Be paranoid, pivot and persevere: How Carsales stays in top gear

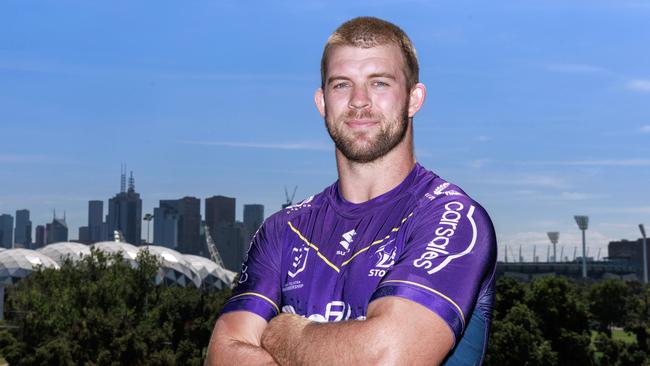

Carsales chief Cameron McIntyre’s happy place is inside his giant Ram TRX – which is apt given his love of cars led to his current role overseeing the online motoring giant.

It is only a 10-minute stroll from the Cremorne headquarters of Carsales in inner-city Melbourne to the bolthole surroundings of former chief Greg Roebuck’s private office, which has a downstairs warehouse that houses his woodworking and fitness equipment.

Hanging on one of the walls is the door of a crashed Carsales V8 supercar.

“Greg is not involved with the company day to day but he is engaged with the people. He is physically close to our office and he sees lots of people around the streets, and catches up with quite a few of them,” says his successor and protege, Carsales chief executive Cameron McIntyre.

“I love that, I think it is great,”

It is now more than six years since Roebuck stepped down as chief of Carsales, the online business he founded 20 years earlier that has forever changed the way we buy and sell cars.

Carsales will always be known as one of the troika – with Seek and REA Group – that destroyed the traditional classified advertising model for cars, jobs and property.

Roebuck and his co-founder, Walter Pisciotta, always adopted an owner-operator mindset in growing the business, and that culture has carried through with McIntyre, his board and management team.

Roebuck, Pisciotta and their associates, who were all foundation shareholders in Carsales, hold about 7 per cent of the company today. Pisciotta is still on the board.

They were this week rewarded for their faith in the company when Carsales increased its final dividend by 33 per cent to 32.5c per share, taking its full-year dividend to 61c, up 22 per cent year on year.

The company reported a 43 per cent increase in adjusted net profit after tax to $278.2m and a 17 per cent lift in adjusted earnings per share to 78.1c, which lifted its shares by 7 per cent on Monday.

“It goes to a belief in the strategy of the business, the management team inside the business and the ability of the business to perform year in, year out,” McIntyre says of the ongoing support of the founding shareholders.

He and Roebuck catch up regularly.

“I am conscious of not disclosing publicly sensitive information, but outside of that we catch up regularly and we are good friends. Greg is still very proud of the business he created,” he says.

McIntyre, who was the former chief operating officer and a nine-year Carsales veteran when he took over from Roebuck in 2017, credits his long-time mentor for teaching him the “three ps” which have become the secret sauce of the company.

“The first is perseverance. Always be prepared to pivot, change, evolve and persevere through that,” he says.

“The second is paranoia, so always be paranoid about where competition comes from and be a step ahead.

“The third is performance. You just have to perform. Performance comes from optimisation in terms of what we do and how we do it. From innovation around product and new ideas, to programmatic merger and acquisition activity, and being prepared to invest.

“Greg always believed in being paranoid, to persevere, pivot and be prepared to make mistakes. One of Greg’s great strengths was that he would not die wondering about things, he was always prepared to have a go.”

Risk takers

Carsales’ paranoia has been manifested in its preparedness to disrupt itself.

For instance, in 2020 it launched a ride-share and taxi aggregation app called Placie, seeking to disrupt the transport industry and become a one-stop shop for all consumer travel.

“We thought people would move more into mobility based services and we invested in that for three years,” McIntyre says.

“Covid came and went but we have decided it is not where the consumer is at the moment. So we’ve stopped it.

“We have been prepared to invest in areas that haven’t worked. That is about as a business being mature enough to make hard decisions about what is working and not working. You need to know when to run hard or walk away.”

Last year the firm launched the Carsales corporate venture capital program, designed to make minority investments in early-stage firms focused on adtech, fintech, electric vehicles and batteries, and artificial intelligence.

“That part of our growth strategy is about finding businesses that could potentially one day be competitors to Carsales or could provide us with technology that we are not specialists in. To help extend or deepen our ecosystem,” McIntyre says.

“We are a paranoid business and we don’t want to be disrupted. We can identify these opportunities early and place small bets by taking small equity positions in these businesses.

“It is also about acquiring talent and particular talent.”

But he stresses the bets are small and targeted.

“This isn’t about throwing darts at a dart board. We are quite specific in what we do,” McIntyre says.

“The funnel is not so big in this space, so you have to search high and low. You shouldn’t expect us to spend tens of millions of dollars here. It is just about placing a few small bets.”

One of Carsales’ most important pivots came more than a decade and a half ago when it evolved from being just in automotive to expand into non-automotive categories.

The change was based on the simple philosophy that a bike, a boat and a truck are the same as a car in terms of digital marketing.

More recently, the company has launched a caravan e-commerce store and is working on a payments solution in Australia for private buyers and sellers of vehicles.

“The caravan store is about keeping people engaged outside the buy-sell cycle. We know people that go to our caravan-and-camping site go off and buy accessories like air conditioners, power generators and fridges,” McIntyre says.

“This is helping people chose the right accessories for the vans or RVs they are buying.

“Part of it is also about understanding more about the consumers coming to our site. We are testing and learning with this deployment.

“But I see this as being a long-term play and relevant to a number of other verticals we have too.”

He says the work on a payments platform, which could go live at some stage in 2024, is about “trying to remove friction points in the buy-sell process”.

The new platform would allow buyers and sellers to transfer funds electronically through the Carsales website.

Another key pivot in recent years has been the transition from being a purely domestic-based business to one with quality exposures to high-growth offshore markets.

Carsales now has operations in South Korea, the United States, Brazil, Chile and Mexico, and 53 per cent of its revenue now comes from international markets.

In March the company raised $500m to buy a controlling stake in Brazil’s biggest auto classifieds site – essentially swapping positions with its joint-venture partner, Spain’s Banco Santander. Carsales now has 70 per cent of the business, up from 30 per cent previously.

The history of corporate Australia is littered with failed offshore expansions.

But McIntyre says the key to Carsales’ international strategy has been to look for high-growth markets where digital marketing is evolving and where there is significant opportunity around intellectual property and product synergies.

“Taking minority stakes upfront also means we can learn the market and where the opportunities exist, understanding that each market and culture is different,” he says.

“We can properly understand what makes the management tick and get alignment around our business cultures and values before we acquire a controlling position. In the case of Brazil it has taken 10 years.”

Carsales also has a blueprint for dealing with corporate governance in foreign subsidiaries, which has been rolled out through all major regions, including Australia.

“The way we tend to operate is we have independent boards in each of our jurisdictions with one independent director or our business partners, ourselves and management. So there is a frame of reference for our board, which adds another layer of oversight and independence,” McIntyre says.

“That is a framework we have been evolving. It also creates succession opportunities even at a Carsales level – as the main board of the company gets to know other independent directors that are inside the organisation.”

Dream cars

Ask McIntyre what is one of his favourite places in the world, and the answer is unambiguous.

“My happy place at the moment is inside my Ram TRX,” he says of the American-made black pick-up truck he purchased last August. It has a thumping 6.2l supercharged V8 engine that can go from 0 to 100km/h in under five seconds.

Former Carsales chairman and Collingwood Football Club president Jeffrey Browne owns one that carries a black and white number plate adorned with a magpie emblem and the letters SIDBYS – which is shorthand for the club’s signature slogan, “side by side”.

McIntyre says: “I also have two Teslas so there is carbon neutrality. Cars are a lot of fun, they give me a lot of satisfaction.

“I have always liked them, but now I am more passionate about them.”

Today he owns five vehicles. When he turned 18 his first was a 1976 Ford Escort XL with what he terms a “sewing machine engine”, which he used to service himself.

McIntyre’s love of cars has fuelled his passion for running Carsales.

The 198cm tall 53 year old, whose three daughters play state basketball, also has a deep passion for rugby union, which he played during his school years growing up in New Zealand.

In the past three years he has spent more time attending rugby league matches, as Carsales has been a major sponsor of the NRL team, Melbourne Storm.

He also has a soft spot for the cellar-dwelling North Melbourne Kangaroos AFL club, which will finish in the bottom two spots on the ladder again this year.

“Given the way my footy team is going, I’m certainly following rugby league more these days,” he quips.

The scoreboard for Carsales is far more impressive.

Over the past five years its share price has risen more than 80 per cent and earnings per share have increased 21 per cent per year.

Since listing on the Australian Securities Exchange in September 2009, the share price is up more than 600 per cent.

In its most recent result, Carsales’ top-line growth was driven by a solid performance across the business, including a 13 per cent revenue increase in Australia driven by resilient demand for used cars and increasing adoption of higher-value products,

In North America, where revenues rose 14 per cent, the growth was driven by adding more customers, increased adoption of premium products, and private ad yield upside from dynamic pricing.

A key focus going forward is using artificial intelligence to improve customer experience and enhance the security of product offerings.

For example Carsales has built an artificial intelligence engine called Tessa that automates the checking and approval of adverts for vehicle sales in seconds rather than hours which it previously took during peak periods.

McIntyre also started a trend when he became Carsales CEO – he had previously been chief financial officer of the firm for seven years.

Over the past year, the successors to chief executive roles at top listed companies such as Telstra, Qantas and Coles were all former CFOs.

But he says being a numbers person is just an added bonus on the path to getting the top job.

“It comes down to understanding the business in detail, having a strategic mindset and having a great relationship with the people inside the organisation,” McIntyre says.

“Knowing finance doesn’t necessarily help you with that, especially the last part.

“Our greatest asset is our people.

“The real key to success is how you build a strategy and a vision around the organisation and sell it. You need to be able to bring people on that journey.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout