Seven Group chief Ryan Stokes says inflation is back for good

Seven Group chief Ryan Stokes is warning that businesses will have to adapt to a return of inflation, high energy prices and labour shortages as the economy rebounds.

Seven Group chief Ryan Stokes is warning that businesses will have to adapt to a return of inflation, high energy prices and labour shortages as the economy rebounds from the pandemic.

After seven years with core inflation below 2 per cent, consumer price growth jumped to 3.5 per cent in 2021 and Mr Stokes said it marked a new norm as an era of government stimulus and cheap credit subsides.

“We think it’s back to normal. In reality the last 15 years with cheap credit and access to capital coupled with technological advancements have really suppressed inflation to probably an unusually low point and now those factors are unwinding and that’ll basically revert back to a normalised inflation dynamic,” Mr Stokes told The Australian.

The conglomerate offers an insight into sentiment across the economy through its heavy machinery operator WesTrac, Coates equipment leasing business, Seven West Media, 30 per cent stake in Beach Energy and, most recently, construction materials with its Boral buyout.

Global supply chain issues were being felt through its business with parts and machinery stuck in transit amid bottlenecks that have been felt through the transport and infrastructure sectors. However, Mr Stokes said it was part and parcel of a return to strong demand through different parts of the economy.

“A lot of the supply chain issues related to demand growth globally. We think that will be sustained,” he said.

“The inflation factor will be a part of business as we go forward.

“It has been in the past and I think this is just a normal part of business now, and we certainly try to position our mindset around that and take action to ensure that we’re well positioned to deal with that new norm of inflation rates.”

Seven Group has flagged an earnings lift of up to 10 per cent for the 2022 financial year amid an upgrade for its Coates Hire business, and will use a $2.1bn windfall from its Boral investment to pay off a loan facility for the deal.

The conglomerate, which is also the biggest shareholder in Seven West Media, said 2022 underlying earnings before interest and tax from continuing operations would be up between 8-10 per cent, with WesTrac on track to deliver low-single-digit earnings growth and Coates guidance upgraded to low-double-digit growth.

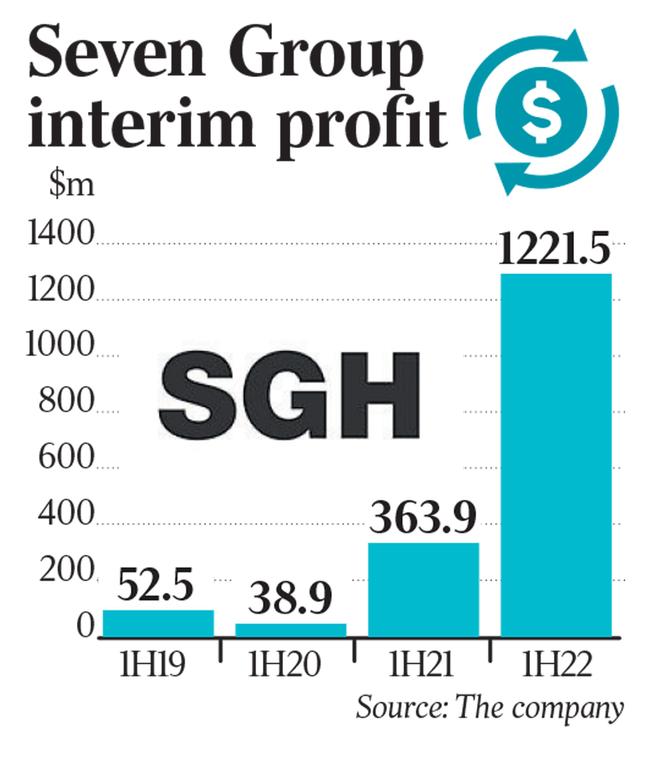

Underlying profit jumped 21 per cent to $302m in the first half, while investment in WesTrac meant its operating cashflow fell to $221m. Trading revenue rose 3 per cent to $3.9bn, with earnings jumping 29 per cent to $511m.

Seven Group will pay a fully franked dividend of 23c a share, unchanged on last year. It will use a $2.1bn windfall from construction materials giant Boral to pay back a $2.9bn loan used to acquire its stake, after the construction materials giant sold out of North America.

WesTrac earnings fell 0.7 per cent to $209m, while Coates saw its earnings rise 13 per cent to $119m.

Boral’s earnings soared 388 per cent to $77m, reflecting a full period of profit after it cemented its 70 per cent stake, while energy surged 86 per cent to $66m on stronger oil and gas prices and media earnings were up a third to $51m for the six-month period.

Mr Stokes said a squeeze on bringing in new supplies of oil and gas would probably keep oil and gas prices high over the medium term. “I think one of the byproducts through Covid is there has been a reduction of expenditure in development and production in oil and gas. I guess that means that as we look forward there is also a step up in demand that will play through with pricing,” he said.

Kerry Stokes stepped down as Seven Group chairman in August in a major changing of the guard in corporate Australia following an audacious takeover raid on Boral. The billionaire took control of Boral last year after Seven Group amassed a majority stake, with Ryan Stokes installed as Boral chairman.

Seven West Media last week recorded a lift in interim net profit with the healthy numbers sheeted back to the resurgent television ad market and a sharp spike in the company’s digital earnings.

Seven Group shares fell 3.1 per cent to $21.67, giving it a market capitalisation of $8.12bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout