephen Johns and Coles’s James Graham. Three were awarded a pay cut, including a 6.4 per cent decline for Westpac’s John McFarlane – the second year running his pay has been slashed. ASX’s Damian Roche and CSL’s Brian McNamee also had cuts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout