Jobless rate falls to 4.2 per cent, lowest since GFC

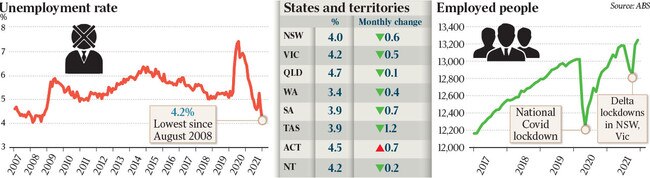

Unemployment fell to 4.2 per cent in December – the lowest since 2008 – stoking expectations of a rate rise.

Unemployment fell to 4.2 per cent in December – the lowest since the 2008 global financial crisis – stoking market expectations that wage growth could accelerate more quickly and the Reserve Bank might be forced to raise interest rates earlier than 2024.

While the December jobs figures predated the impact of the Omicron variant, which has disrupted supply chains by forcing thousands of staff to stay home and isolate, Josh Frydenberg declared that the jobs numbers underlined the resilience of the Australian economy.

Hours worked jumped by 1 per cent in December and underemployment declined to its lowest level since November 2008.

NSW (32,000 new jobs) and Victoria (25,000) reported the strongest bounce-back in employment as Delta lockdowns eased and four states had unemployment at or below 4 per cent.

Unemployment was 4 per cent in NSW, 4.2 per cent in Victoria, 4.7 per cent in Queensland, 3.4 per cent in Western Australia, 3.9 per cent in South Australia and Tasmania, 4.2 per cent in the Northern Territory.

Scott Morrison said the results were encouraging, but acknowledged that with almost 800,000 active Covid cases and the continuing supply chain crises, the practical reality for many Australians might not be reflected by the positive figures.

“Those two months will be encouraging but Australians know it is still tough … There is much more work to do to ensure that we can keep our economy strong after this pandemic,” the Prime Minister said.

While health officials are optimistic that the Omicron wave may have peaked in NSW and Victoria, business leaders remain cautious about the outlook for 2022.

An Ai Group annual chief executives survey revealed 79 per cent of respondents expected the pandemic to continue to be problematic. The same proportion of respondents also predicted higher business costs over the year, with almost three-quarters anticipating difficulties in finding and retaining skilled staff.

Ai Group chief executive Innes Willox warned that the survey showed signs inflationary pressure might emerge as most chief executives were also expecting a continuation in 2022 of the cost pressures they experienced in 2021. “These expectations and their expectations of being able to pass some of these higher costs on to customers, puts business leaders at odds with the relatively benign inflation outlook anticipated by the official economic agencies,” Mr Willox said. “The inflation outlook is clearly a key area to watch over coming months.”

On Wednesday, Mr Morrison announced the government would discount visa fees for foreign students and backpackers in an attempt to attract 175,000 temporary migrants to fill shortages in the health, aged care, agriculture, retail, hospitality, food and transport sectors.

The Treasurer said the resilience of the economy was underpinned by the $360bn in household and business savings accumulated through the pandemic.

“This is the equal-fourth lowest unemployment rate in Australia since the ABS data series began back in 1978,” Mr Frydenberg said.

Economists were divided on when the RBA would raise rates.

Westpac chief economist Bill Evans predicted the central bank would begin raising rates in August with a 15-basis-point rise followed by a 25-basis-point hike in October.

CommSec senior economist Ryan Felsman said he expected the “solid” increase in employment would lead the RBA to end its bond-buying program at the February 1 board meeting, before lifting the cash rate in November.

BIS Oxford Economics chief economist Sarah Hunter highlighted the fact the underemployment rate had reached a 13-year low. Consequently, once the Omicron wave subsided, the “very supportive” economic settings would likely flow into inflationary pressures, she said.

“The demand is still there, and that really says to me that private sector wages growth in particular is going to keep picking up,” Ms Hunter said.

“And that I think is going to be a catalyst for domestic inflationary pressure, which is what the RBA are really looking at.”

Economist Saul Eslake categorically ruled out a rate rise ahead of 2023. “The RBA will be one of the last central banks in the developed world to raise rates,” he said. “I mean, we will do it before Japan does. But we will be one of the last in the developed world.”

Mr Eslake said the end of the RBA’s quantitative easing program was all but certain when the board met on February 1.

If other countries’ experience with the Omicron outbreak held true for Australia, he expected the economy should be able to resume at a “pretty good pace” soon.

Deloitte Access Economics partner Chris Richardson said the December jobs numbers were “a beautiful set of figures’’.

But he cautioned against expectations that the RBA would raise the cash rate before 2023, noting there would be a lag before the tight labour market translated into rising wages and prices.

“There is a sweet spot in between,” Mr Richardson said. “People are assuming it all happens too fast. Remember that lots of wage agreements in Australia are two and three years; even with a very tight job market that says a slow flow through to wages, which in turn means a slow flow through prices.

“The news is magnificent. But it doesn’t say any change in interest rates is imminent.”

The viral outbreak has led to labour shortages plaguing the economy, as the long closure of international borders and soaring Omicron cases compounded pre-existing skills shortages.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said the December figures offered a “rear-view observation” of employment.

“With labour and skills shortages across many sectors, already strong labour force figures make clear that further emphasis is needed from government to boost workforce participation, invest in skills and VET, and establish an ambitious skilled migration program,” Mr McKellar said.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout