Investment risks in China are abating after a difficult period, analysts at Lonsec say

Given China’s prominence in the Emerging markets and Asia ex Japan Indices, performance for these broader indices has also remained weak generating cumulative returns of 3.6 per cent and negative 0.8 per cent respectively.

The period was marked by a series of regulatory developments, each one more extreme than the prior in terms of testing investor patience, discipline, and appetite for Chinese equities. The common prosperity theme – a rhetoric increasingly promoted by the Communist Party during this time – permeated strongly in all instances.

A quick Covid-19 recovery through early and mid-2020 led the Chinese market to surpass its 2015 highs of some $US10 trillion ($14 trillion). However, the euphoria quickly fizzled out as the first wave of regulatory crackdowns surfaced.

After a four-month anti-monopoly probe, Chinese regulators fined Alibaba US$2.75bn and suspended the upcoming IPO of its financial arm, Ant Group to tackle a long simmering problem in the tech sector: anti-competitive practices.

The subsequent sell-off in internet stocks – initially short-lived – signalled the start of a sharp reversal of a long-term uptrend of large-cap technology companies.

The interventions were not isolated to the technology sector, however. The education sector bore the full brunt of policy actions in July with the release of new policy guidelines addressing the burden of an excessively competitive academic culture. The stipulations overhauled the entire industry, effectively transforming it into a non-profit sector overnight. Share prices of the three largest players, New Oriental Education, TAL Education and Gaotu Techedu fell 54 per cent, 71 per cent and 63 per cent respectively on the day of the announcements and have since been effectively worthless.

READ MORE:Chinese regulators try to get Ant Group to share data | Ant Group float ‘could be up in weeks’ | Ant Group to raise more than $34 billion in record IPO

Besides taking aim at the education sector, China’s focus on the growth and development of the next generation also spilt over to the online game industry. In August 2021, China limited the amount of time children can spend on video games to rein in gaming addiction, which may harm their academic and personal development. This had significant implications for the world’s largest online gaming market and materially impacted the fortunes of companies such as Tencent and NetEase.

Volatility returned in the last quarter of 2021 as the property sector – a key driver of economic growth, local government funding, and investment savings for a large portion of the Chinese population – succumbed to stringent policies to curb speculation and credit expansion.

For investment managers with significant exposure to China, the period was challenging to say the least. In terms of performance, on a subsector basis, global large cap managers with a significant exposure to China produced the weakest outcomes; an average cumulative return of negative 6.2 per cent. Relative underperformance was tilted towards managers with higher exposure to offshore listed companies in Hong Kong and US-listed ADRs which fell indiscriminately during this period. By contrast, managers who held onshore China A shares delivered stronger returns on the back of many sectors doing well.

Having battled through monumental challenges over the last several months, investors have rightly been concerned about the future of the Chinese investment landscape. Risks of ongoing Covid-19 induced lockdowns, slowing growth, further regulatory interventions, and escalating geopolitical political tensions have been at the forefront of investment discussions.

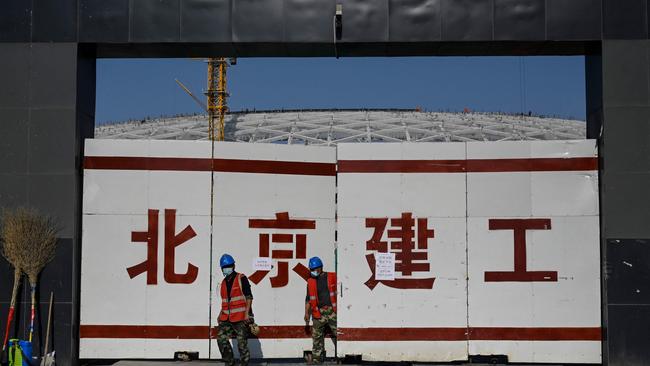

Given this backdrop, the CCP’s Two Sessions meeting last month in March has provided investors with valuable insights into the government’s plan to promote stable growth in the region. Key priorities for 2022 include a GDP growth target of 5.5 per cent with a CPI target of around 3 per cent. This growth target is at the higher end of the market expectations range and emphasises the government’s pro-growth policy stance.

READ MORE:China scrambling to prevent property pandemonium | Chinese investment revival in Australian property possible

It also highlights the significance of 2022 as a politically important year for Xi Jinping who is poised to extend his term as party chief for a precedent-breaking third time during the CCP national congress in the latter half of this year. In saying that, Lonsec considers these short-term targets to be ambitious and critically dependent on key aspects such as easing of lockdown restrictions and a more relaxed Covid-19 approach.

Longer term, in Lonsec’s view, the regulatory storm appears to have subsided. In March 2022, China’s vice premier Liu He addressed key market concerns calling for transparency in dealings with big tech firms. Alibaba’s share price subsequently rebounded by 65 per cent – showing the significance of this speech. Policymakers have also demonstrated an urgency to reverse the liquidity crunch currently faced by quality developers and restore consumer confidence in the property sector. Finally, the government has moved to provide monetary and fiscal stimulus at a time when the rest of the world is struggling with rampant inflation which has led to an increased risk of stagflation.

In the months to come Lonsec expects market risks to abate further, albeit volatility and risk premiums may remain elevated for some time. Also given the recency of regulatory developments, parts of the market such as the internet, education, healthcare may see a lower return profile over the medium term.

However, high-quality companies in China with new growth drivers such as the green economy, improved mental and physical health of the nation, and inward-focused technology replacement programs, for example in semiconductors, are expected to grow rapidly.

James Kirk is Lonsec’s Asia/emerging markets research manager. Hira Sakarani is an investment analyst with the firm.

To say that the last several months have been difficult for the investment landscape in China would be an understatement. The MSCI China NR Index has returned negative 28.7 per cent on a cumulative basis for the 18 months ending March 2022.