Captains urge change of tack to cover Donald Trump’s US tax cuts

The captains of Australia’s corporate scene have warned that the nation must quickly react to Donald Trump’s tax cuts.

The captains of Australia’s corporate scene, representing banking, property, aviation, retail and infrastructure, have warned that the nation’s taxation system must quickly react to US President Donald Trump’s momentous corporate tax cuts or risk the economy drifting into irrelevancy as capital and businesses leave for cheaper jurisdictions.

There was general dismay over the federal government’s backflip to call a royal commission into banking, even from the chairman of Westpac, Lindsay Maxsted, who joined with the other big banks last year to call on the government to have one, calling the inquiry “unattractive” and the “lesser of two evils’’.

And there is also no appetite for another postal plebiscite after the marriage equality vote, this time on the issue of a republic, with Qantas chairman Leigh Clifford telling The Australian: “We need a more mature debate, and I don’t want to hear the word ‘republic’ again!”

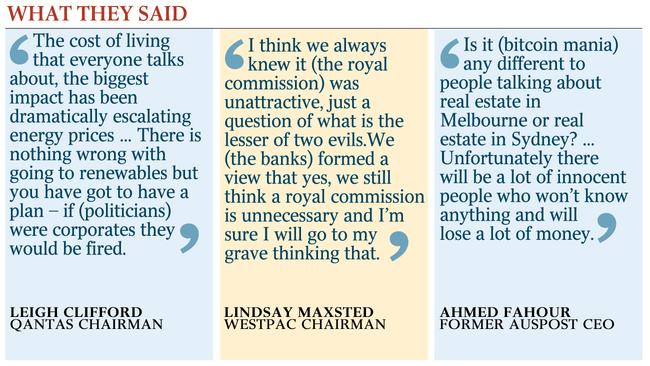

Mr Clifford fired off both barrels at state governments for their “incompetent” energy policies, saying that if CEOs had acted in a similar way they would be fired.

Gathered for a day’s sailing in Sorrento, on Victoria’s Mornington Peninsula, for the KPMG Couta Boat Classic, much of the talk was on Mr Trump’s bold legislation to slash US corporate tax rates from 35 per cent to 21 per cent.

Immediately making all other regions — including Australia, whose corporate tax rate is 30 per cent — less competitive, it poses a challenge to the nation’s economy, especially as companies look to relocate to the US to take advantage of lower taxes.

Mr Clifford said the US would now have the advantage of cheaper energy and lower tax rates, with a more nimble bureaucracy helping to streamline approvals and investment projects.

“We are in a competitive environment, even more so because of the tax cuts, and I think, therefore, both parties in Australia have got to say what they are going to do in response to the mood,’’ Mr Clifford said.

“What are they going to do to lower corporate tax and what are they going to do in relation in productivity as a whole as we have clearly fallen behind — we have got to get those right if we are going to get investment and investment that creates jobs.

“So in effect the tax cuts in the US are going to create jobs in the US and they are going to put the pressure back on us here.’’

Mr Clifford added that energy prices this year would remain a crucial issue for the Australian economy as “incompetent” governments rushed to renewables.

“The biggest (economic) impact has been dramatically escalating energy prices, power prices in particular ... as a result of what I would call incompetent government, mostly state government policies, either (through the issue of) access to resources or the indecent haste to move to a greater proportion of renewables,” he said.

“There is nothing wrong with going to renewables but you have got to have a plan — if they (the state governments) were corporates they would be fired.’’

Brendan Fleiter, former Australia Post deputy chairman and chairman of Godfrey’s, said Australia must be competitive in order for capital to keep flowing the nation’s way.

“Someone is going to have to do it (cut taxes here) or we are just going to drift,’’ Mr Fleiter said.

Macquarie Bank director Patricia Cross, whose boat Bella won Division 1 line honours in yesterday’s race, said the government needed to act on tax rates.

“My wish lists are always around things like corporate tax and, especially when looking at what is happening in the US from an investment point of view, that is a double-edged sword for Australia,” Ms Cross said.

“On the one hand it will help the US economy, stockmarket and all that and we will get a rebound, but on the other hand it does make us less competitive.’’

KPMG chairman Alison Kitchen said the US tax move represented “another competitive challenge for the Australian economy”.

“I don’t think for companies it necessarily means they will rush to move their investment, but every time people run their numbers, tax is a part of running the numbers, and that’s a material shift,’’ Ms Kitchen said.

“So companies will have to look at it and think about the relative economics now of where they want to make their investments and I think what we should do about it is lobby our politicians to say, ‘come on, get on with it and stop mucking about with big or small business’.

“(Australia’s) 30 per cent rate is a high tax rate now compared to a lot of counties in the region and so if we want to be serious about our politicians creating an environment where business can flourish then that’s a clear signal we need to do something.’’

Catherine Walter, a director of Australian Foundation Investment Co and the RBA’s Payment System Board, agreed action was needed but said Australia’s franking credit system meant Australia’s higher tax rate was softened and this needed to be kept in mind when comparing the nation’s tax system with that of the US.

“To the extent it’s a global world for corporate returns and corporate investment the competition is not necessarily purely Australian so Australia has to look at the way it is globally competitive,” Ms Walter said. “But the Australian tax system has a franking credit regime which as a practical point reduces the overall impact of tax, so there needs to be a sophisticated collaboration of the actual comparison but that having been done it is important that we stay globally competitive.’’

The former boss of Swisse vitamins, Radek Sali, took a different tack, saying Australia should be cautious before slashing tax rates to keep up with the US as it might have unwanted social impacts.

“Australia is very different to the US, in the fact we have a better standard of living that is shared equally among the population, and I think we need to be very careful about any impact on that,” Mr Sali said. “My concern would be that we would tip things out of balance if we rushed to change and match it to be a similar system that isn’t really that similar.”

Westpac and Transurban chairman Mr Maxsted described the decision by the big four banks to call for a bank inquiry the “lesser of two evils’’ but he also maintained it was unnecessary.

“I think we always knew it was unattractive, just a question of what is the lesser of two evils and what concerned us during that month of November and early December was where it was going in terms of a parliamentary inquiry and the input going into that,” he said. “And we (the banks) formed a view that yes we still think a royal commission is unnecessary — and I’m sure I will go to my grave thinking that — but it was the lesser of two evils for the government to take control of it, write its terms of reference and go from there.’’

Lendlease chairman and former BHP director David Crawford said it would “take a long time to see anything come out of” the royal commission: “The banks have done a significant amount in lifting their game already so ... what do you expect to come out of this royal commission?”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout