The federal government should revive the company tax carry-back provisions of 2012 to help revive the economy and boost jobs, according to PwC boss Tom Seymour.

In an interview with The Weekend Australian, Seymour noted the concept was also introduced by the New Zealand government this year to allow companies that make tax losses this year to get refunds for taxes paid in previous years.

He also urged the immediate replacement of stamp duties with land tax, compensated by way of a securitisation scheme.

The tax reform initiatives are just two ways the government could boost income growth and jobs. Seymour thinks there is a need for “more risk taking and innovation at both corporate and government levels in Australia”.

“The Australian culture hasn’t rewarded failure and it is time for the federal government to take leadership on the issues to promote a more entrepreneurial culture,” Seymour said.

“The government can set the tone with more focus on deregulation, to streamline the process to fast-forward project development.

“There is a risk-reward balance and we have to accept high risk.”

He would like targeted policies to promote commodity trading hubs in Australia as Singapore does.

“We don’t have to match Singapore tax rates because Australia has other advantages but we would need to tax the businesses at a concessional rate to attract entrants,” he said.

The carry-back tax concept was applied for small businesses in Australia under the Gillard government and scrapped a year later when the mining tax was killed.

The idea was that if a company lost $1bn last financial year due to COVID then instead of carrying forward that loss they would recover money from the feds for tax paid in the past and resume paying tax as normal in future years.

The previous scheme had a $1m limit on the carry-back. Checks could be imposed, such as having continued ownership as measured by shareholder levels, franking credits, past tax payments and other restrictions to avoid massive avoidance.

The companies that don’t pay much tax due to past losses would be restricted in using the scheme, which is another benefit because it rewards companies that were profitable tax payers.

The advantage of the scheme is it benefits companies that were profitable in the past but were hit like everyone else by the COVID recession.

Seymour said from the government’s perspective the tax take would be a timing issue: instead of a drop in tax receipts next year the fall would come from last year’s receipts, which could be covered with borrowings.

Seymour is also urging an early switch out of stamp duty to land taxes. He said the initial shortfall in state revenues could be made up via a securitisation based on the future income flows.

By way of example, if stamp duty gave the state $200m a year and land tax was only $10m a year the shortfall would be made up by selling an instrument based on the regular $10m a year in income in future years.

Seymour has a long list of potential reforms around the workplace based around the changes caused by COVID.

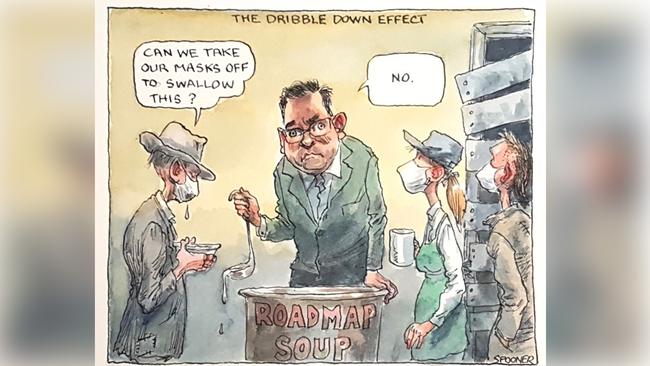

The way he looks at it, Australia is yet to see the worst of the downfall due to the government incentives like JobKeeper and the flood of money pumped into the economy.

“If you look at it the stockmarket is still high, outside Melbourne retail is strong and car sales are OK,” Seymour said.

Next year will look different when the money stops.

“I’m still optimistic about reform and I think the next five years will see more than we have had in the past 30 years,” he said

“The demand for reform will increase next year as the gaps appear in consumption when the wall of money subsides.”

Next month’s budget is a transition budget but it’s May next year when he is looking for big reforms.

Humans react well to emergencies, which is what we had back in March, but now it’s dragging on and in his home town of Brisbane he thinks people are learning to live with it.

He cites telehealth as one of the big COVID initiatives that will boost productivity by minimising trips to a GP’s surgery.

In Sydney less than 10 per cent of staff are in the office, in Brisbane and Adelaide it’s about 25 per cent and in Perth 45 per cent with Melbourne shut.

PwC staff surveys show that no one wants to work from home full time and no one wants to work in the office full time.

That’s a massive change and if it continues it’s going to mean less demand for public transport and different childcare needs.

“Different policy settings will be needed. We are in a world now where everyone is online, which raises cybercrime issues but also benefits which we need to lock in,” Seymour says.

The new PwC boss is five months into his role, which has coincided with the COVID pandemic.

This has meant some logistics changes like scrapping the monthly day and a half operational meetings which are now held twice a month on top of the regular Monday morning executive meetings.

Asked how he will manage the firm’s 9000 people, he says: “It is important to be transparent and authentic and be prepared to take tough decisions.

“In Australia we have spent the last few years worrying about the cream on the cake and now have to worry about how the cake is made. We have to execute well, make sure we are offering a great experience to our clients.”

Get the message

Adelaide-based Cohda Wireless is one of those overnight successes, born 16 years ago after being spun out of the University of South Australia’s Institute of Telecommunications Research.

Its software is used to allow connected vehicles to signal each other and connect to the city infrastructure.

In essence it‘s a wireless system which equips cars to speak to each other.

It will feature in the Ipswich Connected Vehicle trial later this month which will feature 500 vehicles to test the communications.

The software is also used to track vehicles in underground mines to avoid collisions.

It aims to reduce collisions by providing warnings as a car is driving to a blind intersection and another is going through a give way sign.

It is also being trialled in Germany on fire trucks to trigger changes in traffic lights along a designated route to get the truck to the fire quicker, and another in Manhattan on New York City vehicles.

The company has backing from Cisco and NXP, along with venture capital companies including SciVentures, Epicorp UNISA Ventures and Mooroolbark Technology.