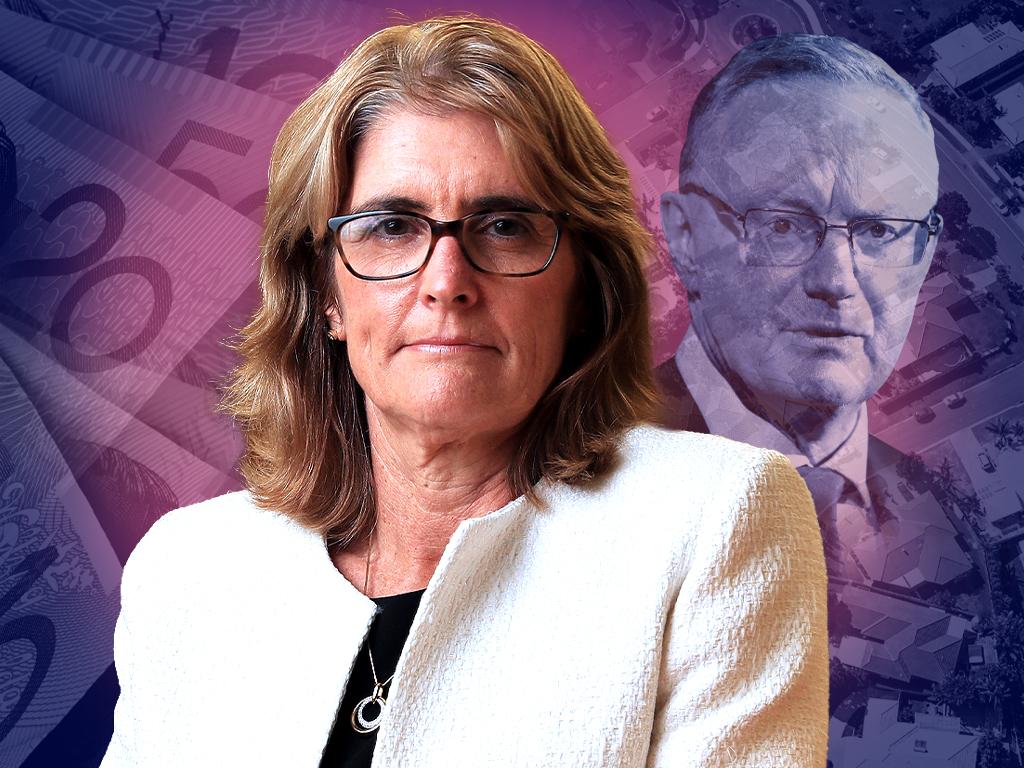

Can new RBA governor Michele Bullock lift business confidence? Business leaders say yes

The first woman RBA governor takes the reins as the nation faces its toughest economic challenge in decades. Australian bosses have their say.

Bosses at Australia’s biggest companies say Michele Bullock’s appointment as Reserve Bank governor offers a fresh face while providing stability to financial markets and a potential lift to business confidence.

But they say Ms Bullock – the first woman to helm the RBA – faces a “balancing act” of managing monetary policy to rein in persistent inflation while avoiding an economic crash.

Federal Treasurer Jim Chalmers opted for an internal hiring to replace outgoing governor Philip Lowe, whose seven-year term expires in September.

Ms Bullock has served as Dr Lowe’s deputy since April last year before the RBA embarked on its most aggressive series of interest rate rises in 30 years when inflation exploded following the Covid-19 pandemic.

Business leaders and analysts say given that Ms Bullock has served as Dr Lowe’s deputy during the RBA’s 12 rate increases – which pushed the official cash rate from 0.1 to 4.1 per cent – her appointment offers a level of continuity in monetary policy. This would aid business confidence, which has soured to recessionary levels during the RBA’s tightening.

Robert Millner, patriarch of the $12bn investment fund Washington H. Soul Pattinson – which has business interests spanning financial services, brickmaking, mining and resources, telecommunications and healthcare – said the new RBA boss faced an uncertain economy.

“We’re starting to see some slowdown on the building side and the biggest problem constraining us all remains high energy costs,” Mr Millner told The Weekend Australian.

“The cost of doing business out there has just gone through the roof, whether it’s chemicals or fertiliser or diesel or labour. And we’ve still got that gap between interest rates and inflation. So either inflation has to come down or interest rates have to go up.”

ANZ chief executive Shayne Elliott said Ms Bullock was a “fine choice” to lead the RBA as “it deals with one of the toughest environment’s in recent history”.

“I look forward to working with her and her team and know she will bring the same fundamental decency, openness and intelligence to the role as her predecessors,” Mr Elliott said.

“All institutions go through periods of change and transformation to remain contemporary, and the RBA is no different.”

Ms Bullock began her career at the RBA in 1985, holding various positions in its economic group and international department until 1998. After heading the RBA’s payments policy, Ms Bullock ascended to the role of assistant governor in 2010.

Commonwealth Bank chief executive Matt Comyn said Ms Bullock was a good choice who worked closely with banks in her role as chair of the Payments System Board.

“Michele Bullock is well known and respected across the financial services industry. She is considered, has extensive experience and is well suited to lead the RBA at this time,” Mr Comyn said.

Medibank chief executive David Koczkar said the rising cost of living was hitting household budgets – a challenge he believed Ms Bullock could meet.

“Monetary policy is a balancing act and her experience holds her in good stead to tackle this,” Mr Koczkar said.

On Thursday – a day before Dr Lowe learned his contract would not be renewed – he said the RBA board was “deadly serious” about returning inflation to its mandated 2 to 3 per cent range by the middle of 2025. Although consumer price growth from 6.8 per cent to 5.6 per cent in May, it is still too high.

Dr Lowe warned Prime Minister Anthony Albanese, the premiers and big businesses that they must invest in new housing, infrastructure and machinery to cope with the nation’s record influx of migrants.

Business Council of Australia chief executive Jennifer Westacott said Ms Bullock’s appointment brings stability to “current and future economic challenges”.

Australian Industry Group chief executive Innes Willox said: “Maintaining stable, predictable and transparent monetary policy is a pillar of a vibrant modern market economy.

“The RBA’s independent stewardship of Australia’s monetary policy under the dual mandate to keep inflation low and employment high, is a bedrock that lifts confidence by stabilising domestic inflation thereby supporting investment, job creation and non-inflationary real wages growth.

“Ms Bullock is an excellent choice to lead this critical economic institution.”

Australian Retailers Association chief executive Paul Zahra said Ms Bullock’s appointment was a “positive for business confidence”, highlighting that women contribute about 75 per cent of discretionary spending and make up 57 per cent of the retail workforce.

“The impact of sustained interest rate increases thus far has been significant on Australian homeowners and retailers – who are at the mercy of a discretionary spending slowdown alongside rising operating costs across the board,” Mr Zahra said.

Barclays analysts expect policy continuity under Ms Bullock with Dr Lowe delivering a final official cash rate hike next month.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout