Kaufland battle plan expects ‘open hostility’

German supermarket Kaufland says ‘the parochial views of many Australians’ is one of the toughest challenges it faces.

German supermarket Kaufland has highlighted what it calls “the parochial views of many Australians’’ as one of the toughest challenges it will face when it enters the local market in 2021, as members of the community react to a foreign entrant with a mix of “fear and open hostility”.

Kaufland will attempt to win over shoppers with the launch of a customer loyalty program when its stores open, and it also promises that its arrival will have the added benefit of lowering grocery prices and creating local jobs.

“(Kaufland) will provide choice, competition and downward pressure on prices for Australian consumers,” a planning submission prepared on behalf of Kaufland and obtained by The Australian says.

“Just like Aldi, Kaufland Australia will also have its own consumer loyalty programs and philanthropic initiatives.”

The German supermarket operator, owned by Schwarz Group, the world’s fourth-biggest retailer, was scathing of some of the negative criticism it attracted during a process set up by the Victorian Minister for Planning to fast-track the approval of several sites in the state.

“It is unfortunate that some members of the community have reacted to the entrant of a foreign company into the Australian retail market with not only fear but open hostility,’’ the submission says.

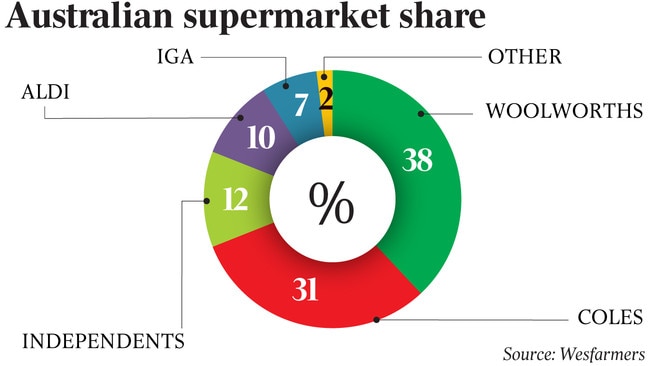

The comments are in contrast to the fast-paced growth experienced by German rival Aldi. The discount supermarket has build a national market share of just under 10 per cent and claims it is delivering double-digit growth. US big box retailer Costco has also been able to roll out an expansion across the east coast.

The planning and location for some of the Victorian stores, such as one in Mornington, has attracted criticism from local community groups, rival retailers and planning experts.

“Submissions like those of the Mount Eliza Community Alliance illustrate one of the greatest difficulties that Kaufland will have in entering the market — the parochial views of many Australians,’’ the submission said. “It demonstrates how important that it will be for Kaufland to provide a point of difference to Woolworths and Coles and to work hard to win over the hearts and minds of Australian shoppers.”

Kaufland is snapping up sites for its planned launch in 2021 and it is building a $459m distribution centre in outer Melbourne. Five sites have already been approved and last month it offered up another nine store sites to be reviewed by the government’s advisory panel approval process.

The Kaufland submission also admits it will have a fight on its hands to wrestle customers away from Woolworths and Coles. In contrast to Aldi, it will offer a loyalty program.

“In entering a new country — particularly one that is well served by entrenched operators with a loyal customer base — Kaufland Australia is cognisant of the fact that first impressions are crucial to its success,” the submission says.

“It must convince the Australian consumer that it is more than just ‘another operator’ but that it presents a true point of difference and provides for the very best supermarket retailing experience possible at the cheapest price.

“To achieve this means taking an uncompromising approach to customer comfort and store efficiency.”

Kaufland is attracted to Australia’s $90bn grocery sector because of its high margins and the strong market power held by the supermarket leaders.

“Kaufland’s investigations into whether Australia represented a suitable expansion opportunity concluded that the existing operators within the Australian retail environment benefit from a duopolistic market dominated by two major players (with a third operator gaining market share) and experience comparably high profit margins. Kaufland concluded that there was scope to enter the market, by providing a point of difference.

“In order to deliver on that customer experience and in acknowledgement of the shortcomings of the established operators identified above, Kaufland Australia seeks to deliver the best of both worlds — a full-service supermarket stocked with local, regional and international products at discount pricing, in a comfortable and convenient environment.”

Kaufland’s key point of difference is the size of its store and breadth of offer.

Kaufland stores are typically more than double the size of a large-format Woolworths or Coles, and they offer a range of as many as 30,000 different products, more than 50 per cent more than a standard supermarket and compared to about 1500 products at an Aldi.

Kaufland will also carry a wide range of categories beyond groceries to general merchandise, consumer electronics, clothing, toys and hardware.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout